U.S. Dollar Slides Amid U.S. Fed Rate Cut Prospects

09 Março 2025 - 9:52PM

RTTF2

The U.S. dollar weakened against other major currencies in the

Asian session on Monday amid prospects of the U.S. Fed cutting

interest rates earlier after a report showed employment in the U.S.

increased by slightly less than expected in the month of February.

However, concerns remain that the U.S. trade war may hurt global

growth and worsen inflation.

The weakness in the value of the U.S. dollar comes after the

Labor Department released a report showing employment in the U.S.

increased by slightly less than expected in the month of

February.

The closely watched report said non-farm payroll employment

climbed by 151,000 jobs in February after rising by a downwardly

revised 125,000 jobs in January.

Economists had expected employment to grow by 160,000 jobs

compared to the addition of 143,000 jobs originally reported for

the previous month.

The report also said the unemployment crept up to 4.1 percent in

February from 4.1 percent in January, while economists had expected

the unemployment rate to remain unchanged.

Fed Chair Jerome Powell laid out a list of potential reasons why

new import levies could result in more sustained price pressures on

Friday, saying it is unclear if the Trump administration's tariff

plans will turn out to be inflationary.

In the Asian trading today, the U.S. dollar fell to more than a

3-month low of 0.8765 against the Swiss franc and more than a

4-month low of 1.2946 against the pound, from Friday's closing

quotes of 0.8795 and 1.2920, respectively. If the greenback extends

its downtrend, it is likely to find support around 0.85 against the

franc and 1.31 against the pound.

Against the euro and the yen, the greenback edged down to 1.0871

and 147.09 from last week's closing quotes of 1.0832 and 148.03,

respectively. The greenback may test support near 1.10 against the

euro and 141.00 against the yen.

Looking ahead, German trade data and industrial production for

January are slated for release in the pre-European session at 2:00

am ET.

In the New York session, U.S. consumer inflation expectations

for February is set to be published.

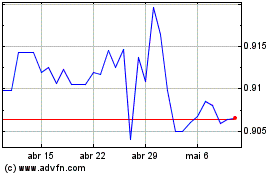

US Dollar vs CHF (FX:USDCHF)

Gráfico Histórico de Câmbio

De Fev 2025 até Mar 2025

US Dollar vs CHF (FX:USDCHF)

Gráfico Histórico de Câmbio

De Mar 2024 até Mar 2025