Alphabet (NASDAQ:GOOGL) – The U.S. Department

of Justice is considering asking a judge to force Google to sell

parts of its business to mitigate its search dominance, including

Chrome and Android. The DOJ proposes measures to reduce Google’s

dominance, which could impact revenues and benefit competitors.

Google plans to appeal, calling the proposals “radical” and

harmful. The decision could lead to a historic breakup of the tech

giant. Shares fell 1.4% pre-market, after rising 0.9% on

Tuesday.

Rio Tinto (NYSE:RIO), Arcadium

Lithium (NYSE:ALTM) – Rio Tinto announced the acquisition

of Arcadium Lithium for $6.7 billion in an all-cash deal. Rio will

pay $5.85 per share, a 90% premium over the previous price. This

move gives Rio access to global lithium mines and deposits,

strengthening its position as one of the largest lithium producers.

Rio’s shares fell 1.3% pre-market, after closing down 4.3% on

Tuesday. Arcadium’s shares surged 31.1% pre-market.

Boeing (NYSE:BA) – Boeing ended negotiations

with the union representing 33,000 U.S. workers after failing to

reach an agreement on wages and benefits. The strike, now nearing

four weeks, continues with the union demanding a 40% wage increase

and the return of pensions, while Boeing offered 30%. The company

is trying to raise billions, facing the risk of a potential credit

downgrade. Investment banks have suggested common stock and

convertible bond offerings to alleviate the situation. S&P

placed Boeing on CreditWatch negative due to the strike, estimating

a $10 billion cash outflow in 2024, which could result in a

downgrade. Additionally, the FAA issued a safety alert on the

rudder of certain Boeing 737 models after the NTSB identified

possible failures. The alert requires airlines to revise procedures

and notify pilots of potential rudder jams, affecting over 40

foreign operators. Boeing delivered 33 jets in September, down from

40 in August, with the strike impacting 737 MAX production. The

company also recorded 65 new orders in the month, totaling 315 for

the year. Shares fell 1.6% pre-market, after closing down 0.8% on

Tuesday.

Azul (NYSE:AZUL) – The Brazilian airline is

seeking to raise around $400 million after reaching an agreement

with lessors to eliminate nearly $550 million in obligations. The

company will offer preferred shares in exchange for the debt,

easing concerns over its debt load and improving its financial

structure. Shares fell 6.2% pre-market, after closing up 6.3% on

Tuesday.

Microsoft (NASDAQ:MSFT) – Oppenheimer

downgraded Microsoft, citing overly optimistic investor

expectations for the immediate impacts of artificial intelligence.

Analyst Timothy Horan warned that AI adoption is slow, and OpenAI’s

losses are concerning, potentially reaching $3 billion by 2025.

Despite the downgrade, Microsoft shares closed up 1.3% on Tuesday.

Shares rose 0.2% pre-market.

OpenAI – OpenAI has reached an agreement with

Hearst Communications to integrate content from its magazines and

newspapers into ChatGPT. The licensing includes publications such

as Esquire and Cosmopolitan, ensuring content appears with proper

attribution. This aligns with OpenAI’s strategy to include

professional journalism in its products, despite some disputes with

outlets like The New York Times. Additionally, OpenAI will announce

a new office in Singapore later this year, expanding its presence

in the Asia-Pacific region. The company has already started forming

a local team, focusing on government and commercial partnerships.

Oliver Jay was named managing director to lead these operations.

This will be OpenAI’s second office in Asia, after Tokyo.

Nvidia (NASDAQ:NVDA) – Nvidia highlighted the

energy efficiency of its new Blackwell chips during an event in

Washington, claiming the energy required to develop OpenAI’s GPT-4

software dropped from 5,500 gigawatts to 3 gigawatts. The company

also promoted its software that allows for the implementation of

personalized AI services. Nvidia shares closed up 4.1% on Tuesday,

marking five consecutive days of gains. They are now 2% away from

their all-time high of $135.58, reached in June. Shares rose 1.3%

pre-market.

Taiwan Semiconductor Manufacturing Co

(NYSE:TSM) – TSMC surpassed third-quarter revenue expectations,

driven by growing demand for artificial intelligence. The company

posted $23.62 billion (T$759.69 billion) in revenue, exceeding

forecasts and representing a 36.5% increase year-over-year. Full

earnings will be released on October 17. Shares rose 0.5%

pre-market, after closing up 0.8% on Tuesday.

Super Micro Computer (NASDAQ:SMCI) – Super

Micro Computer shares closed down 5% on Tuesday, despite a 16% gain

on Monday following the announcement of 100,000 GPU deployments for

AI factories. Concerns persist over profit margins and accounting

irregularity claims, overshadowing the positive demand data. Shares

fell 0.5% in Wednesday’s pre-market.

Qualcomm (NASDAQ:QCOM) – Qualcomm shares fell

0.4% on Tuesday after being downgraded by KeyBanc, due to concerns

over Apple developing its own modem and the slow recovery of PC

demand. Analyst John Vinh highlighted that this could significantly

impact Qualcomm’s revenue, which heavily relies on Apple and

Samsung. Shares fell 0.4% pre-market.

Amazon (NASDAQ:AMZN) – Temu, competing with

Amazon, is selling Fire TV-compatible remotes for just $4, well

below the price of generic versions on Amazon, attracting consumers

by offering a cheaper alternative. Shares rose 0.2% pre-market,

after closing up 1.1% on Tuesday.

Adobe (NASDAQ:ADBE) – Adobe announced that,

starting next year, it will launch a free web-based app to help

creators embed “Content Credentials” in their work, ensuring proper

credit and control over usage in AI systems. The service aims to

promote transparency and protect creators’ work integrity. Shares

closed up 1.8% on Tuesday.

Meta Platforms (NASDAQ:META) – Meta announced

new AI tools to simplify video creation and editing for

advertisers, targeting users who watch videos on Facebook and

Instagram. The tools will allow image transformation into videos

and automatic ad editing. Meta continues investing in video with a

new dedicated feed on Facebook, aimed at increasing watch time and

ad display. Shares fell 0.2% pre-market, after closing up 1.4% on

Tuesday.

Roblox (NYSE:RBLX) – Hindenburg Research

announced a short position in Roblox on Tuesday, alleging the

company inflated its user and engagement metrics, confusing daily

active users (DAUs) with platform visits. Roblox denied the

accusations that DAUs include bots and alternative accounts. Shares

fell 0.6% pre-market, after closing down 2.1% on Tuesday.

Pinterest (NYSE:PINS) – Pinterest has been

receiving positive reviews from Goldman Sachs and Oppenheimer.

Analysts praise the platform’s growth potential and monetization

capabilities, especially after its partnership with Amazon.

Projections indicate a possible 30% increase in stock price over

the next 12 months. Shares were flat pre-market, after closing up

1% on Tuesday.

Trump Media & Technology Group (NASDAQ:DJT)

– Trump Media & Technology Group shares surged 18.5% on

Tuesday, as investors weighed the impact of Vice President Kamala

Harris’s interview on the future of Truth Social. The rise reflects

interest in how the elections may affect the company, despite its

weak financial performance. Shares rose 0.6% pre-market.

Verizon Communications (NYSE:VZ),

Frontier Communications (NASDAQ:FYBR) – Verizon

secured $10 billion in short-term bank financing for its

acquisition of Frontier Communications Parent Inc. Morgan Stanley

leads the group of banks providing a bridge loan, to be replaced

with permanent financing later. Verizon aims to expand its

high-speed internet business with the purchase, valued at around

$9.59 billion. Verizon shares rose 0.3% pre-market, after closing

up 0.4% on Tuesday.

Kosmos Energy (NYSE:KOS), BP

plc (NYSE:BP) – Kosmos Energy reported that an arbitrator

ruled in favor of BP, prohibiting the sale of liquefied natural gas

from the Greater Tortue project to third parties. BP, which owns

56% of the project, is the operator and sole buyer of LNG. The

ruling does not change contract terms, and Kosmos does not expect a

significant financial impact. BP shares fell 0.6% pre-market, after

closing down 3.4% on Tuesday.

Newmont Corp. (NYSE:NEM) – Zijin Mining Group

acquired Newmont Corp’s Akyem gold project in Ghana for up to $1

billion, aiming to increase gold production. With 34.6 tons of

reserves, the mine is expected to operate until 2042, with an

annual extraction of 5.8 tons of gold. The deal requires regulatory

approval and is expected to close in Q4. Newmont shares fell 0.4%

pre-market, after closing down 0.5% on Tuesday.

American Water Works (NYSE:AWK) – The U.S.

water and sewer company halted billing and customer service after a

cybersecurity incident. The company identified “unauthorized

activity” in its network on October 3 and disconnected systems to

protect customer data.

Generac Holdings (NYSE:GNRC) – Generac is

facing a shortage of portable generators after Hurricane Helene and

other storms impacted millions of Americans, according to

Bloomberg. CEO Aaron Jagdfeld said demand for the company’s

products surged, leading to a 52-week high in shares. The company

expects significant additional revenue from power outages, as

Hurricane Milton approaches Florida.

X – Brazil’s Supreme Court has authorized X to

resume operations after the company, under Elon Musk, complied with

court rulings. Musk, initially against the orders, reversed his

stance, blocking flagged accounts and paying outstanding fines. The

decision allows the platform to return within 24 hours.

Tesla (NASDAQ:TSLA) – Tesla shares fell 0.6% to

$243.01 in Wednesday’s pre-market, after closing up 1.5% yesterday.

Investors analyzed new 0% financing deals for the Model 3 and Model

Y. These deals could boost sales but require the purchase of Full

Self-Driving software for $8,000.

General Motors (NYSE:GM) – GM CEO Mary Barra

reassured shareholders about demand for electric vehicles and

gas-powered trucks, emphasizing that profit margins have yet to

peak. She noted that EV sales are growing, and the company is

focused on stability rather than aggressive growth. GM said it’s

developing an affordable electric pickup with a range of up to 350

miles, using lithium iron phosphate (LFP) batteries to reduce

costs. Kurt Kelty, GM’s vice president, highlighted the search for

LFP battery supplies in North America to improve profitability and

EV viability. GM is also preparing to reduce inventory in China and

mentioned that the Cruise division, responsible for autonomous

vehicles, resumed supervised driving in selected cities after

facing challenges. GM CFO Paul Jacobson said the company expects to

lose no more than $2 billion with Cruise in 2025. GM shares fell

0.4% pre-market, after closing up 0.1% on Tuesday.

Honda Motor (NYSE:HMC) – Honda is willing to

adjust its electrification plan if demand for battery electric

vehicles continues to decline. CEO Toshihiro Mibe mentioned the

possibility of delaying factory construction and that the automaker

is maintaining its goal of selling only electric vehicles by

2040.

Canadian Pacific Kansas City (NYSE:CP) – The

Unifor union began negotiations with Canadian Pacific Kansas City

after already starting talks with Canadian National Railway.

Representing 1,200 workers, Unifor seeks to resolve issues like

excessive outsourcing and forced overtime, emphasizing that strikes

could paralyze the Canadian economy.

Citigroup (NYSE:C) – Citigroup lawyers asked

Judge Paul Oetken to dismiss a lawsuit from Attorney General

Letitia James, accusing Citibank of failing to reimburse customers

defrauded by online scammers. The bank argues it has robust

procedures to protect consumers and comply with laws related to

electronic transfers.

Mizuho Financial Group (NYSE:MFG) – According

to Bloomberg, Mizuho is preparing for potential market disruptions

by acquiring liquid assets, such as U.S. Treasury bonds, in

response to investors’ overconfidence in a “soft landing” for the

economy. The company seeks to mitigate risks and maintain

flexibility in the face of potential economic shocks.

Bank of America (NYSE:BAC) – Bank of America

appointed Eamon Brabazon as co-head of global mergers and

acquisitions, alongside Ivan Farman. Brabazon, with nearly nine

years at the institution and experience in mergers across Europe,

the Middle East, and Africa, will help define the global strategy

for the division. Shares fell 0.1% pre-market, after closing down

0.1% on Tuesday.

HSBC (NYSE:HSBC) – Many financial firms are

touting the benefits of artificial intelligence to boost

productivity, but according to HSBC’s Edward Achtner, tangible

results are still limited. Achtner highlighted the importance of a

strategic approach to adopting AI, mentioning the use of the

technology to combat fraud and money laundering, as well as

supporting workers with generative AI. Shares rose 0.3% pre-market,

after closing down 3.8% on Tuesday.

Saratoga Investment (NYSE:SAR) – Saratoga

Investment shares closed up 1.4% at $23.58 on Tuesday after its

fiscal second-quarter report showed total investment income of $43

million and earnings per share of $1.33, beating expectations. The

company’s assets under management fell from $1.1 billion to $1.04

billion.

Blackstone (NYSE:BX) – Blackstone provided a

$600 million private loan to Acuity Knowledge Partners, a research

company owned by Permira Holdings. The loan, combining senior and

junior debt, is aimed at refinancing Acuity’s existing debt.

Permira acquired Acuity in January 2023. Blackstone shares fell 1%

pre-market, after closing up 0.3% on Tuesday.

KKR (NYSE:KKR) – Emmanuel Lagarrigue of KKR

argued that prioritizing supply over demand hinders green hydrogen

investments. He noted that KKR is now pursuing a demand-driven

approach to encourage investments in clean fuels, especially after

forming a joint venture in Spain to produce green hydrogen.

Robinhood Markets (NASDAQ:HOOD) – The culture

of stock investment in Britain is stagnant, but Robinhood Markets

seeks to expand in the country, capitalizing on the enthusiasm for

online gambling. The company will offer U.S. stock trading and

margin loans, aiming to diversify its revenue, particularly amid

regulatory pressures in the U.S. Shares fell 1.1% pre-market, after

closing up 9.8% on Tuesday.

Home Depot (NYSE:HD) – Home Depot will require

all corporate employees to work one day in a store each quarter to

strengthen support for retail staff. The move, which includes

managers and remote workers, aims to improve the understanding of

challenges faced in stores. Shares closed up 1.5% on Tuesday.

Pfizer (NYSE:PFE) – Pfizer CEO Albert Bourla

will meet with hedge fund executives at Starboard Value next week,

after the fund acquired a roughly $1 billion stake in the

pharmaceutical company. Starboard seeks changes to improve Pfizer’s

performance, which has struggled after the drop in Covid product

sales. Shares rose 0.4% pre-market, after closing down 0.1% on

Tuesday.

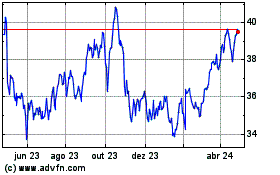

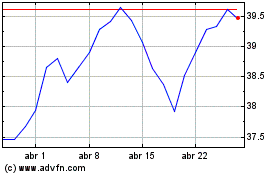

BP (NYSE:BP)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

BP (NYSE:BP)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024