MAISONS DU MONDE: ANNUAL RESULTS 2024 IN LINE WITH GUIDANCE:

Positive free cash flow / Net Sales € 1.002 billion / Visible

effects of Inspire Everyday expected in 2025, with a gradual return

to growth

PRESS RELEASE

Nantes, March 11, 2025

ANNUAL RESULTS 2024 IN LINE WITH GUIDANCE:

Positive free cash flow

Net Sales € 1.002 billion

Visible effects of Inspire Everyday expected

in 2025, with a gradual return to growth

2024 Highlights

-

Generated free cash flow (FCF) of €15m driven by strict control

of working capital requirements (WCR) and by €45m in cost savings,

despite lower turnover (-10,2% Lfl)

-

A store network of 338 stores, of which 14 managed by

affiliates

-

63 revamped stores, including new concept in 2 shopping centers,

with capex/sales below 2.5%

-

Launched loyalty program in France in October 2024 and

rebalanced media mix with a refocus on the Brand

-

Improved customer experience in France: NPS increased by 4

points

Perspectives 2025-2026: Return to

growth

-

Opening of new stores, particularly through affiliate and

franchise partners

-

Continued efforts on customer events to further promote the

Brand

-

Category extensions, notably including bathroom, outdoor

lighting and pet accessories

-

Revamping of online customer experience

-

Continued store renovations with a focus on shopping centers:

targeting a total of 100 revamped stores by 2025 year-end, while

maintaining the capex/sales ratio around 2.5%

-

Cost savings target increased: more than €100m over 3 years vs.

€85m previously communicated, of which roughly €60m during

2025-2026

-

Further working capital improvement by one month vs 2024, mainly

through inventory reduction

-

Further operating model simplification: additional reduction of

SKUs by around 10%, and 50% supplier base reduction (vs 2022) to be

achieved by 2025 year-end

François-Melchior de Polignac, CEO of Maisons

du Monde, commented: “We are making steady progress with our

transformation under the Inspire Everyday plan. We intend to

continue investing in our brand, in our online and offline customer

experience, and in the distinctiveness of our offer as we prepare

for the return to growth. In parallel, we will expand on our 2024

achievements to further simplify our operating model, lower our

cost base, and improve our cash flow generation potential. With

these actions, we remain on track to deliver on our objective of

generating a cumulative FCF of over €100m during 2024-2026, having

generated €15m in 2024.”

____

AUDIO WEBCAST FOR INVESTORS AND ANALYSTS:

March 11, 2025 at 9:00 a.m. CET / Presentation in English

Webcast Connection:

https://edge.media-server.com/mmc/p/cm5rg33e

____

2024 Sales

Group sales for the year 2024 amounted to €1.002

billion euros, reflecting a decrease of 10.2% compared to 2023 at

constant scope and -11.2% in total, in a difficult context for the

Homes and Decoration sector, accentuated by unfavourable

macroeconomic factors.

| |

FY24 |

FY23 |

% |

|

€ in millions |

Actual |

Actual |

Variation |

| |

|

|

|

| Group

GMV |

1 136,3 |

1 266,3 |

(10,3%) |

| |

|

|

|

| Net

sales |

1 001,9 |

1 128,0 |

(11,2%) |

| Like-for-like

sales |

969,1 |

1 079,0 |

(10,2%) |

| |

|

|

|

|

Sales by product category |

|

|

|

| |

|

|

|

|

Decoration |

558,6 |

649,9 |

(14,0%) |

| % of

sales |

55,8% |

57,6% |

(1,8ppt) |

| Furniture |

443,2 |

478,1 |

(7,3%) |

| % of

sales |

44,2% |

42,4% |

1,9ppt |

| |

|

|

|

|

Sales by distribution channel |

|

|

|

| |

|

|

|

| Stores |

723,0 |

818,4 |

(11,7%) |

| % of

sales |

72,2% |

72,6% |

(0,4ppt) |

| Online |

278,8 |

309,6 |

(9,9%) |

| % of

sales |

27,8% |

27,4% |

0,4ppt |

| |

|

|

|

|

Sales by geography |

|

|

|

| |

|

|

|

| France |

555,8 |

625,5 |

(11,1%) |

| % of

sales |

55,5% |

55,5% |

0,0ppt |

| Inter |

446,0 |

502,5 |

(11,2%) |

|

% of sales |

44,5% |

44,5% |

(0,0ppt) |

The Group continued with the proactive management of its store

network, in line with its transformation plan. At the end of

December 2024, the store network reached 338 stores, including 14

affiliates.

FY 2024 FINANCIAL PERFORMANCE

EBIT

| |

FY24 |

FY23 |

% |

|

€ in millions |

Actual |

Actual |

Variation |

| |

|

|

|

| Net

sales |

1 001,9 |

1 128,0 |

(11,2%) |

| |

|

|

|

| Cost of Good

Sold (1) |

(360,9) |

(414,6) |

(13,0%) |

| |

|

|

|

|

Gross Margin |

641,0 |

713,4 |

(10,1%) |

| As a % of

net Sales |

64,0% |

63,2% |

0,7ppt |

| |

|

|

|

|

Stores and central costs |

(332,0) |

(339,6) |

(2,2%) |

|

Logistic costs |

(163,6) |

(166,3) |

(1,6%) |

| Operating

costs |

(495,7) |

(505,8) |

(2,0%) |

| |

|

|

|

|

Current EBITDA |

145,3 |

207,6 |

(30,0%) |

| As a % of

net Sales |

14,5% |

18,4% |

(3,9ppt) |

| |

|

|

|

|

D&A |

(144,1) |

(161,8) |

(10,9%) |

| As a % of

net Sales |

(14,4%) |

(14,3%) |

(0,0ppt) |

| |

|

|

|

|

EBIT |

1,2 |

45,8 |

(97,3%) |

|

As a % of net Sales |

0,1% |

4,1% |

(3,9ppt) |

The gross margin rate, of 64%, was up 80

bps compared to 2023, due to the continuation of the favourable

effects of freight costs and the positive contribution of the

Marketplace offsetting the negative impact of promotional activity,

especially around the end of the year.

Store operating costs and central costs

amounted to €496m euros compared to €505m euros in 2023. The

targeted actions on costs made it possible to record a gross saving

of €45m.

EBITDA margin decreased from 18.4% to

14.5% given the decline in volumes.

D&A came down slightly, despite the

depreciation of the second distribution center in the north of

France but which was offset by lower provisions booked in FY24 vs

F23.

The EBIT margin is positive at 0.1%

compared to 4.1% for the year 2023, strongly impacted by the drop

in sales.

NET RESULT

| € in

millions |

FY24 |

FY23 |

|

EBIT |

1,2 |

45,8 |

| Financial

expenses |

(22,2) |

(22,3) |

| Exceptional

income & expenses |

(11,6) |

(8,9) |

|

Impairment |

(81,0) |

- |

| Fair value

financial instruments |

(8,1) |

(0,6) |

| Income

tax |

6,5 |

(5,2) |

|

Net income |

(115,3) |

8,8 |

Net income amounted to -115.2 million

euros compared to 8.8 million euros at December 31, 2023, and

includes:

- A

financial result of -22 million euros, stable vs 2023

-

Exceptional income & expenses amounted to €-11,6m, compared to

€9m at the end of December 2023, mainly linked to store closure

costs

- An

impairment of €81m (non-cash charge) on historical goodwill

- An €8

million charge related to the fair value of hedging financial

instrument

- An

income tax credit of 6.5 million euros compared to an expense of

5.2 million euros at December 31, 2023.

In view of the Net income, no dividend will be

proposed to the next shareholder meeting in June 2025.

FREE CASH FLOW

|

(in EUR million) |

|

31 december 2024 |

|

31 december 2023 |

|

|

|

|

EBITDA |

|

145,3 |

|

207,6 |

|

Change in working capital |

|

15,4 |

|

0,2 |

|

Change in other operating items |

|

5,0 |

|

(19,1) |

|

Net cash generated by/ (used in) operating activities |

|

165,7 |

|

188,7 |

|

Capital expenditures (Capex) |

|

(22,7) |

|

(33,0) |

|

Change in debt on fixed assets |

|

(4,9) |

|

(2,5) |

|

Proceeds from sale of non-current assets |

|

1,6 |

|

1,9 |

|

Disposal of financial assets |

|

0,2 |

|

- |

|

Decrease in lease debt |

|

(111,2) |

|

(114,4) |

|

Decrease in lease debt/Lease interest paid |

|

(13,6) |

|

(13,3) |

|

Free cash flow |

|

15,2 |

|

27,4 |

At December 31, 2024, investments reached 23

million euros leading to a Capex/sales ratio of 2.5%, allowing us

to continue investing in our IT tools and our stores.

Maisons du Monde improved its working capital

requirement by €15 million while maintaining good stock

availability to start 2025.

Free cash flow reached 15 million euros

compared to 27 million euros in December 2023.

NET FINANCIAL DEBT

| (€ in millions) |

|

31 december 2024 |

|

31 december 2023 |

|

Term loan |

|

75,2 |

|

100,0 |

|

Revolving Credit Facilities (SFA) |

|

89,8 |

|

(1,0) |

|

Other debt |

|

10,2 |

|

20,1 |

|

Gross debt |

|

175,2 |

|

119,1 |

|

Finance leases |

|

521,2 |

|

571,0 |

|

Cash & Cash equivalents |

|

(90,5) |

|

(29,9) |

|

Net debt (IFRS 16) |

|

605,8 |

|

660,2 |

|

less : lease debt (IFRS 16) |

|

(521,2) |

|

(571,0) |

|

Plus : lease debt (finance lease) |

|

0,5 |

|

1,2 |

|

Net debt (without IFRS 16) |

|

85,1 |

|

90,4 |

|

LTM (Last twelve months) EBITDA (1) |

|

22,3 |

|

81,3 |

|

Leverage Ratio (2) |

|

3,81 |

|

1,11 |

| |

|

|

|

|

|

(1) EBITDA of €145.3 millions is restated in accordance with the

senior credit facility agreement |

|

|

| (2) as stated

in SFA |

|

|

|

|

Leases decreased by €50m reflecting decisions taken on the store

portfolio and the Group continues to renegotiate rents with its

landlords.

Net financial debt excluding IFRS 16 at December 31, 2024

amounted to 85.1 million euros, down slightly compared to December

31, 2023.

At the end of December 2024, the Group had

around €200m euros of liquidity and has secured financing by its

bank pool until April 2028, the Group having obtained an adjustment

to its covenants from its banking partners, who accepted it

unanimously at the end of last year until June 30, 2025.

APPENDIX

|

Consolidated income statement |

|

2024 |

|

2023 |

|

(in EUR million) |

|

|

|

Sales |

|

1,001.9 |

|

1,128.0 |

|

Other revenue |

|

28.3 |

|

28.6 |

|

Total revenue |

|

1,030.2 |

|

1,156.6 |

|

Cost of sales |

|

(355.0) |

|

(405.5) |

|

Personnel expenses |

|

(228.3) |

|

(238.3) |

|

External expenses |

|

(311.2) |

|

(316.4) |

|

Depreciation, amortisation and allowance for provisions |

|

(144.1) |

|

(161.8) |

|

Fair value – derivative financial instruments |

|

(8.1) |

|

(0.6) |

|

Other income/(expenses) from operations |

|

9.5 |

|

11.2 |

|

Current operating profit |

|

(7.0) |

|

45.2 |

|

Other operating income and expenses |

|

(92.6) |

|

(8.9) |

|

Operating profit / (loss) |

|

(99.6) |

|

36.3 |

|

Cost of net debt |

|

(7.2) |

|

(6.2) |

|

Cost of lease debt |

|

(13.7) |

|

(13.5) |

|

Finance income |

|

4.3 |

|

4.3 |

|

Finance expenses |

|

(5.6) |

|

(6.8) |

|

Financial profit / (loss) |

|

(22.2) |

|

(22.3) |

|

Profit / (loss) before income tax |

|

(121.8) |

|

14.0 |

|

Income tax |

|

6.5 |

|

(5.2) |

|

Profit / (loss) |

|

(115.3) |

|

8.8 |

|

Attributable to: |

|

|

|

|

|

· Owners of the parent |

|

(115.4) |

|

8.6 |

|

· Non-controlling interests |

|

0.1 |

|

0.2 |

|

Reported EPS (in €) |

|

(2.99) |

|

0.21 |

| |

|

|

|

|

|

Consolidated balance sheet |

|

31 Dec. 2024 |

|

31 Dec. 2023 |

|

(in EUR million) |

|

|

|

ASSETS |

|

|

|

|

|

Goodwill |

|

246.0 |

|

327.0 |

|

Other intangible assets |

|

248.4 |

|

247.1 |

|

Property, plant and equipment |

|

135.7 |

|

158.1 |

|

Right-of-use assets related to lease contracts |

|

518.9 |

|

568.7 |

|

Other non-current financial assets |

|

13.0 |

|

13.9 |

|

Deferred income tax assets |

|

8.0 |

|

8.8 |

|

Derivative financial instruments |

|

0.6 |

|

- |

|

NON-CURRENT ASSETS |

|

1,170.6 |

|

1,323.6 |

|

Inventory |

|

199.7 |

|

202.1 |

|

Trade receivables and other current receivables |

|

58.4 |

|

73.9 |

|

Current income tax assets |

|

5.0 |

|

17.7 |

|

Derivative financial instruments |

|

8.9 |

|

- |

|

Cash and cash equivalents |

|

90.5 |

|

29.9 |

|

CURRENT ASSETS |

|

362.5 |

|

323.6 |

|

TOTAL ASSETS |

|

1,533.1 |

|

1,647.2 |

|

|

|

|

|

|

|

EQUITY AND LIABILITIES |

|

|

|

|

|

TOTAL EQUITY |

|

499.5 |

|

596.4 |

|

Non-current borrowings |

|

53.9 |

|

83.9 |

|

Medium and long-term lease liability |

|

411.8 |

|

450.0 |

|

Deferred income tax liabilities |

|

33.9 |

|

39.2 |

|

Post-employment benefits |

|

10.8 |

|

9.2 |

|

Provisions |

|

19.0 |

|

21.8 |

|

Derivative financial instruments |

|

0.3 |

|

1.0 |

|

Other non-current liabilities |

|

- |

|

2.9 |

|

NON-CURRENT LIABILITIES |

|

529.7 |

|

608.0 |

|

Current borrowings and convertible bonds |

|

121.3 |

|

35.2 |

|

Short-term lease liability |

|

109.4 |

|

121.0 |

|

Trade payables and other current payables |

|

263.5 |

|

269.5 |

|

Provisions |

|

2,9 |

|

3.1 |

|

Current income tax liabilities |

|

5.3 |

|

2.9 |

|

Derivative financial instruments |

|

- |

|

9.3 |

|

Others current liabilities |

|

1.5 |

|

1.8 |

|

CURRENT LIABILITIES |

|

503.9 |

|

442.8 |

|

TOTAL LIABILITIES |

|

1,033.6 |

|

1,050.8 |

|

TOTAL EQUITY AND LIABILITIES |

|

1,533.1 |

|

1,647.2 |

|

Consolidated cash flow statement |

|

|

|

|

|

(in EUR million – IFRS 16) |

|

31 Dec. 2024 |

|

31 Dec. 2023 |

|

Profit/(loss) before income tax |

|

(115.3) |

|

8.8 |

|

Adjustments for: |

|

|

|

|

|

· Depreciation, amortisation,

and allowance for provisions |

|

227.1 |

|

163.7 |

|

· Net gain/(loss) on

disposals |

|

5.4 |

|

4.0 |

|

· Fair value – derivative

financial instruments |

|

8.1 |

|

0.6 |

|

· Change in fair value –

unconsolidated investments |

|

- |

|

1.5 |

|

· Share-based payments |

|

0.1 |

|

1.0 |

|

· Other |

|

(0.0) |

|

- |

|

· Cost of net financial

debt |

|

7.2 |

|

6.2 |

|

· Cost of lease debt |

|

13.7 |

|

13.5 |

|

· Income Tax |

|

(6.5) |

|

5.2 |

|

Change in operating working capital requirement |

|

15.4 |

|

0.2 |

|

Income tax paid |

|

10.5 |

|

(16.0) |

|

Net cash generated by/(used in) operating

activities(a) |

|

165.7 |

|

188.7 |

|

Acquisition of non-current assets: |

|

|

|

|

|

· Property, plant and

equipment |

|

(9.5) |

|

(19.3) |

|

· Intangible assets |

|

(13.5) |

|

(14.7) |

|

Change in loans and advances granted |

|

0.3 |

|

1.0 |

|

Disposal of financial assets |

|

0.2 |

|

- |

|

Change in debts on fixed assets |

|

(4.9) |

|

(2.5) |

| Sale of

non-current assets |

|

1.6 |

|

1.9 |

|

Dividends received |

|

0.0 |

|

- |

|

Net cash generated by/(used in) investing

activities(b) |

|

(25.8) |

|

(33.6) |

|

Impact of changes in scope of consolidation without change of

control |

|

(1.6) |

|

- |

|

Proceeds from issuance of borrowings |

|

90.0 |

|

114.2 |

|

Repayment of borrowings |

|

(30.2) |

|

(223.2) |

|

Decrease of lease debt |

|

(111.2) |

|

(114.4) |

|

Acquisitions (net) of treasury shares |

|

(0.0) |

|

(1.1) |

|

Dividends paid |

|

(2.3) |

|

(11.6) |

|

Interest paid |

|

(6.6) |

|

(1.6) |

|

Interest on lease debt |

|

(13.6) |

|

(13.3) |

|

Interest received |

|

0.5 |

|

- |

|

Net cash generated by/(used in) financing

activities(c) |

|

(75.0) |

|

(251.0) |

|

Exchange gains/(losses) on cash and cash equivalents |

|

0.5 |

|

(0.1) |

|

Net increase/(decrease) in cash & cash

equivalents(a)+(b)+(c) |

|

65.4 |

|

(96.0) |

|

|

|

|

|

|

|

Cash & cash equivalents at period begin |

|

25.1 |

|

121.1 |

|

Cash & cash equivalents at period end |

|

90.5 |

|

25.1 |

In addition to the financial indicators set

out in International Financial Reporting Standards (IFRS), Maisons

du Monde's management uses several non-IFRS metrics to evaluate,

monitor and manage its business. The non- IFRS operational and

statistical information related to Group's operations included in

this press release is unaudited and has been taken from internal

reporting systems. Although none of these metrics are measures of

financial performance under IFRS, the Group believes that they

provide important insight into the operations and strength of its

business. These metrics may not be comparable to similar terms used

by competitors or other companies

Sales: it includes the revenue

from sales of decorative items and furniture through i) Stores

(owned or affiliates), ii) to franchisees, iii) websites and iv)

B2B activities. They also include marketplace commissions.

Like-for-like sales (LFL) growth:

Represents the percentage change in sales from the Group’s retail

stores, websites and B2B activities, net of product returns between

one financial period (n) and the comparable preceding financial

period (n-1), excluding changes in sales attributable to stores

that opened or were closed during either of the comparable periods.

Sales attributable to stores that closed temporarily for

refurbishment during any of the periods are included.

Gross margin: Is defined as sales

minus cost of sales. Gross margin is also expressed as a percentage

of Sales.

Current EBITDA: Is defined as

current operating profit, excluding:

-

i. depreciation, amortization, and allowance for provisions

and,

-

ii. the change in the fair value of derivative financial

instruments. The EBITDA margin is calculated as EBITDA divided by

Sales.

LTM EBITDA: Last twelve months

EBITDA.

EBIT: Is defined as current EBITDA

minus depreciation, amortization, and allowance for provisions. The

EBIT margin is calculated as EBIT divided by Sales.

Net debt (without IFRS 16) : Is

defined as the Group’s finance leases, unsecured term loan,

unsecured revolving credit facilities, deposits and bank

borrowings, net of cash and cash equivalents.

Leverage ratio: Is defined as net

debt without IFRS 16 divided by LTM EBITDA.

Free cash flow: Is defined as net

cash from operating activities less the sum of capital expenditures

(capital outlays for property, plant and equipment, intangible,

other non-current assets, change in debt on fixed assets, proceeds

from disposal of non-current assets and financial) and reduction of

rental debt and interest on rental debt.

Disclaimer: Forward Looking

Statement

This press release

contains certain statements that

constitute "forward-looking statements," including

but not limited to statements

that are predictions of or indicate future events,

trends, plans or objectives, based on certain assumptions or which

do not directly relate to historical or current facts. Such

forward-looking statements are based on management's current

expectations and beliefs and are subject to a number of risks and

uncertainties that could cause actual results to differ materially

from the future results expressed, forecasted or implied by such

forward- looking statements. Accordingly, no representation is made

that any of these statements or forecasts will come to pass or that

any forecast results will be achieved. Any forward-looking

statements included in this press release speak only as of the date

hereof and will not give rise to updates or revision. For a more

complete list and description of such risks and uncertainties,

refer to Maisons du Monde’s filings with the French Autorité des

marchés financiers.

Financial agenda

15 May

2025

Q1 2025 sales

26 June

2025

Annual General Meeting

25 July

2025

Q2 sales and H1 2025 results

23 Octobre

2025 Q3

and 9-month 2025 sales

About Maisons du Monde

Maisons du Monde is the leading player in

inspiring, accessible, and sustainable home and decoration. The

Brand offers a rich and constantly refreshed range of furniture and

decorative items in a multitude of styles. Leveraging a highly

efficient omnichannel model and direct access to consumers, the

Group generates over 50% of its sales through its online platform

and operates in 9 European countries.

corporate.maisonsdumonde.com

Contacts

|

Investor Relations |

Press Relations |

Carole Alexandre

Tel: (+33) 6 30 85 12 78 |

Pierre Barbe

Tel: (+33) 6 23 23 08 51 |

|

calexandre@maisonsdumonde.com |

pbarbe@maisonsdumonde.com

Michelle Kamar

Tel : (+33) 6 09 24 42 42

michelle@source-rp.com |

- 2025.02.04 MdM Communiqué de presse_FY2024_EN_Final

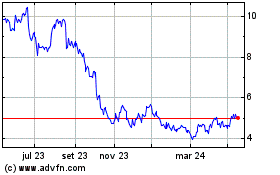

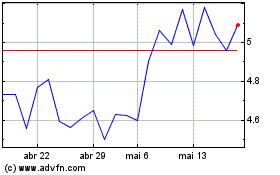

Maisons du Monde (EU:MDM)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Maisons du Monde (EU:MDM)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025