Canadian Dollar Climbs As Inflation Accelerates

19 Novembro 2024 - 10:09AM

RTTF2

The Canadian dollar strengthened against its major counterparts

in the New York session on Tuesday, following the release of

hotter-than-expected inflation data for October.

Data from Statistics Canada showed that the consumer price index

rose 2.0 percent year-over-year in October, following a 1.6 percent

increase in September. Economists had expected a 1.9 percent

increase.

On a seasonally adjusted monthly basis, the CPI rose 0.3 percent

versus a flat reading in September.

Core CPI, excluding food and energy, remained unchanged at 0.2

percent.

The CPI report lowered expectations for a bigger rate cut by the

Bank of Canada in December.

The loonie touched 1.3968 against the greenback, setting a 6-day

high. The currency is likely to locate resistance around the 1.36

level.

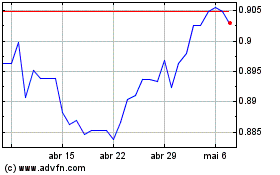

The loonie rebounded to 0.9098 against the aussie following the

data, from an early 1-week low of 0.9139. If the loonie rises

further, it is likely to test resistance around the 0.89

region.

The loonie rose to a 4-day high of 110.51 against the yen, from

an early 4-day low of 109.25. The currency is poised to challenge

resistance around the 112.00 level.

In contrast, the loonie held steady against the euro and was

trading at 1.4796. This may be compared to an early 5-day high of

1.4766.

AUD vs CAD (FX:AUDCAD)

Gráfico Histórico de Câmbio

De Out 2024 até Nov 2024

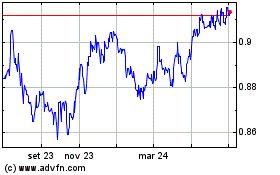

AUD vs CAD (FX:AUDCAD)

Gráfico Histórico de Câmbio

De Nov 2023 até Nov 2024