Analyst Says Bitcoin RSI Dominance Needs To Crash To This Level For The Bull Run To Resume

11 Março 2025 - 11:00PM

NEWSBTC

Bitcoin has maintained its dominance on the altcoin market even

amidst the ongoing price corrections. The leading cryptocurrency

has been in the spotlight throughout this market cycle, but a

technical outlook suggests that it needs to give way. Particularly,

a crypto analyst known as Seth on social media platform X pointed

to Bitcoin’s dominance relative strength index (RSI) as a crucial

factor that must change before Bitcoin and the broader market can

kick off another leg upward. Bitcoin Dominance RSI Hits New Level

Seth’s latest analysis, shared on social media platform X,

highlights a critical observation regarding Bitcoin’s market

dominance. He noted that Bitcoin’s monthly dominance RSI recently

surged to 70, a level that has never been reached before in

Bitcoin’s history. While this might seem like a bullish signal at

first glance, the analyst suggests otherwise, warning that the

dominance RSI must cool down for the final phase of the bull run to

take place. This perspective comes as the crypto market experiences

a downturn, leaving investors questioning when the next bullish

wave will begin. Related Reading: Bitcoin Price Suffers Bearish

Deviation After Filling CME Gap, Is This Good Or Bad? RSI, or

relative strength index, tracks the speed and change of price

movements and is used to identify overbought or oversold

conditions. With Bitcoin’s RSI dominance at such an extreme level,

even with the recent price decline, it suggests that BTC’s control

over the market is at an unsustainable peak, which could slow down

the broader market rally. According to Seth, those who fail to

grasp this concept do not understand the fundamental mechanics of

financial markets, as this principle applies beyond just Bitcoin

and altcoins. Given this, the healthiest path forward would be a

reduction in Bitcoin’s dominance over the next few weeks, with the

analyst projecting a fall to 44% dominance. Why BTC’s RSI Dominance

Decline Matters A decline in Bitcoin’s RSI dominance would mean

that the market is shifting toward more balanced conditions,

allowing capital to flow into altcoins and drive up their prices.

Throughout past bull cycles, particularly in 2021, Bitcoin’s rise

to a peak was often followed by a surge in altcoin investments,

triggering widespread rallies across the market. Related Reading:

Bitcoin Price Consolidates In Tight Zone: Why A Crash To $84,000 Is

Likely This pattern has historically marked the final phase of a

bull run, where capital flows away from Bitcoin and into altcoins

with a higher potential for short-term gains. Until Bitcoin’s

dominance cools off, the altcoin sector may struggle to gain

momentum and continue to derail the final phase of the BTC bull

run. At the time of writing, BTC is trading at $81,500, reflecting

a 2.5% decline in the last 24 hours. Market data from CoinMarketCap

indicates that Bitcoin’s dominance currently stands at 61.0%,

having risen by 0.65% within the same period. This growing

dominance suggests that capital remains concentrated in BTC.

Featured image from Unsplash, chart from Tradingview.com

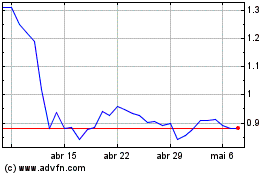

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025