Whales Add 190,000 Ethereum In The Last 24 Hours – The Accumulation Continues

01 Março 2025 - 9:30PM

NEWSBTC

The crypto market is facing intense fear, with many analysts

speculating that a prolonged bear market could be on the horizon.

Ethereum has been one of the hardest-hit assets, experiencing a

massive decline of over 27% in less than five days. Investors are

growing cautious as ETH struggles to hold key support levels,

fueling uncertainty about its short-term direction. Related

Reading: Is Solana In A Macro Trend Move? Charts Show Potential

Shift Despite the widespread panic, large investors appear to be

taking advantage of the dip. Data from Santiment reveals that

whales have accumulated significant amounts of ETH in the last 24

hours, suggesting that institutional players and high-net-worth

individuals are positioning for a potential recovery. Historically,

such accumulation phases by big players have preceded strong

reversals, indicating that smart money might be betting on an

eventual rebound. While selling pressure remains high, this whale

activity could provide a foundation for ETH to stabilize and regain

lost ground. However, for a bullish recovery to take shape,

Ethereum needs to reclaim crucial levels above $2,500. The next few

days will be critical in determining whether ETH can bounce back or

if the market will continue to slide further down. Ethereum

Accumulation Signals Trust Ethereum is trading slightly above the

most critical support level since December 2023, a price zone that

could determine its short-term direction. Bulls must hold this

level to prevent further declines and initiate a recovery phase,

but selling pressure remains strong. Analysts are divided, with

some expecting a prolonged bear market while others see potential

for a rebound. Crypto expert Ali Martinez shared Santiment data on

X, revealing that whales bought another 190,000 ETH in the last 24

hours. This adds to the broader trend of accumulation that has been

ongoing for the past month. Historically, such whale activity

signals confidence from large investors, who often accumulate at

discounted prices before an uptrend resumes. If this trend

continues, Ethereum could be setting up for a strong recovery

rally. Related Reading: Dogecoin Open Interest Declines 67% In

Three Months – Can Meme Coins Recover? However, bullish momentum

remains uncertain. ETH needs to reclaim key levels above $2,500 to

confirm a reversal, and failing to do so could lead to further

corrections. The market is currently driven by fear and

uncertainty, but the continuous whale accumulation suggests that

smart money is positioning for future gains. The coming days will

be crucial in determining whether Ethereum can bounce back or if

the bearish trend will persist. ETH Testing Crucial Long-Term

Demand Ethereum is trading at $2,220 after reaching its lowest

level since late November 2023. The recent sell-off has pushed ETH

below critical support zones, and bulls are struggling to regain

control. The price is now below the 200-week exponential moving

average (EMA) at around $2,290 and the 200-week moving average (MA)

at around $2,480, signaling a bearish outlook unless a strong

recovery takes place soon. For Ethereum to regain momentum, bulls

must reclaim the $2,500 level in the coming days. A breakout above

this level would signal renewed strength, potentially leading to a

massive recovery rally as traders regain confidence. However, ETH

remains under pressure, and failing to reclaim the $2,300 mark

could confirm further declines. If this scenario unfolds, Ethereum

could face a deeper correction toward the $2,000 psychological

support, or even lower, depending on market sentiment. Related

Reading: Ethereum Retraces To Critical Monthly Demand Level – Can

ETH Hold Selling Pressure? With the market still dominated by fear

and uncertainty, traders are watching key technical levels closely.

If ETH can stabilize above $2,200 and push higher, a relief rally

could be on the horizon. Otherwise, Ethereum could remain trapped

in a prolonged downtrend, testing investor patience and market

resilience. The next few days will be critical for ETH’s price

action. Featured image from Dall-E, chart from TradingView

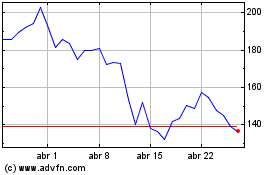

Solana (COIN:SOLUSD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Solana (COIN:SOLUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025