Is XRP Growth Real Or Just Smoke And Mirrors? Here’s What Liquidation Data Shows

04 Outubro 2023 - 3:00PM

NEWSBTC

XRP, the digital currency associated with Ripple Labs, has been

making headlines with its recent price rally. However, a report

suggests that the hype surrounding its performance might be

overstated, as market data paints a different picture.

Despite a positive legal ruling and a robust community, XRP seems

to struggle to gain the same level of confidence as Bitcoin (BTC)

and Ethereum (ETH) among investors. Liquidation data from CoinGlass

reveals that in the past 24 hours, approximately $4.20 million

worth of XRP has been liquidated. Interestingly, the short

positions accounted for a mere $66.13K in losses, while long

traders recorded a substantial $2.09 million loss. Source:

Coinglass Related Reading: Shiba Inu Investors Beware: 425 Billion

Tokens On The Move – Is It A Sell-Out? Liquidation Data Raises

Questions On XRP’s Price Rally This data underscores the fact that

the recent ruling by Judge Analisa Torres, which classified XRP as

not a security when traded on exchanges, failed to ignite

significant bullish sentiment for the cryptocurrency. Comparing

this liquidation data with that of Bitcoin and Ethereum reveals a

stark contrast, further suggesting that XRP is still considered a

less promising digital asset. This contrast raises doubts about the

bullish predictions made by some experts following the recent legal

ruling. It appears that despite its strong community support, XRP’s

growth indicators are not aligning with the optimism that has

surrounded it. XRP market cap currently at $28.4 billion. Chart:

TradingView.com Currently priced at $0.529 according to CoinGecko,

XRP has seen a 5.0% growth in the past 24 hours and a seven-day

rally of 7.4%. Despite these gains, market observers remain

cautious about the coin’s long-term potential. XRP Trajectory:

Contrasting Perspectives In a separate report, there is a

contrasting perspective that suggests XRP could still experience

significant growth in value. This report highlights the fact that

during the prolonged legal battle with the US Securities and

Exchange Commission that began in December 2020, XRP has shifted

its focus to overseas markets. This strategic move has led to

impressive client wins in emerging markets, where Ripple’s payment

platform has the potential to make a substantial impact. XRP

seven-day price action. Source: Coingecko Related Reading: Is

Dogecoin On Life Support? Analyzing Its Recent Price Downturn These

client wins have paved the way for promising developments,

particularly in projects related to cross-border payment systems

and Central Bank Digital Currencies (CBDCs). These initiatives hold

the potential to drive the long-term value of XRP, as they expand

its use cases beyond speculative trading. XRP’s recent price surge

may have garnered attention, but skepticism remains prevalent in

the market. While some believe in its potential for further growth,

the current data and market sentiment suggest that XRP still has

hurdles to overcome to solidify its position as a top-tier digital

currency. (This site’s content should not be construed as

investment advice. Investing involves risk. When you invest, your

capital is subject to risk). Featured image from iStock

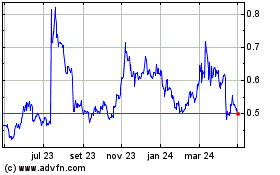

Ripple (COIN:XRPUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Ripple (COIN:XRPUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024