US Banking Crisis Worsens With Half Of America’s Banks On the Verge Of Failure

02 Maio 2023 - 5:00PM

NEWSBTC

The recent sharp decline in shares of major U.S. regional banks has

sparked fears of another banking crisis. The collapse of First

Republic Bank, the largest U.S. bank failure since 2008, has sent

shockwaves through the financial sector, prompting experts to warn

that a “confidence crisis” could happen to any bank in the country.

Investors have reacted quickly to the news, with shares of PacWest

Bancorp, Western Alliance Bank, and KeyCorp plummeting by as much

as 30%, 21%, and 10%, respectively. The KBW Regional Banking Index

has also taken a hit, falling by 5.2% and its lowest since December

2020. Related Reading: Avalanche (AVAX) Climbs Higher: Q1 2023

Results Show Impressive Growth US Banking Industry In Peril, Half

Of America’s Banks Nearing Insolvency Mario Nawfal, a renowned

financial expert, has expressed concern over the recent

plummeting of bank shares in major U.S. regional banks, signaling a

deepening banking crisis in the country. In the aftermath of the

collapse of First Republic Bank, the largest U.S. bank failure

since the 2008 financial crisis, shares of PacWest Bancorp, Western

Alliance Bank, and KeyCorp fell drastically, with the KBW Regional

Banking Index hitting their lowest level since December 2020.

Nawfal warns that if a confidence crisis can happen to the First

Republic, it can happen to any bank in the country. He attributes

the current state of the US banking industry to “insatiable greed

and reckless” money printing, which have had dire consequences. The

collapse of First Republic Bank is just the tip of the iceberg, and

things could get much worse if the Federal Reserve doesn’t pivot,

Nawfal claimed. The implications of JPMorgan being the

government’s first line of defense in a banking crisis are also a

cause of concern for analysts from Evercore ISI, a global

independent investment banking advisory firm. Nawfal further stated

that the US banking industry is in peril, and urgent measures must

be taken to prevent a complete collapse. Major US Banks Experience

Significant Share Price Falls, Halting Trading PacWest Bancorp and

Western Alliance Bancorp, two major players in the US banking

industry, have halted trading in their equities after experiencing

significant share price falls of 24% and 20%, respectively.

This follows the recent sale of First Republic Bank to JPMorgan,

which occurred after the US regulator, the Federal Deposit

Insurance Corporation (FDIC), took control of the struggling San

Francisco-based lender. First Republic Bank’s share price had

collapsed by a staggering 97% this year following the crisis of

confidence triggered by the collapse of Silicon Valley Bank in

March. According to a report by The Telegraph, First Republic

Bank’s deposits plunged by $100 billion in the first quarter of the

year, highlighting the severity of the crisis. The sale of the bank

to JPMorgan indicates the dire state of the US banking industry and

the need for urgent action to prevent a complete collapse.

Furthermore, according to The Telegraph, The US Federal Reserve has

begun a two-day meeting to determine whether it should raise its

benchmark lending rate for the tenth time. Since March last year,

the Fed has aggressively increased interest rates to combat high

inflation, which remains above its long-term target of two

percent. The Federal Open Market Committee (FOMC) is widely

expected to raise its base rate by a quarter-point on Wednesday,

bringing the interest rate to between 5 and 5.25%, the highest

level since the global financial crisis. The situation is not just

concerning for investors but also the wider US economy. The banking

industry plays a critical role in the economy, and a collapse could

have severe repercussions, including a credit crunch and a

recession. Related Reading: Ethereum Sees Inflows Of $505M Into

Binance, Sign Of Selling? Featured image from Unsplash, chart from

TradingView.com

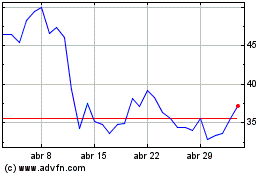

Avalanche (COIN:AVAXUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

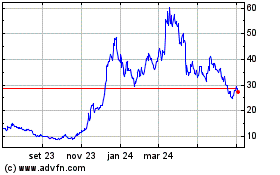

Avalanche (COIN:AVAXUSD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024