Bitcoin (BTC) And Ethereum (ETH) Fall 4% Amid Silvergate Fallout

03 Março 2023 - 12:30PM

NEWSBTC

Crypto assets such as Bitcoin and Ethereum have always been known

to be impacted by the news, and the latest news today that resulted

in a plummet in the market is the Silvergate fallout. This news has

caused a sharp decline in two of the largest crypto assets in the

market. According to a report from Bloomberg, crypto

platforms are now cutting ties with the U.S.-based crypto-friendly

bank following its disclosure of its review of whether it can

remain viable. So far, Coinbase and Digital Asset Capital

Management are the latest on the list to end their partnership with

Silvergate. Bitcoin (BTC) And Ethereum (ETH) Sharp Decline

Following the negative news concerning the crypto-focused bank

Silvergate, Bitcoin and Ethereum have both seen a sharp fall in

price by 4.5% and 4.7% respectively over the past 24 hours. Both

assets have seen notable differences in the highs and lows in the

past 24 hours. Related Reading: Bitcoin Births Another Set Of

Millionaires As BTC Nears $24,000 At the time of writing, BTC’s

price made a 24-hour low of $21,921 and a high of $23,541. In

contrast, ETH’s price has also made some notable movement with 24

hour low of $1,550 and a high of $1,653. Notably, Bitcoin has since

been indicating an upcoming bearish trend following its enormous

40% spike in January and its slowed-down rally in February.

Compared to January when BTC surged from the $16,000 zone seen late

last year to as high as $23,799 as of January 29, the largest

crypto by market cap only picked up from there to $25,000 in

February having a little rally last month compared to the 40% seen

the month before. Currently, the BTC chart still indicates a

continuous downward trend as the asset price is looking to dip

below our previously marked-out support of just under $22,000. On

the other hand, ETH price action is not far from being

distinct. Over the past week, Ethereum has been signaling a

bearish trend after falling gradually by nearly 5% in the past 7

days despite the upcoming Shanghai launch. The asset has suffered a

decline in not only price but also in market cap. Over the past 15

days, more than $18 billion has been removed from ETH’s market cap

after falling from a market cap high of $206 billion seen on

February 16 to $188 billion as of March 3. Regardless, the asset

still ranks steadily as the second largest crypto by market cap

after Bitcoin. Alongside BTC and ETH’s fall, the global

cryptocurrency market capitalization has also suffered a 5% fall in

valuation over the past 24 hours. Though the crypto market was able

to maintain composure amid the regulator crackdown, the Silvergate

saga appears to have a higher impact on the market. Related

Reading: Ethereum Price Won’t Go Down Quietly: Key Supports To

Watch Silvergate Relation With The Crypto Industry Silvergate is a

U.S. bank that has served the crypto market in general. The bank

allowed the rapid transfer of funds between accounts and crypto

exchanges such as Coinbase and Crypto.com, as well as

over-the-counter trading desks with its Silvergate network.

Following the crash of the FTX exchange last year, the bank

suffered a run on deposits given its connection with the exchange

being a key client. After delaying its annual 10-K report with the

Securities and Exchange Commission (SEC). This week, the bank

revealed that it is reviewing whether it can still continue to

operate. This update has caused ripples within its list of

partnerships, as well as a decline in its stock price. On Thursday,

Coinbase announced that it has ended its relationship with the

bank. Shortly after that, other crypto platforms and firms

such as Gemini, Crypto.com, and crypto hedge fund Digital Asset

Capital Management disclosed they’re cutting off ties with the

U.S.-based crypto-friendly bank. Richard Galvin, co-founder at

Digital Asset Capital Management already said the company is

looking to move away from Silvergate and look into Swiss banks,

according to Bloomberg. So far, Silvergate stock with the ticker SL

has plummeted more than 10% from a high of $14 on Wednesday to

$5.72 at the time of writing. Featured image from Unsplash, Chart

from TradingView.

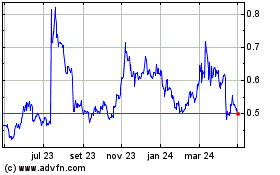

Ripple (COIN:XRPUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Ripple (COIN:XRPUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024