Alphabet (NASDAQ:GOOGL) – Alphabet exceeded

expectations in Q3, with earnings per share of $2.12, surpassing

the $1.85 estimate, and revenue of $88.27 billion, beating the

forecast of $86.30 billion. Net income rose to $26.3 billion.

YouTube’s ad revenue reached $8.92 billion, while the Other Bets

division saw revenue expand to $388 million. Google Cloud revenue,

the report’s highlight, generated $11.35 billion, a 35% increase,

driven by AI, offsetting investment costs. Shares rose 5.6% in

pre-market after a 1.8% rise on Tuesday.

AMD (NASDAQ:AMD) – AMD reported adjusted EPS of

92 cents as expected, with revenue up 18% to $6.82 billion,

surpassing the $6.71 billion estimate, driven by MI300

accelerators. The data center segment doubled sales, with a 122%

year-on-year rise in AI-focused Instinct GPUs. For Q4, AMD projects

revenue around $7.5 billion, slightly below the $7.55 billion

analyst expectation, indicating slower-than-expected AI sales

growth. Shares fell 8.2% pre-market after a 4.0% gain on

Tuesday.

Reddit (NYSE:RDDT) – Reddit recorded Q3 revenue

of $348.4 million, surpassing the $313.6 million estimate. A

positive EPS of 16 cents contrasted the expected 7-cent loss. Net

income reached $29.9 million, though daily active users slightly

missed projections at 97.2 million. For Q4, Reddit forecasts

revenue between $385 million and $400 million, bringing 2024 total

revenue to an expected $1.26-$1.27 billion, above the $1.20 billion

analyst prediction. Shares jumped 23.9% pre-market after a 2.6%

rise on Tuesday.

Snap Inc. (NYSE:SNAP) – Snap exceeded Q3

expectations with an adjusted EPS of 8 cents versus the expected 5

cents, and revenue of $1.37 billion, a 15% increase, slightly above

the $1.36 billion estimate. Daily active users reached 443 million,

exceeding targets. However, Q4 revenue guidance fell below

expectations, between $1.51 billion and $1.56 billion. Shares rose

9.5% pre-market following a 1.7% gain on Tuesday.

Qorvo (NASDAQ:QRVO) – Qorvo surpassed Q2

expectations with an EPS of $1.88 over the forecasted $1.84, and

revenue of $1.05 billion, beating the $1.03 billion estimate. For

Q3 2025, the company projects EPS between $1.10 and $1.30 and

revenue around $900 million, below consensus expectations. Shares

dropped 18% pre-market after a 0.2% Tuesday rise.

UBS Group AG (NYSE:UBS) – UBS exceeded Q3

expectations with net income of $1.4 billion, nearly double the

forecast of $740 million. Total revenue reached $12.3 billion,

surpassing the $11.5 billion estimate, while operating expenses

fell to $10.3 billion. Credit Suisse integration advances, with

phase one migrations completed in Luxembourg and Hong Kong. Shares

rose 0.8% pre-market following a 1.3% increase on Tuesday.

Chipotle Mexican Grill (NYSE:CMG) – Chipotle

reported Q3 net income of $387.4 million with an adjusted EPS of 27

cents, beating the 25-cent estimate. Revenue rose 13% to $2.79

billion, below the $2.82 billion forecast. Same-store sales

increased 6%, slightly below the 6.3% expectation. Shares dropped

6.6% pre-market following a 0.2% dip on Tuesday.

Visa (NYSE:V) – Visa exceeded fiscal Q4

expectations, with net income of $5.3 billion and EPS of $2.65,

surpassing the $2.57 forecast. Revenue totaled $9.6 billion, ahead

of the $9.49 billion estimate. Payment volume grew 8%, driven by a

“stable and resilient” consumer and strong value-added services,

notably in marketing. Visa also announced a 13% quarterly dividend

increase and plans to lay off 1,400 employees, including 1,000 in

tech roles, aiming to streamline international operations. Shares

rose 1.7% pre-market after a 0.8% Tuesday drop.

First Solar (NASDAQ:FSLR) – First Solar posted

an adjusted EPS of $2.91, missing the $3.11 expectation, with

revenue of $887.7 million, below the $1.08 billion forecast. The

company cut its annual earnings projection to $13.00-$13.50 per

share and revenue between $4.1 billion and $4.25 billion. First

Solar believes competitors may be infringing on its TOPCon solar

technology patents and has sent legal notices after investigating

potential violations since July. Shares fell 8.6% pre-market after

a 2.6% Tuesday decrease.

Chubb (NYSE:CB) – Chubb reported record net

income of $6.7 billion for the first nine months, up 16.9%

year-on-year, with operating profit at $6.75 billion (+13.8%). In

Q3, net income reached $2.32 billion (+13.8%) and operating profit

was $2.33 billion (+14.3%). Year-to-date EPS was $16.38 (+18.8%).

Shares rose 0.3% pre-market following a 1.0% drop on Tuesday.

Enovix (NASDAQ:ENVX) – Enovix reported Q3

revenue of $4.3 million, up from $3.8 million in the previous

quarter, with a net loss of $22.5 million, an improvement from the

$115.9 million loss in Q2. For Q4, Enovix expects revenue between

$8 million and $10 million, with operating expenses around $48.6

million. Shares rose 9.0% pre-market after a 6.8% drop on

Tuesday.

Mondelez International (NASDAQ:MDLZ) – Mondelez

reported Q3 net revenue of $9.2 billion, surpassing the analyst

forecast of $9.11 billion. Adjusted EPS came in at 99 cents, higher

than the projected 85 cents. Gross profit margin increased to

40.5%, driven by lower costs and higher prices. Demand grew in

Europe, North America, and China, offsetting declines in Latin

America. The company maintained its annual guidance.

Caesars Entertainment (NASDAQ:CZR) – Caesars

reported an unexpected Q3 loss of 4 cents per share, against an

expected profit of 12 cents. Sales declined 4% to $2.87 billion,

below the $2.92 billion estimate, impacted by competition and

construction disruptions in New Orleans. Shares fell 5.0%

pre-market after a 0.6% decrease on Tuesday.

GSK (NYSE:GSK) – The UK-based GSK maintained

its 2024 outlook despite an unexpected Q3 decline in vaccine

demand. Core EPS fell by 1% to 49.7 pence, while revenue dropped 2%

to £8.01 billion. Vaccine sales declined by 15%, though specialty

medicine sales rose by 19%. Shares fell 3.9% pre-market after a

0.8% Tuesday increase.

Other Corporate Highlights

Apple (NASDAQ:AAPL) – Apple is expected to

report its highest quarterly revenue growth in two years, driven by

strong iPhone demand, particularly in China. Investors are watching

for initial responses to the iPhone 16 as the company expands AI

investments. Analysts predict a 5.7% revenue increase, with iPhone

sales up 3.8% and services up 13.3%, despite regulatory challenges

and a one-time $10 billion tax rate. Shares fell 0.3% pre-market

following a 0.12% gain on Tuesday.

OpenAI, Broadcom (NASDAQ:AVGO),

TSMC (NYSE:TSM) – OpenAI is collaborating with

Broadcom and TSMC to develop proprietary AI-focused chips,

integrating new AMD chips alongside Nvidia to meet high

infrastructure demands. OpenAI, though considering building its own

factories, will prioritize partnerships and cost optimizations,

with plans for a custom chip by 2026. Broadcom shares fell 0.7%

pre-market, and TSMC shares also dropped 0.7%.

Getty Images (NYSE:GETY) – Former Stream Global

Services and 3Com CEO Scott Murray was sentenced to 10 months in

prison after pleading guilty to launching a false $4 billion bid to

acquire Getty Images, aiming to inflate stock prices. The scheme

allowed him to sell shares quickly, profiting approximately $1.49

million.

Sony Group (NYSE:SONY) – Sony will shut down

Firewalk Studios, developer of the shooter game Concord,

which was pulled shortly after its release this year. The mobile

game studio Neon Koi, which hadn’t launched any titles, will also

close, affecting around 210 employees. Shares rose 0.8% pre-market

after a 0.6% gain on Tuesday.

Netflix (NASDAQ:NFLX) – Netflix announced that

Global Public Policy VP Dean Garfield and Communications Chief

Rachel Whetstone are departing. Shares increased 0.3% pre-market

following a 1.4% Tuesday rise.

Paramount Global (NASDAQ:PARA) – Independent

filmmaker David Ellison will gain control of his family’s interests

in Paramount Global following a merger between Skydance Media and

Paramount. The Ellison family and RedBird Capital Partners are

acquiring Paramount shares and purchasing National Amusements Inc.

from the Redstone family, with finalization expected next year.

Shares declined 0.1% pre-market after a 0.4% increase on

Tuesday.

Tupperware Brands (USOTC:TUPBQ) – A U.S.

bankruptcy judge approved Tupperware’s asset sale to creditors,

allowing the company to emerge from bankruptcy while retaining most

operations. Creditors, including Stonehill Capital and Alden

Global, will provide $23.5 million in cash and debt relief.

Tupperware plans a digital and asset-light model in core

markets.

Lovesac (NASDAQ:LOVE) – Lovesac agreed to pay

$1.5 million to settle SEC charges that two former executives

concealed $2.2 million in shipping expenses, manipulating

accounting to meet Wall Street targets. The settlement avoided

financial restatements but resulted in “materially misleading

financial statements,” according to the SEC.

Bank of America (NYSE:BAC) – Bank of America is

weighing potential legal action following a CFPB investigation into

its use of Zelle for fund transfers. This investigation reflects

concerns about rising Zelle fraud, now the leading U.S.

peer-to-peer payment network, and involves regulatory discussions

to resolve or litigate the case. Shares dropped 0.6% pre-market

after a 0.2% Tuesday decline.

Goldman Sachs (NYSE:GS), Morgan

Stanley (NYSE:MS), Apollo Global

Management (NYSE:APO) – At the Future Investment

Initiative, Goldman Sachs and Morgan Stanley CEOs projected a surge

in corporate deals in 2025, with major firms going public globally.

Apollo Global CEO Marc Rowan noted that a Trump presidency could

further boost mergers and acquisitions, as well as investment

liberalization.

Charles Schwab (NYSE:SCHW) – Charles Schwab

will extend 24-hour trading within two weeks, allowing clients to

access top U.S. stocks and hundreds of ETFs. Supported by Blue

Ocean Technologies, full rollout is set for early 2025, starting

with active traders. Shares rose 0.4% pre-market following a 0.2%

decline on Tuesday.

BlackRock (NYSE:BLK) – BlackRock is now the

sole contender in talks to acquire HPS Investment Partners, with a

deal possible by year-end, according to Bloomberg. If an agreement

falls through, HPS may pursue an IPO, targeting an $11 billion

valuation or partial sale.

L3Harris Technologies (NYSE:LHX) – L3Harris

subsidiary Aerojet Rocketdyne has doubled its production of GMLRS

rocket engines, heavily used in Ukraine, to meet global demand.

This boost responds to U.S. stock depletion and ongoing missile

usage in the Ukraine and Middle East conflicts, driving an

increased need for armaments.

Boeing (NYSE:BA) – Governors from Utah,

Missouri, and Montana urged Boeing and the IAM union to resolve a

nearly seven-week strike involving 33,000 machinists, citing

economic impacts on states and suppliers. Boeing has paused

supplier purchases, leading to layoffs and production cuts, with no

new talks planned. The union met in person with Boeing for the

first time since rejecting a contract offer, with Acting Labor

Secretary Julie Su mediating. Shares remained steady pre-market

after a 1.5% rise on Tuesday.

Toyota Motor (NYSE:TM) – Toyota reported an 8%

decline in global production for September, with drops in the U.S.

(14%) and China (19%) due to disruptions, including a temporary

suspension of Grand Highlander and Lexus TX SUVs in the U.S. over

airbag issues. Global sales fell 7%, pressured by EV competition in

China. Shares rose 1.1% pre-market following a 0.3% Tuesday

decline.

BHP Group (NYSE:BHP) – After a failed $49

billion bid for Anglo American in May, BHP shifted focus to other

growth opportunities. Chairman Ken MacKenzie highlighted a $3.25

billion deal with Lundin Mining to expand copper operations in

South America. Targeting a 30% reduction in operational emissions

by 2030, BHP seeks further partnerships and plans to continue coal

operations for several decades. Shares rose 0.3% pre-market.

McDonald’s (NYSE:MCD) – McDonald’s faces a

consumer class-action lawsuit following an E. coli outbreak linked

to onions in Quarter Pounders. Plaintiffs Amanda McCray and William

Kraft, who experienced symptoms, claim they wouldn’t have purchased

the product if they’d known of the risk. The lawsuit, filed in

federal court in Chicago, seeks over $5 million in damages.

Chewy (NYSE:CHWY) – Keith Gill, also known as

“Roaring Kitty,” has exited his stake in Chewy. In July, he

disclosed a 6.6% position in the pet supply retailer, surprising

the market since he is better known for his investment in GameStop,

now led by former Chewy founder Ryan Cohen. Shares dropped 1.5%

pre-market after a 0.4% Tuesday decline.

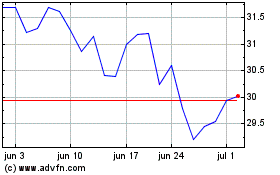

UBS (NYSE:UBS)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

UBS (NYSE:UBS)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024