Matrixport Executive Thinks BUSD Crackdown Won’t Spread To All Stablecoins

15 Fevereiro 2023 - 7:23AM

NEWSBTC

Matrixport’s executives believe the regulatory enforcement on BUSD

will not impact all stablecoins. Moreover, according to the

executive, other issues surround the crackdown. The United States

regulators are striking hard on some crypto firms, including

Kraken, Coinbase, and Paxos. In addition, the recent crackdown on

Binance USD stablecoin might increase uncertainty in the crypto

space as many wonders if the crackdown spreads to other

stablecoins. The Current Crackdown Linked to Issuer Management

Problems The New York Department of Financial Services (NYDFS)

ordered the issuer of BUSD, Paxos Trust Company, to stop issuing

the BUSD stablecoin. The action was based on unresolved problems

regarding the issuer’s oversight in its relationship with the

Binance crypto exchange. Related Reading: Bitcoin NUPL Retests Key

Support, Will BTC Rebound? Paxos would still handle the redemption

of the existing stablecoin tokens from users till 2024. The NYDFS

confirms that it will continue to monitor the firm’s approach

through the redeeming process. The head of research at Matrixport,

a crypto-financial service firm, reacted to the brewing tension in

the crypto industry following the regulators’ crackdown on BUSD. He

stated that the enforcement action on BUSD is not a target against

all stablecoins. The executive thinks that the blockchain firm

Paxos could have been flexible in its management of BUSD. So, the

main problem is not generally revolving around stablecoins.

Further, Thielen explained that Paxos failed to comply with the

primary management roles as the issuer of the stablecoin. For

example, according to him, the firm couldn’t conduct tailored and

periodic assessments of issued BUSD customers. Also, there wasn’t

any due diligence in the firm’s management. Notably, the United

States Securities and Exchange Commission (SEC) sent a notice to

Paxos alleging its sales of unregistered security earlier this

month. In addition, the regulator plans to sue Paxos over its

activities with BUSD. Regulators Doubt The BUSD Backed Reserves

According to Thielen, the stablecoin has issued about $11 billion

on the Ethereum blockchain. Also, about $4.8 billion of Binance-peg

BUSD tokens are on the BNB Smart Chain (BSC). Notably, Binance

offers a token-pegged service that locks BUSD on Ethereum. However,

Binance-Peg BUSD is on BNB Chain and several other blockchains like

Polygon and Avalanche. The Matrixport executive explained that the

NYDFS might be worried that the $4.8 billion are not fully backed.

There could be issues with the supposed 1:1 backing for the BUSD

stablecoin. Also, he mentioned that part of the reasons for the

crackdown on BUSD could be from the incident in January when

Binance joined its customers’ funds with collateral. Related

Reading: Bitcoin Large Transactions Explode, Whales Buying The Dip?

On its part, Paxos confirmed its readiness to comply with the

order, as it will stop BSUD issuance by February 21. Also, the

blockchain firm assured users that the stablecoin has a 1:1 US

dollar backing on its reserves. Furthermore, it stated that the

reserves are fully segregated and kept in bankruptcy remote

accounts. Featured image from Pixabay, charts from TradingView.com

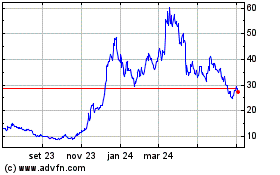

Avalanche (COIN:AVAXUSD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

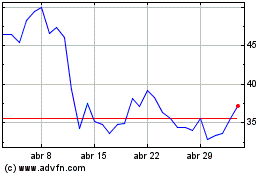

Avalanche (COIN:AVAXUSD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025