Steep Drop By Oil Prices May Lead To Initial Strength On Wall Street

28 Outubro 2024 - 10:09AM

IH Market News

The major U.S. index futures are currently pointing to initial

strength on Wall Street on Monday, with stocks likely to move

mostly higher after turning in a mixed performance last week.

Early buying interest may be generated amid a steep drop by the

price of oil, as crude oil for December delivery is plummeting

$4.36 to $67.42 a barrel.

The nosedive by the price of crude oil comes as Israel’s

retaliatory attack against Iran over the weekend did not damage the

Islamic republic’s energy facilities.

Overall trading activity may be somewhat subdued, however, as

traders look ahead to the release of key U.S. economic data later

in the week.

The monthly jobs report as well as a report on personal income

and spending that includes the Federal Reserve’s preferred

inflation readings are likely to be in the spotlight.

Reports on third quarter GDP, consumer confidence, pending home

sales and manufacturing sector activity may also attract some

attention.

The data could impact the outlook for the economy as well as

expectations regarding how quickly the Fed will lower interest

rates.

Earnings news is also likely to be in focus in the coming days,

with Alphabet (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), Exxon Mobil

(NYSE:XOM), Intel (NASDAQ:INTC), McDonald’s (NYSE:MCD), Meta

Platforms (NASDAQ:META), Microsoft (NASDAQ:MSFT) and Pfizer

(NYSE:PFE) among the companies due to report their quarterly

results.

After ending Thursday’s session on opposite sides of the

unchanged line, the major U.S. stock indexes turned in another

mixed performance during trading on Friday. While the tech-heavy

Nasdaq added to yesterday’s strong gain, the Dow extended its

losing streak to five sessions.

The Nasdaq reached a new record intraday high in early trading

but gave back ground over the course of the session before ending

the day up 103.12 points or 0.6 percent at 18,518.61.

Meanwhile, the Dow slid 259.96 points or 0.6 percent to

42,114.40, pulling back well off last Friday’s record closing high.

The S&P 500 also edged down 1.74 points or less than tenth of a

percent to 5,808.12.

The major averages also turned in a mixed performance for the

week. The Dow tumbled by 2.7 percent and the S&P 500 slumped by

1.0 percent, but the Nasdaq rose by 0.2 percent.

Stocks moved mostly higher early in the session, with the major

averages all moving to the upside amid ongoing optimism about the

outlook for the economy.

Adding to the economic optimism, the University of Michigan

released revised data showing consumer sentiment unexpectedly

improved in the month of October.

The University of Michigan said its consumer sentiment index for

October was upwardly revised to 70.5 from a preliminary reading of

68.9. Economists had expected the index to be upwardly revised

slightly to 69.0.

With the bigger than expected upward revision, the consumer

sentiment index is now modestly above the final September reading

of 70.1.

The consumer sentiment index has now increased for the third

consecutive month, reaching its highest level since hitting 77.2 in

April.

Buying interest waned over the course of the session, however,

as treasury yields rebounded following yesterday’s pullback amid

lingering concerns the Federal Reserve will lower interest rates

slower than previously anticipated.

The Fed is still widely expected to lower rates by a quarter

point next month, but CME Group’s FedWatch Tool currently indicates

a 24.0 percent chance the central bank will leave rates unchanged

in December.

The extended losing streak by the Dow came amid notable declines

by shares of McDonald’s (NYSE:MCD), Dow Inc. (NYSE:DOW) and

Travelers (NYSE:TRV).

Airline stocks showed a substantial rebound after falling

sharply on Thursday, with the NYSE Arca Airline Index surging by

2.0 percent.

A sharp increase by the price of crude oil also contributed to

significant strength among oil service stocks, as reflected by the

1.3 percent gain posted by the Philadelphia Oil Service Index.

On the other hand, gold stocks came under pressure despite a

modest increase by the price of the precious metal, dragging the

NYSE Arca Gold Bugs Index down by 2.1 percent.

Interest rate-sensitive utilities and housing stocks also saw

notable weakness amid lingering concerns about the outlook for

rates.

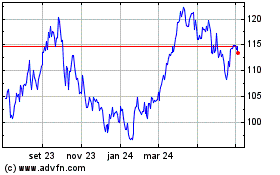

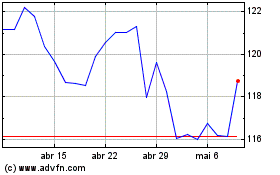

Exxon Mobil (NYSE:XOM)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Exxon Mobil (NYSE:XOM)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024