Slightly Tamer-Than-Expected Inflation Data May Lead To Strength On Wall Street

14 Janeiro 2025 - 11:22AM

IH Market News

The major U.S. index futures are currently

pointing to a higher open on Tuesday, with stocks likely to move to

the upside after recovering from early weakness to end the previous

session mixed.

The futures saw a notable advance following the release of a

Labor Department report showing producer prices rose by slightly

less than expected in the month of December.

The Labor Department said its producer price index for final

demand crept up by 0.2 percent in December after climbing by 0.4

percent in November. Economists had expected producer prices to

rise by 0.3 percent.

Meanwhile, the report said the annual rate of producer price

growth accelerated to 3.3 percent in December from 3.0 percent in

November. The acceleration matched economist estimates.

The smaller than expected monthly increase by producer prices

may help ease recent concerns about the outlook for inflation and

interest rates, although the faster annual growth may keep buying

interest somewhat subdued.

On Wednesday, the Labor Department is scheduled to release its

more closely watched report on consumer price inflation in the

month of December.

Economists currently expect consumer prices to rise by 0.3

percent in December, matching the increase seen in November. The

annual rate of growth is expected to accelerate to 2.9 percent from

2.7 percent.

Stocks showed a notable move to the downside early in the

session on Monday but regained ground over the course of the

trading day. The S&P 500 climbed well off its worst levels of

the day and into positive territory, although the Nasdaq remained

in the red.

The S&P 500 rose 9.18 points or 0.2 percent to 5,836.22,

while the Nasdaq fell 73.53 points or 0.4 percent to a one-month

closing low of 19,088.10.

The narrower Dow, on the other hand, spent most of the day in

positive territory before closing up 358.67 points or 0.9 percent

at 42,297.12.

Weakness in the tech sector weighed on Wall Street early in the

session, as AI darling and market leader Nvidia (NASDAQ:NVDA)

plunged by as much as 4.7 percent.

Quantum computing stocks also saw continued weakness after Meta

(NASDAQ:META) CEO Mark Zuckerberg echoed Nvidia CEO Jensen Huang’s

remarks that quantum is at least a decade away from being a “useful

paradigm.”

Ongoing concerns about the outlook for interest rates also

generated negative sentiment following last Friday’s

stronger-than-expected monthly jobs report.

Selling pressure waned over the course of the trading session,

however, leading some traders to pick up stocks at reduced levels

as the S&P 500 rebounded from its lowest intraday level in over

two months.

Meanwhile, the advance by the Dow partly

reflected a strong gain by UnitedHealth (NYSE:UNH) after the U.S.

government proposed a 4.3 percent average total increase to its

2026 reimbursement rates for Medicare Advantage plans.

Steel stocks showed a substantial move to the upside on the day,

driving the NYSE Arca Steel Index up by 2.6 percent.

U.S. Steel (NYSE:X) helped lead the sector higher, surging by

6.1 percent after a report from the Wall Street Journal said

Cleveland-Cliffs (NYSE:CLF) is discussing joining with Nucor

(NYSE:NUE) on a possible bid for the company.

Significant strength also emerged among biotechnology stocks, as

reflected by the 2.2 percent jump by the NYSE Arca Biotechnology

Index.

Oil producer, housing, and natural gas stocks also saw notable

strength, while considerable weakness remained visible among gold,

airline and computer hardware stocks.

U.S Index Futures Trading – Taking the first steps with Plus500

Beginning your futures trading journey requires careful

preparation. Start by opening a Plus500

account with their minimum $100 deposit — qualifying

for their initial bonus program.

Spend time in the demo environment, understanding how futures

contracts behave and how the platform’s tools can support your

strategy.

As you develop confidence, consider starting with micro

contracts, which offer smaller position sizes ideal for learning

position management.

Plus500’s educational resources can guide you through

this process, helping you understand both basic concepts

and advanced trading strategies.

Start your futures trading journey with Plus500

today

Trading futures carries substantial risk of loss and is not

suitable for all investors. Plus500US Financial Services LLC is

registered with the CFTC and member of the NFA. Past performance

does not guarantee future results. Bonus terms and conditions

apply.

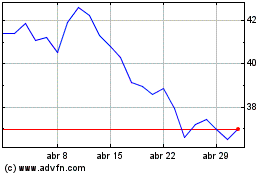

US Steel (NYSE:X)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

US Steel (NYSE:X)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025