Bitwise CIO: Crypto Looks Like July 2024—Here’s What Happened Next

26 Fevereiro 2025 - 8:00AM

NEWSBTC

In a memo released on February 25, 2025, Matt Hougan—Chief

Investment Officer (CIO) at Bitwise Asset Management—drew striking

parallels between today’s crypto market and what he observed in

July 2024. Titled “Short-Term Pain, Long-Term Gain (Redux),”

Hougan’s latest analysis suggests that, despite the current

pullback, the industry’s underlying fundamentals remain as

compelling as ever. Crypto Echoes Of July 2024 Hougan opened his

memo by recalling the environment in July 2024, when he penned an

earlier piece called “Short-Term Pain, Long-Term Gain.” Back then,

crypto markets were reeling: “Bitcoin, which had peaked above

$73,000 in March 2024, had fallen to roughly $55,000, a 24%

pullback. Ethereum was down 27% over the same time period.” At the

time, Hougan noted that “the crypto market is facing a weird

dynamic right now. All the short-term news is bad, and all the

long-term news is good.” He also cited catalysts such as potential

ETF inflows, the upcoming Bitcoin halving, and more supportive

policymaking in Washington, D.C., contrasting them with

then-immediate risks like Mt. Gox distributions and government

sales of Bitcoin. Related Reading: From Hope To Crypto Panic: How A

Day Of Highs For Coinbase Turned Into A Nightmare For Bybit That

analysis proved timely. “Shortly after I wrote the memo, Bitcoin

bottomed and proceeded to rip straight to $100,000,” Hougan wrote.

In his latest note, he sees a similar duality at play: negative

short-term developments on one hand, and powerful long-term

tailwinds on the other. Yesterday, crypto markets were under

renewed pressure: Bitcoin dropped at one point more than 10% to as

low as $86,050, Ethereum by 18%, and Solana lower by 21%. The

immediate trigger: last weekend’s hack of Bybit, a Singapore-based

exchange, which suffered a $1.5 billion Ethereum theft via a

phishing scam. Though Bybit dipped into its reserves to make

clients whole, the breach reverberated across the industry. The

hack followed on the heels of a spate of memecoin scams, including

Libra, endorsed by Argentine President and noted crypto proponent

Javier Milei. The memecoin cost investors billions in what Hougan

described as a “multi-billion-dollar scam.” Moreover, Melania, a

project tied to First Lady Melania Trump, also collapsed, causing

substantial losses for token holders. Trump, a memecoin linked to

US President Donald Trump fared no better. “Taken together, these

events probably spell the end of the recent memecoin boom,” Hougan

commented. While many institutional and long-term crypto

participants may view the memecoin sector with skepticism, its

trading volume and buzz have fueled overall market

activity—particularly in the Solana ecosystem. Related Reading:

Crypto CEO Calls Start Of The Altcoin Season With A Caveat Despite

the negative headlines, Hougan points to a robust foundation

beneath crypto markets. First, Hougan highlights the pro-crypto

regulation under the Trump administration. In his view, “We are in

the early days of a massive shift in Washington’s attitude towards

crypto.” He cites the US Securities and Exchange Commission’s

recent decision to drop high-profile lawsuits against companies

like Coinbase and ongoing legislative efforts around stablecoins

and market structure. Such developments, he argues, will help

crypto break into mainstream finance. Second, institutional

adoption is still growing. Large-scale buyers—including asset

managers, corporations, and even governments—continue to accumulate

Bitcoin. Hougan notes that so far this year, “investors have plowed

$4.3 billion into bitcoin ETFs,” and he expects that figure to

balloon to $50 billion by year-end. Hougan also expects a

stablecoin boom. Stablecoin assets under management have climbed to

a record $220 billion, marking a 50% jump from last year. With

favorable legislation making its way through Congress, Hougan

believes the sector could grow to $1 trillion by 2027. Lastly, the

Bitwise CIO predicts the rebirth of DeFi and tokenization. Lending,

trading, prediction markets, and derivatives see record heightened

usage. Meanwhile, the tokenization of real-world assets continues

to hit all-time highs in assets under management, suggesting that

blockchain-based representations of traditional securities and

commodities may be on the rise. Hougan refers back to his July 2024

thesis to underline today’s opportunity. On the negative side,

markets have to navigate aftershocks from Bybit’s massive hack and

the implosion of multiple memecoin projects. On the positive side,

regulatory clarity, institutional inflows, stablecoin expansion,

and DeFi innovation continue unabated. “This is what I call a

no-brainer,” Hougan wrote, underscoring his stance that serious

long-term factors overwhelmingly outweigh the short-term setbacks.

He does offer a measured warning, noting this pullback may prove

more pronounced than last summer’s dip: “The memecoin boom was

large, and the hangover could be more significant. It might take

days, weeks, or months to work through it.” Yet his conclusion

remains firm: the long-term growth narrative remains intact. “When

that happens, I like my money on the long term,” he stated,

reiterating that patience can be rewarded in a market often swayed

by headline-driven volatility. At press time, BTC traded at

$88,349. Featured image created with DALL.E, chart from

TradingView.com

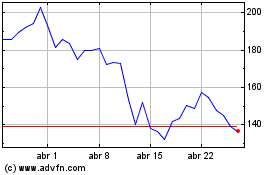

Solana (COIN:SOLUSD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Solana (COIN:SOLUSD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025