CORRECTING and REPLACING Destra Multi-Alternative Fund Declares Year End 2024 Distribution

11 Dezembro 2024 - 2:45PM

Business Wire

First paragraph, third sentence of release dated December 10,

2024, the ex-distribution date should be December 20, 2024 (instead

of December 19, 2024).

The updated release reads:

DESTRA MULTI-ALTERNATIVE FUND DECLARES YEAR END 2024

DISTRIBUTION

On December 10, 2024, Destra Multi-Alternative Fund (the “Fund”

or “DMA”), a closed-end fund traded on the New York Stock Exchange

under the symbol DMA, declared a year end distribution of $0.3239

per share for 2024. The record date for the distribution is

December 20, 2024, and the payable date is December 31, 2024. The

Fund will trade ex-distribution on December 20, 2024.

Pursuant to the Fund’s Dividend Reinvestment Plan (“DRP”),

unless the registered owner of the Fund’s Common Shares elects

otherwise by contacting the Fund’s plan agent, Equiniti Trust

Company, LLC (“EQ”), all dividends declared on the Common Shares

will be automatically reinvested in additional Common Shares by EQ.

Common Shareholders who elect not to participate in the DRP will

receive all dividends and other distributions in cash, paid by

check mailed directly to the shareholder of record. Shareholders

may obtain more information on the shareholder services offered to

the Fund by calling EQ at the Fund's dedicated toll free number

800-591-8238.

A portion of the distribution may be treated as paid from

sources other than net investment income, including, but not

limited to, short-term capital gain, long-term capital gain, or

return of capital. As required by Section 19(a) of the Investment

Company Act of 1940, a notice will be distributed to shareholders

in the event that a portion of the distribution is derived from

sources other than undistributed net investment income. The final

determination of the source and tax characteristics of this

distribution will depend upon the Fund’s investment experience

during its fiscal year and will be made after the Fund’s year end.

The Fund will send to investors a Form 1099-DIV for the calendar

year that will define how to report this distribution for federal

income tax purposes. For further information regarding the Fund’s

distribution, please visit www.destracapital.com.

Destra Multi-Alternative Fund (NYSE: DMA) is a core alternative

solution that seeks to achieve long-term performance non-correlated

to the broad stock and bond markets. It invests primarily in

alternative strategies and asset classes including real estate,

direct private equity, alternative credit, commodities, and hedge

strategies.

Destra Capital Advisors LLC, based in Bozeman, MT, serves as

Investment Adviser and Secondary Market Servicing agent to the

Fund. Validex Global Investing serves as the Investment Sub-Adviser

to the Fund.

Shares of the Fund can be purchased on the New York Stock

Exchange through any securities broker.

Information regarding the Fund and Destra Capital Advisors can

be found at www.destracapital.com.

Please contact Destra Capital Advisors LLC, the Fund’s

marketing, and investor support services agent, at

DMA@destracapital.com or call (877) 855-3434 if you have any

questions regarding DMA.

NOT FDIC INSURED

NO BANK GUARANTEE

MAY LOSE VALUE

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241210280790/en/

Destra Capital Advisors LLC DMA@destracapital.com (877)

855-3434

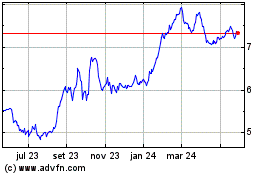

Destra Multi Alternative (NYSE:DMA)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

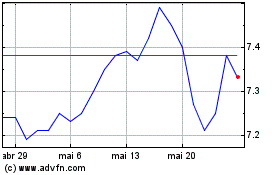

Destra Multi Alternative (NYSE:DMA)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025