Can Avalanche (AVAX) Reclaim $30? Top Analyst Predicts A Dip Before A Bounce

03 Setembro 2024 - 9:00PM

NEWSBTC

Avalanche (AVAX) is currently trading at a crucial level after a

24% retrace that began last week. The crypto market is experiencing

extreme fear and uncertainty, with most altcoins hovering near

yearly lows. Analysts and investors closely monitor AVAX’s price

action as the market remains volatile. Related Reading:

Avalanche (AVAX) Consolidation Continues As Funding Rate Signals

Possible Market Shift Top analyst and trader Kaleo has shared his

insights, predicting AVAX may dip further before a recovery occurs.

This forecast has caught the attention of many, given the current

market conditions and the pressure AVAX faces. The coming

days will be pivotal in determining whether AVAX can find support

and begin its recovery or if it will continue to decline along with

other altcoins. As the situation unfolds, the stakes are high for

both short-term traders and long-term investors. Avalanche Holding

Above $20 Avalanche (AVAX) has entered a consolidation phase after

experiencing aggressive corrections, resulting in a staggering 73%

loss in its price since March. This significant drawdown has

captured the attention of many analysts and investors, who are now

closely monitoring AVAX’s next moves. Among them is top analyst and

investor Kaleo, who has shared a detailed analysis of X, drawing

comparisons between the current price structure of AVAX and its

performance in 2021. That year, AVAX witnessed a substantial pump,

followed by a massive correction, before embarking on an explosive

rally that propelled it to new all-time highs. Kaleo suggests that

a similar pattern could unfold now, indicating that AVAX might be

on the brink of a new uptrend. His analysis shows that AVAX is

expected to dip to the low $20 level before starting a strong

recovery. Related Reading: The Curse Of September: Is Another

Massive Bitcoin Sell-Off Coming? Kaleo’s prediction appears to be

holding, as AVAX has managed to stay above the critical $20 support

level. This resilience suggests potential strength and indicates

that the next target could be the $30 mark if the current support

is maintained. Investors are watching these levels closely, as they

could signal the beginning of a significant upward move for AVAX

shortly. AVAX Technical Analysis Avalanche (AVAX) trades at $22.22,

following a modest 4% bounce from the $21.17 low set on Sunday. For

bullish momentum to build, AVAX needs to reclaim the 4-hour 20

moving average (MA) at $23.75. This level is a crucial indicator of

short-term strength, as it often marks the transition to a more

consistent pattern of higher highs and higher lows when the price

stays above it. A sustained move above $23.75 could set the stage

for AVAX to target the critical $30 level. Breaking through $30 is

essential for reversing the current bearish structure, as it would

likely trigger a more rapid recovery. Related Reading: Ethereum

(ETH) Struggles To Break Past $2,600: What’s Driving ETH Down?

However, if AVAX fails to hold above $20, it could signal further

downside potential. The price may seek lower demand levels in such

a scenario, with $17 as the next significant support. Featured

image from Dall-E, chart from TradingView

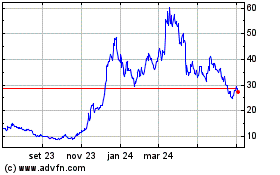

Avalanche (COIN:AVAXUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

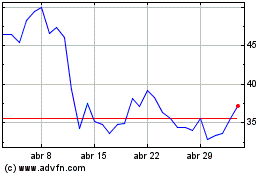

Avalanche (COIN:AVAXUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024