BlackRock Energy and Resources Income Trust Plc - Portfolio Update

26 Novembro 2024 - 6:34AM

UK Regulatory

BlackRock Energy and Resources Income

Trust Plc - Portfolio Update

PR Newswire

LONDON, United Kingdom, November 26

|

BLACKROCK ENERGY AND RESOURCES INCOME TRUST plc

(LEI:54930040ALEAVPMMDC31)

|

|

|

All

information is at

31 October 2024 and

unaudited.

|

|

|

|

|

|

Performance

at month end with net income reinvested

|

|

|

|

|

|

|

One

|

Three

|

Six

|

One

|

Three

|

Five

|

|

|

Month

|

Months

|

Months

|

Year

|

Years

|

Years

|

|

Net

asset value

|

1.1%

|

0.3%

|

-0.3%

|

12.8%

|

39.6%

|

117.3%

|

|

Share

price

|

1.1%

|

0.3%

|

-0.8%

|

14.2%

|

33.9%

|

120.6%

|

|

Sources:

Datastream, BlackRock

|

|

|

|

|

|

At month end

|

|

|

|

Net

asset value – capital only:

|

131.57p

|

|

|

Net

asset value cum income1:

|

131.85p

|

|

|

Share

price:

|

119.25p

|

|

|

Discount to NAV

(cum income):

|

9.6%

|

|

|

Net

yield:

|

3.8%

|

|

|

Gearing - cum

income:

|

7.4%

|

|

|

Total

assets:

|

£160.8m

|

|

|

Ordinary shares

in issue2:

|

121,964,497

|

|

|

Gearing range (as

a % of net assets):

|

0-20%

|

|

|

Ongoing

charges3:

|

1.19%

|

|

|

|

|

|

|

1 Includes net

revenue of 0.28p.

2 Excluding

13,621,697 ordinary shares held in treasury.

3 The Company’s

ongoing charges are calculated as a percentage of average daily net

assets and using the management fee and all other operating

expenses excluding finance costs, direct transaction costs, custody

transaction charges, VAT recovered, taxation and certain other

non-recurring items for the year ended 30 November 2023.

In

addition, the Company’s Manager has also agreed to cap ongoing

charges by rebating a portion of the management fee to the extent

that the Company’s ongoing charges exceed 1.25% of average net

assets.

|

|

|

|

|

|

|

Sector Overview

|

|

|

|

Mining

|

40.1%

|

|

|

|

Energy

Transition

|

30.3%

|

|

|

|

Traditional

Energy

|

30.3%

|

|

|

|

Net

Current Liabilities

|

-0.7%

|

|

|

|

|

-----

|

|

|

|

|

100.0%

|

|

|

|

|

=====

|

|

|

|

|

|

|

|

|

Sector Analysis

|

% Total Assets^

|

|

Country Analysis

|

% Total Assets^

|

|

|

Mining:

|

|

|

|

|

|

|

Diversified

|

19.7

|

|

Global

|

50.2

|

|

|

Copper

|

6.1

|

|

United

States

|

23.5

|

|

|

Gold

|

3.6

|

|

Canada

|

11.9

|

|

|

Aluminium

|

2.7

|

|

Latin

America

|

3.5

|

|

|

Industrial

Minerals

|

2.4

|

|

United

Kingdom

|

3.4

|

|

|

Uranium

|

2.1

|

|

Australia

|

2.3

|

|

|

Nickel

|

1.3

|

|

Italy

|

2.2

|

|

|

Steel

|

1.2

|

|

Other

Africa

|

2.0

|

|

|

Metals &

Mining

Subtotal

Mining:

|

1.0

40.1

|

|

Germany

Ireland

Finland

Net

Current Liabilities

|

0.6

0.6

0.5

-0.7

|

|

|

|

|

|

|

-----

|

|

|

|

|

|

|

100.0%

|

|

|

|

|

|

|

=====

|

|

|

Traditional

Energy:

|

|

|

|

|

|

|

E&P

|

14.9

|

|

|

|

|

|

Integrated

|

6.7

|

|

|

|

|

|

Oil

Services

|

3.4

|

|

|

|

|

|

Distribution

|

3.2

|

|

|

|

|

|

Oil,

Gas & Consumable Fuels

|

1.6

|

|

|

|

|

|

Refining &

Marketing

|

0.5

|

|

|

|

|

|

Subtotal

Traditional Energy:

|

30.3

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy

Transition:

|

|

|

|

|

|

|

Energy

Efficiency

|

13.2

|

|

|

|

|

|

Electrification

|

7.3

|

|

|

|

|

|

Renewables

|

6.5

|

|

|

|

|

|

Storage

|

2.2

|

|

|

|

|

|

Transport

|

1.1

|

|

|

|

|

|

Subtotal

Energy Transition:

|

30.3

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

Current Liabilities

|

-0.7

|

|

|

|

|

|

|

-----

|

|

|

|

|

|

|

100.0

|

|

|

|

|

|

|

=====

|

|

|

|

|

|

|

|

|

|

|

|

|

^

Total Assets for the purposes of these calculations exclude bank

overdrafts, and the net current liabilities figure shown in the

tables above therefore exclude bank overdrafts equivalent to 6.7%

of the Company’s net asset value.

|

|

|

Ten Largest Investments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company

|

Region of Risk

|

% Total Assets

|

|

|

|

|

|

|

|

Rio

Tinto

|

Global

|

5.0

|

|

|

Anglo

American

|

Global

|

3.9

|

|

|

Shell

|

Global

|

3.3

|

|

|

Targa

Resources

|

United

States

|

3.2

|

|

|

Vale

- ADS

|

Latin

America

|

2.7

|

|

|

Vertiv

Holdings

|

Global

|

2.7

|

|

|

Norsk

Hydro

|

Global

|

2.6

|

|

|

ConocoPhillips

|

Global

|

2.6

|

|

|

Schneider

Electric

|

Global

|

2.5

|

|

|

Teck

Resources

|

Global

|

2.5

|

|

|

|

|

|

|

|

Commenting

on the markets, Tom Holl and Mark Hume, representing the Investment

Manager noted:

The

Company’s Net Asset Value (NAV) increased by 1.1% in October 2024

(in GBP terms).

Global equity

markets fell during the month. US economic data pointed to stronger

than expected growth with a higher number of jobs added in

September 2024 and upward revisions to prior months. US inflation

data as shown by core Consumer Price Index (CPI) also remained

higher than expected. These led to US bond yields rising and

reduced expectations around the scale and pace of US interest rate

cuts. In Europe, the ECB reduced interest rates by a further 0.25%

following lower growth, employment and inflation data. Positive

sentiment from China’s boost from monetary stimulus announced last

month eased with a lack of clarity over the potential for fiscal

stimulus measures. Higher broader market valuation levels going

into Q3 results, US election uncertainty, changes in interest rate

expectations and elevated geopolitical risks have contributed to

notable individual stock price reactions.

Within energy, in

recent months geopolitical risk in the Middle East has contributed

to oil price volatility. During October 2024, oil prices rose to

$80 on the potential for risk of disruption to energy

infrastructure, before falling back to end the month little

changed. Brent and WTI oil prices rose by 1.2%, ending the month at

$73/bbl and $70bbl respectively. The US Henry Hub natural gas price

fell -7% during the month to end at $2.7/mmbtu, as gas producers

continued to add back supply, which had previously been

curtailed.

The

mining sector had challenged performance in October as a lack of

detail on China’s stimulus measures weighed on commodities. In the

commodities space, iron ore (62% fe), copper and nickel fell by

7.3%, 3.3% and 10.5% respectively. The aluminium price held up

better, down by just 0.7%, as supply was disrupted by port issues

at Jamalco and as future supply looked set to be increasingly

constrained by Alcoa announcing the curtailment of its Kwinana

alumina refinery in Western Australia. In the precious metals

space, gold and silver prices rose by 4.1% and 4.8% respectively,

appearing to benefit from ‘safe-haven’ demand as a result of

ongoing geopolitical tensions in the Middle East and the

approaching U.S. presidential election. Additionally, we saw more

technology hyperscalers indicating a preference for nuclear to

power their artificial intelligence (AI) datacentres, which lifted

sentiment on uranium and uranium miners.

Within the

sustainable energy theme, the Internation Energy Agency (IEA)

released its World Energy Outlook 2024 and Renewables 2024. IEA

expect more than 5,500GW of new renewable energy capacity between

2024 and 2030. Solar is expected to account for c.80% of this new

capacity due to growth in manufacturing capacity and a continuation

of

improving solar

PV economics. The EU announced tariffs on China EV imports in

addition to the existing 10%, ranging from an additional 17% to

35%.

26

November 2024

|

|

|

ENDS

|

|

|

|

|

|

|

|

Latest

information is available by typing www.blackrock.com/uk/beri on the

internet, "BLRKINDEX" on Reuters, "BLRK" on Bloomberg or "8800" on

Topic 3 (ICV terminal).

Neither the

contents of the Manager’s website nor the contents of any website

accessible from hyperlinks on the Manager’s website (or any other

website) is incorporated into, or forms part of, this

announcement.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Release |

Blackrock Energy And Res... (LSE:BERI)

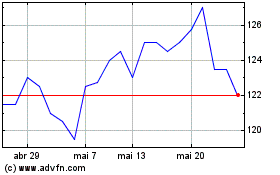

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

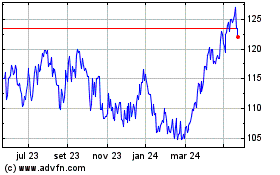

Blackrock Energy And Res... (LSE:BERI)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024