SUI Gets Spicy: Network Fires Back At Token Supply FUD

07 Maio 2024 - 8:00AM

NEWSBTC

Sui, the year-old Layer-1 blockchain darling, is facing a harsh

reality check. While celebrating its first anniversary on May 3rd,

2034, the network finds itself embroiled in a controversy

surrounding its tokenomics, the design and distribution of its

cryptocurrency, SUI. Related Reading: Is Avalanche About To Blow?

Don’t Miss This Potential Breakout – Analyst SUI Supply: Cause for

Concern? The fire was ignited by Justin Bons, founder of Cyber

Capital, who tweeted concerns about the SUI token supply being

overly concentrated in the hands of the founders and early

contributors. Bons pointed to a potential 80% allocation – 160

million out of a total 10 billion – going to Mysten Labs, Sui’s

creator, and another 600 million earmarked for “early

contributors,” raising eyebrows about potential centralization.

1/16) SUI has a great design, except for its token economics: SUI

claims to have a capped supply of 10B, with 52% being “unallocated”

till 2030 The problem is that over 8B SUI is being staked right

now! Over 84% of the staked supply is held by founders! SUI is

centralized: 🧵 — Justin Bons (@Justin_Bons) May 2, 2024 This

alleged lack of decentralization worries investors. If these

significant token holders decide to sell their SUI holdings (dump),

it could cause a dramatic price drop, harming regular investors.

Sui Fights Back: Transparency On The Agenda The network wasted no

time in refuting these claims. The network vehemently denied any

accusations of a centralized token supply, calling them

“misleading” and “inaccurate.” In a bid to assure investors, Sui

emphasized that Mysten Labs doesn’t have control over the Sui

Foundation treasury, community reserves, or investor tokens. Total

crypto market cap currently at $2.3 trillion. Chart: TradingView

The network further clarified that the foundation, as the largest

holder of locked tokens, will release them according to a publicly

available schedule. They reiterated their commitment to

transparency, stating that “every token that will be released has

been allocated.” Additionally, Sui highlighted that all staking

rewards earned by the foundation are reinvested back into the

community, a detail also reflected in the public emission schedule.

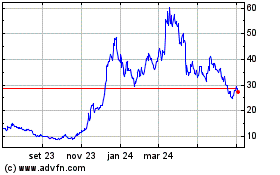

SUI 24-hour price action. Source: Coingecko Trust Issues: The

Market Responds While Sui attempts to quell concerns, some market

participants remain skeptical. They question the network’s motives,

labeling the token distribution strategy as potentially

manipulative. This skepticism coincides with a recent slump in

SUI’s price. Related Reading: Whispers In The Deep: Why Are

Ethereum Whales Disappearing? Despite impressive gains in the past,

the token has shed over 25% in the last month and sits a staggering

90% below its all-time high. This price performance fuels doubts

about the project’s long-term viability. The Importance Of

Transparency: A Lesson For Blockchain Projects The SUI tokenomics

controversy underscores a critical lesson for the entire blockchain

industry: transparency is paramount for building investor trust.

Justin Bons’ concerns, though potentially exaggerated, highlight

the need for clear communication and verifiable token distribution

plans. As the blockchain space matures, projects that prioritize

transparency and fair distribution models will likely garner

stronger investor confidence and ultimately, a more sustainable

future. Featured image from Penn Today – University of

Pennsylvania, chart from TradingView

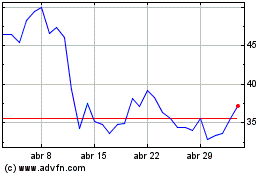

Avalanche (COIN:AVAXUSD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Avalanche (COIN:AVAXUSD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025