Upbeat Amazon, Intel Earnings May Spark Rebound On Wall Street

01 Novembro 2024 - 10:06AM

IH Market News

The major U.S. index futures are currently pointing to a higher

open on Friday, with stocks likely to regain ground following the

sell-off seen in the previous session.

Early buying interest may be generated in reaction to upbeat

earnings news from big-name companies like Amazon (NASDAQ:AMZN) and

Intel (NASDAQ:INTC).

Shares of Amazon are surging by 6.9 percent in pre-market

trading after the online retail giant reported third quarter

results that exceeded analyst estimates on both the top and bottom

lines.

Semiconductor giant Intel is also soaring by 7.4 percent in

pre-market trading after reporting better than expected third

quarter results and providing strong guidance.

Shares of Exxon Mobil (NYSE:XOM) may also move to the upside

after the oil giant reported third quarter earnings that beat

expectations.

On the other hand, shares of Apple (NASDAQ:AAPL) are seeing some

pre-market weakness even though the tech giant reported better than

expected fiscal fourth quarter results.

The futures remained firmly positive after the Labor Department

released a closely watched report showing much weaker than expected

job growth in the month of October.

The Labor Department said non-farm payroll employment crept up

by 12,000 jobs in October after jumping by a downwardly revised

223,000 jobs in September.

Economists had expected employment to climb by 113,000 jobs

compared to the surge of 254,000 jobs originally reported for the

previous month.

Meanwhile, the report said the unemployment rate came in at 4.1

percent in October, unchanged from September and in line with

economist estimates.

While the data may raise some concerns about the strength of the

economy, the report may also lead to renewed optimism about the

outlook for interest rates.

After moving sharply lower early in the session, stocks

continued to see considerable weakness throughout the trading day

on Thursday. The Nasdaq saw a particularly steep drop on the day

amid a sell-off by technology stocks.

The major averages saw further downside going into the close,

ending the session near their worst levels of the day. The Nasdaq

plunged 512.78 points or 2.8 percent to 18,095.15, the S&P 500

tumbled 108.22 points or 1.9 percent to 5,705.45 and the Dow

slumped 378.08 points or 0.9 percent to 41,763.46.

The sell-off on Wall Street came amid a negative reaction to

earnings news from tech giants Microsoft (NASDAQ:MSFT) and Meta

Platforms (NASDAQ:META).

Shares of Microsoft plunged by 6.0 percent after the company

reported better than expected fiscal first quarter results but

provided disappointing revenue guidance for the current

quarter.

Facebook parent Meta also dove by 4.1 percent after reporting

third quarter earnings that beat estimates but weaker than expected

user growth. Meta also forecast an increase in capital spending due

to AI investments.

Traders were also reacting to closely watched consumer price

inflation data that largely came in line with economist

estimates.

The Commerce Department said its personal consumption

expenditures (PCE) price index rose by 0.2 percent in September and

the annual rate of growth slowed to 2.1 percent, which both matched

expectations.

However, the annual rate of growth by the core PCE price index,

which excludes food and energy prices, was unchanged from the

previous month at 2.7 percent. Economists had expected the pace of

growth to slow to 2.6 percent.

The slightly faster than expected core price growth may have

added to recent concerns the Federal Reserve will lower interest

rates more slowly than hoped.

“The year-over-year core PCE print indicated a 2.7% increase

suggesting that the Fed is still on a bumpy course in this last

mile to quell inflation and declare victory,” said Quincy Krosby,

Chief Global Strategist for LPL Financial.

She added, “Although a 25-basis point move lower at the next Fed

meeting is expected the Fed will need to acknowledge that with

still resilient consumer spending, higher wages from a series of

successful strikes, and a solid labor market, they will need to

adopt the ‘gradual’ approach towards lowering rates until there’s a

comfort level within the FOMC that inflation isn’t poised to

continue edging higher.”

A report from the Labor Department showing initial jobless

claims unexpectedly fell to a five-month low last week may also

have added to the worries about slower rate cuts.

With Microsoft helping lead the way lower, software stocks saw

substantial weakness on the day, dragging the Dow Jones U.S.

Software Index down by 4.3 percent.

Significant weakness was also visible among semiconductor

stocks, as reflected by the 4.0 percent nosedive by the

Philadelphia Semiconductor Index. The index tumbled to its lowest

closing level in over a month.

Gold stocks also moved sharply lower along with the price of the

precious metal, resulting in a 3.2 percent slump by the NYSE Arca

Gold Bugs Index.

Computer hardware, commercial real estate and brokerage stocks

also saw considerable weakness, while utilities and energy stocks

bucked the downtrend.

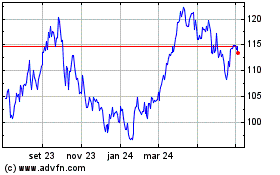

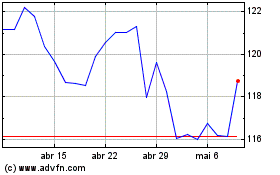

Exxon Mobil (NYSE:XOM)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Exxon Mobil (NYSE:XOM)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024