Interest Rate Optimism May Lead To Continued Strength On Wall Street

14 Outubro 2024 - 10:08AM

IH Market News

The major U.S. index futures are currently pointing to a

modestly higher open on Monday, with stocks likely to add to the

strong gains posted in the previous session.

Stocks may continue to benefit from optimism about the outlook

for interest following last Friday’s report on producer price

inflation.

While hopes the Federal Reserve will lower rates by another 50

basis points next month have largely evaporated, the data

reinforced optimism the central bank will cut rates by 25 basis

points.

Overall trading activity is likely to be relatively subdued,

however, with some traders likely to be away from their desks due

to the Columbus Day holiday.

A lack of major U.S. economic data may also keep some traders on

the sidelines ahead of the release of key reports on retail sales

and industrial production later in the week.

Earnings news from big-name companies, such as Bank of America

(NYSE:BAC), Citigroup (NYSE:C), Goldman Sachs (NYSE:GS), Johnson

& Johnson (NYSE:JNJ), UnitedHealth (NYSE:UNH), Morgan Stanley

(NYSE:MS) and Netflix (NASDAQ:NFLX), is also likely to attract

attention in the coming days.

Following the modest pullback seen in Thursday’s session, stocks

showed a strong move back to the upside during trading on Friday.

The major averages more than offset Thursday’s losses, with the Dow

and the S&P 500 reaching new record closing highs.

The major averages pulled back off their best levels going into

the close but remained firmly positive. The Dow jumped 409.74

points or 1.0 percent to 42,863.86, the S&P 500 climbed 34.96

points or 0.6 percent to 5,815.03 and the Nasdaq rose 60.89 points

or 0.3 percent to 18,342.94.

For the week, the Dow surged by 1.2 percent, while the Nasdaq

and the S&P 500 both shot up by 1.1 percent.

The strength on Wall Street partly reflected a positive reaction

to a Labor Department report showing producer prices in the U.S.

were unexpectedly unchanged in September.

The Labor Department said its producer price index for final

demand came in flat in September after rising by 0.2 percent in

August. Economists had expected producer prices to inch up by 0.1

percent.

The report also said the annual rate of growth by producer

prices slowed to 1.8 percent in September from an upwardly revised

1.9 percent in August.

Economists had expected the annual rate of producer price growth

to dip to 1.6 percent from the 1.7 percent originally reported for

the previous month.

“After an upside surprise from the September CPI report,

producer prices came in below expectations and provide support for

a 25bps rate cut in November,” said Matthew Martin, Senior U.S.

Economist at Oxford Economics.

Traders also reacted positively to earnings news from big-name

banks, with shares of Wells Fargo (NYSE:WFC) surging by 5.6 percent

after the company reported better than expected third quarter

earnings.

JPMorgan Chase (NYSE:JPM) also jumped by 4.4 percent after

reporting third quarter results that exceeded analyst estimates on

both the top and bottom lines.

Meanwhile, a steep drop by shares of Tesla (NASDAQ:TSLA) limited

the upside for the Nasdaq, with the electric vehicle maker plunging

by 8.8 percent amid a negative reaction to its long-awaited

robotaxi event.

Banking stocks saw substantial strength on the upbeat earnings

news from Wells Fargo and JPMorgan, driving the KBW Bank Index up

by 3.0 percent to its best closing level in over two years.

Significant strength was also visible among transportation

stocks, as reflected by the 2.1 percent surge by the Dow Jones

Transportation Average.

Brokerage stocks also showed a strong move to the upside on the

day, with the NYSE Arca Broker/Dealer Index climbing by 1.7

percent.

Biotechnology, computer hardware and natural gas stocks also saw

notable strength, moving higher along with most of the other major

sectors.

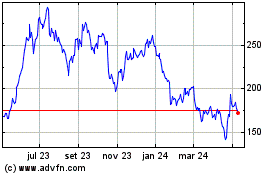

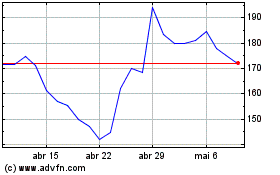

Tesla (NASDAQ:TSLA)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Tesla (NASDAQ:TSLA)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025