An Introduction To Stellar And XLM: Mission, Control, And Consensus

04 Setembro 2021 - 3:27PM

NEWSBTC

This project is an enigma. On the one hand, Stellar is not for

profit, it doesn’t have owners or shareholders, and strives to be

somewhat decentralized. On the other, Stellar is a

compliance-focused protocol, and its directors often meet with

shadowy organizations like the World Economic Forum. According to

their website, the protocol seeks “to unlock the world’s economic

potential by making money more fluid, markets more open, and people

more empowered.” Fine, but, at what cost? Related Reading | Stellar

To Power VISA’s New Partnership, XLM Begins Breakout According to

the legend, Stellar is a Ripple fork. However, as you’ll see below,

that’s not exactly true. Founder of the infamous Mt. Gox

cryptocurrency exchange and co-founder of Ripple, Jed McCaleb,

launched Stellar in 2014. Joyce Kim, a lawyer, was his partner in

the venture. Stripe financed the initial operation. The native

currency of the whole Stelar ecosystem is called Lumen or XLM.

Stellar’s Mission And Approach The recently appointed CEO and

Executive Director of the Stellar Development Foundation, Denelle

Dixon, was recently interviewed by Securities.io. “The vision is

big: Stellar and SDF hope to unlock the world’s economic potential

by making money more fluid, markets more open, and people more

empowered,” she told them. On its website, Stellar justifies its

existence by telling us. “The way the global financial

establishment is structured today, people are born into an economy

just like they’re born into a political system. Stellar is a way

out: it lets people participate in a worldwide, stable, financial

network regardless of where they live.” The controversial aspect is

Stellar’s approach. It’s completely opposed to the cryptocurrency

ethos. The company wants to build a bridge between the traditional

banking system and the cryptocurrency space, but by following the

traditional banking system’s rusty rules. “The software has always

been intended to enhance rather than undermine or replace the

existing financial system.” In other words, Stellar aims to

provide a platform with which all financial actors can interact

without any friction. All financial actors that are properly

identified and approved by the legacy system, that is. What

Is The Stellar Consensus Protocol? As a consensus mechanism,

Stellar doesn’t use Proof-Of-Work or Proof-Of-Stake. It uses its

own Stellar Consensus Protocol (SCP.) For a formal definition,

let’s quote the paper that Stellar presented at the Symposium on

Operating Systems Principles. How did Stellar solve the Byzantine

general problem? “With SCP, each institution specifies other

institutions with which to remain in agreement; through the global

interconnectedness of the financial system, the whole network then

agrees on atomic transactions spanning arbitrary institutions, with

no solvency or exchange-rate risk from intermediary asset issuers

or market makers.” And, what does the Stellar Consensus Protocol

accomplish exactly? “SCP lets Stellar atomically commit

irreversible transactions across arbitrary participants who don’t

know about or trust each other. That in turn guarantees new

entrants access to the same markets as established players, makes

it secure to get the best available exchange rates even from

untrusted market makers, and dramatically reduces payment latency.”

For the system to function, Stellar relies on Federated Byzantine

Agreements. For a description of what those do, let’s quote

Bit2meAcademy: “For the FBAs to function properly, participants

must wait for the majority to reach a consensus. In this way,

participants know which transactions are most relevant before

starting to settle them. So when the majority of the network takes

a position, the network accepts the transaction and makes it

unfeasible to roll it back for an attacker. In other words, the

Stellar Consensus Protocol tends towards centralization and just

ignores most of the problems that Proof-Of-Work solves. It does use

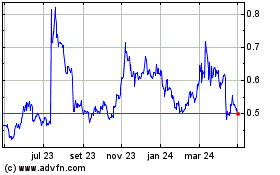

significantly less energy, though. XLM price chart for 09/04/2021

on Bitfinex | Source: XLM/USD on TradingView.com Key

Characteristics Of The Stellar Blockchain Almost all of the Stellar

validators are corporate entities of some sort. Or are maintained

by the Stellar Development Foundation. However, “anyone can

install the Stellar software and join the consensus process.” Each

Stellar Lumen account must have a minimum of XLM in them. This

minimum balance protects the network from spam accounts. The

Stellar Lumen’s mission is to pay for gas to conduct operations

inside the Stellar ecosystem. The Stellar ecosystem was not

designed for direct payments. The idea is to provide a platform to

serve as an intermediary in currency exchange. The system “doesn’t

privilege any particular currency.” The code is open source and

auditable by anyone. “The Foundation helps maintain Stellar’s

codebase, supports the technical and business communities around

Stellar,” great! “And is a speaking partner to regulators and

institutions,” ow. Stellar recently signed a partnership with

“crypto-asset risk management solutions” firm Elliptic. That means,

“Elliptic’s monitoring, compliance, and analysis software now

incorporates support for XLM, the native asset of Stellar.” Ow.

With the recent protocol 13 update, Stellar allows “fine-grained

control of asset authorization.” This means the issuer of an asset

can deauthorize accounts and don’t let them use the asset. This

means, more control and permissions. The Lumens had an inflation

rate of 1% per year. In September 2019, Stellar removed inflation

of Lumens. Also, the Stellar Development Foundation burned 55B of

their Lumens. So, Is Stellar a Ripple Fork? In its FAQ,

Stellar goes back to its origins: “The old Stellar network launched

in July 2014. The node software (stellard) was a modified fork of

the Ripple node software (rippled). The ledger was completely new

and contained no history from Ripple’s network.” Related Reading |

Stellar To Introduce AMM Functionality, What This Means For Its

Ecosystem So, the software was originally based on Ripple’s, but

the ledger was brand new. Nevertheless, in 2015, when they released

the Stellar Consensus Protocol, they re-wrote the software from

scratch. From that point onwards, Stellar doesn’t share any code

with Ripple. Featured Image by Nicole Avagliano on Unsplash -

Charts by TradingView

Ripple (COIN:XRPUSD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Ripple (COIN:XRPUSD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025