U.S. Pull Back Sharply Amid Renewed Inflation, Tariff Concerns

07 Fevereiro 2025 - 6:39PM

IH Market News

Stocks moved sharply lower during trading on Friday, giving back

ground after trending higher over the past few sessions. The major

averages turned negative within the first hour of trading and saw

further downside as the day progressed.

The major averages climbed off their worst levels going into the

close but remained firmly negative. The Nasdaq dove 268.59 points

or 1.3 percent to 19,523.40, the Dow tumbled 444.23 points or 1.0

percent to 44,303.40 and the S&P 500 (SPI:SP500) slumped 57.58

points or 1.0 percent to 6,025.99.

With the significant pullback on the day, the major averages

also closed lower for the week. The S&P 500 dipped by 0.2

percent, while the Dow and the Nasdaq both fell by 0.5 percent.

The weakness that emerged early in the session came after the

University of Michigan released a report showing consumer sentiment

has unexpectedly deteriorated in February amid a surge by

year-ahead inflation expectations.

The University of Michigan said its consumer sentiment index

slumped to 67.8 in February after rising to 71.1 in January.

Economists had expected the index to inch up to 72.0.

With the unexpected decrease, the consumer sentiment index

dropped to its lowest level since hitting 66.4 in July 2024.

The deterioration by consumer sentiment came as year-ahead

inflation expectations spiked to 4.3 percent in February from 3.3

percent in January, reaching the highest level since November

2023.

“Many consumers appear worried that high inflation will return

within the next year,” said Surveys of Consumers Director Joanne

Hsu. “This is only the fifth time in 14 years we have seen such a

large one-month rise (one percentage point or more) in year-ahead

inflation expectations.”

Stocks saw further downside after President Donald Trump said he

plans to announce reciprocal tariffs on many countries next week,

with the U.S. imposing tariffs on imports equal to the rates

imposed on American exports.

Traders were also reacting to mixed U.S. jobs data, with a

closely watched Labor Department report showing weaker than

expected job growth in January but an unexpected decrease by the

unemployment rate.

The report said non-farm payroll employment rose by 143,000 jobs

in January compared to economist estimates for an increase of about

170,000 jobs.

Meanwhile, employment in December and November surged by

upwardly revised 307,000 jobs and 261,000 jobs, respectively,

reflecting a net upward revision of 100,000 jobs.

The Labor Department also said the unemployment rate dipped to

4.0 percent in January from 4.1 percent in December. The

unemployment rate was expected to remain unchanged.

“An unemployment rate at 4% is considered very low, giving the

Fed reason to keep fed funds unchanged in the near term,” said

Jeffrey Roach, Chief Economist for LPL Financial.

Sector News

Housing stocks saw substantial weakness amid a notable increase

by treasury yields, dragging the Philadelphia Housing Sector Index

down by 2.7 percent.

Significant weakness was also visible among retail stocks, as

reflected by the 2.4 percent slump by the Dow Jones U.S. Retail

Index.

A steep drop by Amazon (NASDAQ:AMZN) weighed on the sector, with

the online retail giant tumbling by 4.1 percent after reporting

better than expected fourth quarter results but providing

disappointing sales guidance for the current quarter.

Biotechnology, semiconductor and software stocks also saw

considerable weakness, while airline stocks were among the few

groups to buck the downtrend.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region turned in a mixed performance during trading on Friday.

Japan’s Nikkei 225 Index slid by 0.7 percent, while China’s

Shanghai Composite Index jumped by 1.0 percent.

Meanwhile, the major European markets all moved lower on the

day. The German DAX Index fell by 0.5 percent, the French CAC 40

Index declined by 0.4 percent and the U.K.’s FTSE 100 Index dipped

by 0.3 percent.

In the bond market, treasuries showed a notable move to the

downside, extending the modest pullback seen on Thursday.

Subsequently, the yield on the benchmark ten-year note, which moves

opposite of its price, climbed 4.7 basis points to 4.487

percent.

Looking Ahead

Reports on consumer and producer price inflation are likely to

be in focus next week along with congressional testimony by Federal

Reserve Chair Jerome Powell.

SOURCE: RTTNEWS

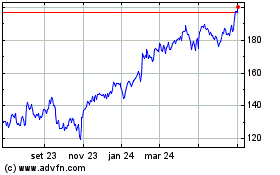

Amazon.com (NASDAQ:AMZN)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

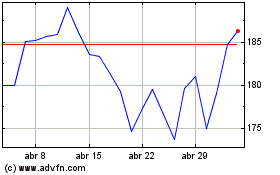

Amazon.com (NASDAQ:AMZN)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025