Avalanche Breaks $14 Price Level, Yet Remains Hinged On Crucial Resistance

23 Maio 2023 - 5:00PM

NEWSBTC

During the recent weekend, Avalanche (AVAX) witnessed a significant

surge in selling pressure, resulting in a bearish breakout. As a

consequence, the price of AVAX dipped close to a multi-month low of

$13.8. However, on the 24-hour chart, the altcoin displayed a

slight upward movement, showing some appreciation. On the other

hand, the weekly chart depicted lacklustre performance for AVAX.

The technical outlook for Avalanche remains bearish, as both demand

and accumulation levels have remained low. The price action of AVAX

has been influenced by the undecided nature of Bitcoin (BTC), which

recently re-entered the $27,000 range. Related Reading: XRP Aims

For $0.50, Hinges on Breaking Through This Price Level This has

caused other altcoins, including AVAX, to exhibit uncertainty on

their respective charts. The overhead resistance level for AVAX

holds significant importance, as surpassing this level could

trigger a rally for the altcoin. Conversely, if sellers exert

further pressure, AVAX may break its consolidation and fall below

its immediate support level, thereby strengthening the bearish

sentiment. Broader market strength is necessary for AVAX to reclaim

its overhead ceiling. The decline in the market capitalization of

AVAX indicates a decrease in buying strength at the current time.

Avalanche Price Analysis: One-Day Chart At the time of writing,

AVAX was priced at $14.70. It is currently trading in close

proximity to its immediate resistance level of $15. A breakthrough

above $15 has the potential to propel the altcoin towards $15.80

and ultimately $16. The involvement of buyers in the market is

crucial to generate demand and facilitate AVAX’s upward price

movement. On the downside, if AVAX fails to sustain its current

price level, it may find support at $14 before potentially trading

below that level. The recent trading session showed a decline in

the amount of AVAX traded, indicating the dominance of sellers in

the market. Technical Analysis Throughout May and part of April,

AVAX experienced consistently low buying pressure, reflecting a

limited demand for the altcoin. The Relative Strength Index (RSI)

was below the 40-mark, indicating that sellers had a greater

presence than buyers at the time of writing. Furthermore, the AVAX

price fell below the 20-Simple Moving Average (20-SMA) line,

demonstrating that sellers were the driving force behind the price

momentum in the market. A significant move above the $15 price

level would help AVAX surpass the 20-SMA line, suggesting a

potential shift in momentum and possibly attracting more buying

interest. Although AVAX recently returned to the $14 price zone,

there are no clear indications of buying strength according to

technical indicators. The Moving Average Convergence Divergence

(MACD), provides insights into price momentum. It formed only one

green histogram, which does not necessarily signify buy signals at

this point. Related Reading: Litecoin Surpasses $90, But This Level

Remains Crucial For The Altcoin The Bollinger Bands, which reflect

price volatility and fluctuations, have remained wide, indicating

that the possibility of price fluctuations cannot be ruled out in

the upcoming trading sessions. Featured Image From UnSplash, Charts

From TradingView.com

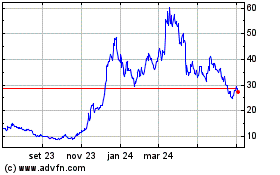

Avalanche (COIN:AVAXUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

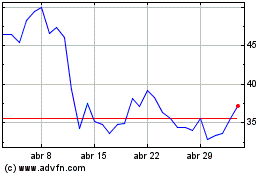

Avalanche (COIN:AVAXUSD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024