U.S. index futures slightly declined in pre-market trading on

Friday, as investors await today’s quarterly results from major

banks like JPMorgan Chase (NYSE:JPM) and

Wells Fargo (NYSE:WFC), and wholesale inflation

data that could influence the likelihood of a rate cut. Market

sentiment is cautious ahead of an uncertain weekend. China is

expected to announce new fiscal stimulus on Saturday, while

geopolitical tensions between Israel and Iran could impact oil

prices.

At 05:50 AM, Dow Jones futures (DOWI:DJI) fell 61 points, or

0.14%. S&P 500 futures lost 0.17%, and Nasdaq-100 futures

dropped 0.27%. The 10-year Treasury yield stood at 4.092%.

In commodities, oil prices fell but are still heading for a

second consecutive weekly gain. Investors are assessing Hurricane

Milton’s damage in the U.S. and potential Israeli retaliation

against Iranian facilities. The market remains cautious with

elevated stock levels and the Fed’s policy. Meanwhile, Libya’s

National Oil Corporation (NOC) restored production to 1.22 million

barrels per day after a central bank crisis.

West Texas Intermediate crude for November dropped 0.70% to

$75.32 per barrel, while Brent for December fell 0.71% to $78.85

per barrel.

Gold prices (PM:XAUUSD) rose 0.18% to $2,637.80 an ounce,

benefiting from economic uncertainties, geopolitical tensions,

higher-than-expected inflation, and a slowdown in the U.S. labor

market.

On today’s U.S. economic agenda, at 8:30 AM, the Producer Price

Index (PPI) for September will be released, with expectations of

0.1%, and core PPI, previously at 0.3%. The prior annual PPI was

1.7%, and the annual core was 3.3%. At 9:45 AM, Chicago Fed

President Austan Goolsbee will give opening remarks. Preliminary

consumer sentiment for October will be announced at 10:00 AM,

projected at 70.3. Dallas Fed President Lorie Logan’s speech at

10:45 AM and Fed Governor Michelle Bowman’s at 1:10 PM complete the

schedule.

In the Asia-Pacific markets, China’s CSI 300 index plummeted

2.8% on Friday, marking a 3.3% loss for the week. Japan’s Nikkei

225 rose 0.57%, boosted by financial and healthcare sectors. In

South Korea, the Kospi index fell slightly, while Australia’s

S&P/ASX 200 lost 0.1%. Hong Kong’s Hang Seng remained closed

due to a local holiday.

Chinese stocks dropped as investors reduced risk ahead of a

Ministry of Finance briefing on potential fiscal stimulus. China’s

Ministry of Finance is expected to announce a new fiscal stimulus

package between $280 and $420 billion (2 to 3 trillion yuan) at a

press conference on Saturday, 10:00 AM local time, while markets

will be closed.

South Korea’s central bank cut interest rates by 0.25%, bringing

them to 3.25%, marking the first cut since 2020. The decision aims

to ease burdens on households facing high borrowing costs, as

inflation in South Korea fell to 1.6% in September, the lowest

level since early 2021 and below the central bank’s 2% average

target. The bank’s governor indicated there is room for more cuts,

but without specific guidance for the near future.

A Reuters poll suggests Japan’s consumer inflation likely slowed

in September due to falling energy costs, while export growth

significantly declined. The core consumer price index is expected

to have risen 2.3% compared to the previous year, down from

August’s 2.8%.

European markets show mixed performance, with sectors moving in

opposite directions as investors analyze UK GDP data and await

China’s anticipated fiscal stimulus.

UK GDP grew by 0.2% in August, as expected, following flat

months earlier this year.

France plans to sell $328 billion (€300 billion) in government

bonds in 2025 to fund its budget after months of political

instability. This amount will help cover an estimated deficit of

€136 billion, smaller than this year’s. The government aims to

restore investor confidence amid growing fiscal concerns.

Among individual stocks, Bayer (TG:BAYN) shares

dropped 2.1% after being ordered to pay $78 million to a

Pennsylvania man who claimed to have developed cancer from using

Roundup herbicide. The jury awarded $3 million in compensatory

damages and $75 million in punitive damages. The company plans to

appeal the decision.

Porsche (TG:PAH3) shares fell 0.6% after a 19% decline in sales

in China during the third quarter, marking the worst performance in

a decade, signaling rising competition from local electric vehicle

manufacturers.

THG (LSE:THG) shares dropped over 5% as it

plans to raise $123.4 million (£95.4 million) through a share issue

at 49 pence each, representing a 5.2% discount. CEO Matthew

Moulding will invest £10 million, with existing and retail

investors also contributing. The fundraising will support the

spinoff of the Ingenuity division and business model

simplification.

ArcelorMittal (EU:MT) shares rose 0.2% after

announcing it will buy Nippon Steel’s 50% stake in the Calvert

joint venture to ease regulatory concerns over Nippon’s acquisition

of US Steel. The company will pay $1, while Nippon Steel will

inject around $900 million in capital and forgive loans.

Italian brake system manufacturer Brembo

(BIT:BRE) shares jumped 3.7% after announcing the acquisition of

Ohlins Racing, a suspension technology specialist, for $405

million, the company’s largest purchase to date.

On Thursday, Wall Street’s major indices posted slight declines:

the Dow Jones and Nasdaq both slipped 0.1%, while the S&P 500

fell 0.2%. The weakness was driven by a U.S. inflation report that

showed a larger-than-expected rise in consumer prices, dashing

hopes for aggressive interest rate cuts by the Federal Reserve.

CME’s FedWatch tool still suggests an 84% chance of a

25-basis-point rate cut next month.

The Consumer Price Index (CPI) rose 0.2% in September, matching

August’s increase but exceeding the 0.1% expectation. Core CPI,

excluding food and energy, increased 0.3%, above the expected 0.2%.

Additionally, jobless claims rose to 258,000, surpassing the

230,000 forecast. As a result, Raphael Bostic, President of the

Atlanta Federal Reserve, said he is “open” to the possibility of

keeping rates unchanged in November.

In earnings reports, numbers are expected from JPMorgan

Chase (NYSE:JPM), Wells Fargo

(NYSE:WFC), BlackRock (NYSE:BLK), Bank

of New York

Mellon (NYSE:BK), Fastenal (NASDAQ:FAST),

and Bank7 (NASDAQ:BSVN), before the

opening bell.

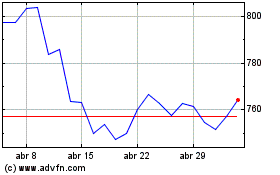

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025