Over 1.8 Million Addresses Bought 52 Million ETH At $2,350: Will Ethereum Continue Falling?

04 Outubro 2024 - 12:30AM

NEWSBTC

Ethereum is down when writing, mirroring the general performance

across the board. The nearly 2% drop in the crypto scene is due to

the contraction of Bitcoin, Ethereum, and top altcoins. At present,

the total market cap is down to $2.17 trillion. It could post even

more losses should bears press on, reversing the gains of

September. Ethereum Under Pressure, Will $2,350 Offer Support? In

the last week alone, CoinMarketCap data shows that Ethereum is down

10%, pushing losses below $2,400, a former support, now resistance.

While it could appear that the sharp dump of the better part of

this week is discouraging participation, some traders are

accumulating at around spot rates. Related Reading: Dogecoin At $10

Thesis: What Each Breakout Cycle Says About The DOGE Price

IntoTheBlock data on October 3 shows that 1.89 million Ethereum

addresses bought 52 million ETH at around the $2,311 and $2,383

range. That a large amount of buyers choose to buy, on average, at

$2,350 means this is a support level that traders should closely

watch. Considering the number of ETH accumulated, sellers would

need to exert more effort to break below this level, forcing the

coin towards $2,100 and August lows. Comparing traders’ action and

the September range, the $2,350 level falls at around 61.8% and

78.6% Fibonacci retracement levels. What’s Next For ETH?

Technically, crypto prices, including ETH, tend to find support

around this Fibonacci retracement zone. Accordingly, how prices

react between the $2,100 and $2,350 zone will likely shape the

medium to long-term trend. Related Reading: What’s Holding Bitcoin

Back? Analyst Says $71,000 Is The Magic Number A refreshing bounce

around this emerging support and Fibonacci retracement zone would

be a massive boost. In this case, ETH could rally, even above

$2,800, as bulls target $3,500. Conversely, any sharp dump below

August and September lows may easily trigger panic selling. Out of

this, ETH can slump below $2,100 and $2,000 and may fall to as low

as $1,800, confirming losses of early August. Considering the state

of price action, sellers have the upper hand. Over the past few

trading sessions, centralized exchanges have had massive outflows.

Earlier today, The Data Nerd revealed that Wintermute, a crypto

market maker, moved 14,221 ETH to Binance, indicating that they

might sell. In August, Wintermute and other leading market makers,

including Jump Capital, sold over 130,000 ETH, forcing prices

lower. Feature image from DALLE, chart from TradingView

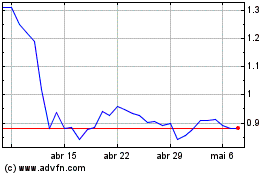

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025