false

--12-31

0001137883

0001137883

2024-09-16

2024-09-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 16, 2024

Brainstorm Cell Therapeutics Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-36641 |

|

20-7273918 |

(State or other jurisdiction of

incorporation) |

|

(Commission File No.) |

|

(IRS Employer Identification No.) |

| 1325 Avenue of Americas, 28th Floor |

|

| New York, NY |

10019 |

| (Address of principal executive offices) |

(Zip Code) |

(201) 488-0460

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.00005 par value |

BCLI |

NASDAQ Stock Market LLC

(Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02. Departure of Directors

or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Amendments to the 2014 Stock Incentive Plan and 2014 Global Share

Option Plan

As described below, on September 16, 2024, Brainstorm Cell Therapeutics

Inc. (the “Company”) held its Annual Meeting of Stockholders (the “Annual Meeting”), virtually via the internet,

and the stockholders of the Company approved Amendment No. 4 to the 2014 Stock Incentive Plan, as amended, and Amendment No. 4 to the

2014 Global Share Option Plan, as amended (collectively, the “Amendments to the 2014 Plans”). The Amendments to the 2014 Plans

amend each of the 2014 Stock Incentive Plan, as amended, and 2014 Global Share Option Plan, as amended, respectively (collectively, the

“Original 2014 Plans”) to (i) increase the shared pool of shares of the Company’s common stock, par value $0.00005 per

share (the “Common Stock”) available for issuance under the Company’s Original 2014 Plans by 8,000,000 shares of Common

Stock, resulting in a shared pool of 13,600,000 shares of Common Stock, and (ii) extend the term of each of the Original 2014 Plans by

ten years.

The Company’s officers and directors are among the persons eligible

to receive awards under the Original 2014 Plans, as amended by the Amendments to the 2014 Plans, in accordance with the terms and conditions

thereunder. A detailed summary of the Original 2014 Plans, as amended by the Amendments to the 2014 Plans, is set forth in Proposal No. 4

in the Company’s Definitive Proxy Statement on Schedule 14A for the Annual Meeting, which was filed with the U.S. Securities and

Exchange Commission on August 16, 2024 (the “Proxy Statement”). Such detailed summary of the Original 2014 Plans, as amended

by the Amendments to the 2014 Plans and the foregoing description of the Original 2014 Plans, as amended by the Amendments to the 2014

Plans, are qualified in their entirety by reference to the full text of the Original 2014 Plans and the Amendments to the 2014 Plans,

copies of which are filed as Exhibits 10.1 through 10.10 to this Current Report on Form 8-K and are incorporated by reference

herein.

Item 5.03 Amendments to Articles of Incorporation

or Bylaws; Change in Fiscal Year.

During the Annual Meeting, the Company’s stockholders approved

amendments to the Company’s certificate of incorporation, as amended, to (i) increase the number of authorized shares of Common

Stock from 100,000,000 shares to 250,000,000 (the “Authorized Share Increase Amendment”) and (ii) authorize the Board of Directors

(the “Board”), in its discretion, should it deem it to be appropriate and in the best interests of the Company and its stockholders,

to amend the Company’s certificate of incorporation to effect a reverse stock split of the Company’s issued and outstanding

shares of Common Stock by a ratio between 1-for-5 and 1-for-15, inclusive, without further approval or authorization of the Company’s

stockholders (the “RSS Amendment”).

The Authorized Share Increase Amendment related to increasing the number

of authorized shares of Common Stock to 250,000,000 shares became effective upon filing of the Certificate of Amendment to the certificate

of incorporation with the Secretary of State of the State of Delaware on September 16, 2024. A copy of the Certificate of Amendment is

attached hereto as Exhibit 3.1 and is incorporated herein by reference. The RSS Amendment related to the reverse stock split allows the

Board to effect a reverse stock split between 1-for-5 and 1-for-15, inclusive, at any time on or before September 16, 2025, at the Board’s

discretion.

Item 5.07 Submission of Matters to a Vote

of Security Holders.

At the Annual Meeting, the Company’s stockholders

voted on the proposals set forth below, each of which is described in greater detail in the Proxy Statement. The following actions were

taken at the Annual Meeting:

1. Stockholders elected the seven (7) nominees

(listed below) for election to the Company’s Board to hold office until the next annual meeting of stockholders and until their

successors are duly elected and qualified or until their earlier resignation or removal, based upon the following votes:

| | |

Votes For | | |

Votes

Withheld | | |

Broker

Non-Votes | |

| Dr. Irit Arbel | |

| 24,307,140 | | |

| 5,036,227 | | |

| 24,890,951 | |

| Dr. Anthony Polverino | |

| 23,926,721 | | |

| 5,416,646 | | |

| 24,890,951 | |

| Dr. Jacob Frenkel | |

| 25,469,246 | | |

| 3,874,121 | | |

| 24,890,951 | |

| Uri Yablonka | |

| 25,441,965 | | |

| 3,901,402 | | |

| 24,890,951 | |

| Dr. Menghisteab Bairu | |

| 26,111,531 | | |

| 3,231,836 | | |

| 24,890,951 | |

| Nir Naor | |

| 23,928,445 | | |

| 5,414,922 | | |

| 24,890,951 | |

| Dr. Stacy Lindborg | |

| 26,155,027 | | |

| 3,188,340 | | |

| 24,890,951 | |

2. Stockholders approved the proposal to ratify

the appointment of Brightman Almagor Zohar & Co., a Firm in the Deloitte Global Network, as the Company’s independent registered

public accounting firm for the Company’s fiscal year ending December 31, 2024, based upon the following votes:

| Votes For | | |

Votes Against | | |

Abstentions | | |

Broker Non-Votes | |

| | 49,943,565 | | |

| 1,050,750 | | |

| 3,240,003 | | |

| 0 | |

3. Stockholders approved the Amendment to the

Company’s certificate of incorporation, as amended, to increase the number of authorized shares of Common Stock from 100,000,000

shares to 250,000,000 shares, based upon the following votes:

| Votes For | | |

Votes Against | | |

Abstentions | | |

Broker Non-Votes | |

| | 42,626,189 | | |

| 11,045,643 | | |

| 562,486 | | |

| 0 | |

4. Stockholders approved of amendments to the

Company’s Original 2014 Plans to increase the shared pool of shares available for issuance under the Original 2014 Plans by 8,000,000

shares from 5,600,000 shares to 13,600,000 shares and extend the terms of the Original 2014 Plans by ten years each, based upon the following

votes:

| Votes For | | |

Votes Against | | |

Abstentions | | |

Broker Non-Votes | |

| | 20,524,249 | | |

| 8,592,455 | | |

| 226,663 | | |

| 24,890,951 | |

5. Stockholders approved an amendment to the Company’s

certificate of incorporation to authorize the Board, in its discretion, should it deem it to be appropriate and in the best interests

of the Company and its stockholders, to amend the Company’s certificate of incorporation to effect a reverse stock split of the

Company’s issued and outstanding shares of Common Stock by a ratio between 1-for-5 and 1-for-15, inclusive, without further approval

or authorization of the Company’s stockholders. The voting results were as follows:

| Votes For | | |

Votes Against | | |

Abstentions | | |

Broker Non-Votes | |

| | 42,880,098 | | |

| 11,293,834 | | |

| 60,386 | | |

| 0 | |

6. The stockholders approved, on a non-binding

advisory basis, holding advisory votes on the compensation of the Company’s named executive officers every three years, based upon

the following vote:

| Votes For 1 Year | | |

Votes For 2 Years | | |

Votes For 3 Years | | |

Abstentions | | |

Broker Non-Votes | |

| | 8,221,436 | | |

| 551,403 | | |

| 17,721,476 | | |

| 2,849,052 | | |

| 24,890,951 | |

7. The stockholders of the Company approved, on

a non-binding advisory basis, the compensation of the Company’s named executive officers, based upon the following vote:

| Votes For | | |

Votes Against | | |

Abstentions | | |

Broker Non-Votes | |

| | 23,439,724 | | |

| 2,640,861 | | |

| 3,262,782 | | |

| 24,890,951 | |

Item 9.01 Financial Statements and Exhibits.

(d): Exhibits:

| Exhibit No. |

Description |

| 3.1* |

|

Certificate of Amendment to the Brainstorm Cell Therapeutics Inc. Certificate of Incorporation. |

| 10.1 |

|

Brainstorm Cell Therapeutics Inc. 2014 Stock Incentive Plan, incorporated by reference to Exhibit 10.1 of Current Report on Form 8-K (File No. 000-54365) filed August 15, 2014. |

| 10.2 |

|

Amendment No. 1 to the Brainstorm Cell Therapeutics Inc. 2014 Stock Incentive Plan, incorporated by reference to Appendix A of the Definitive Proxy Statement on Schedule 14A (File No. 000-36641) filed May 11, 2016. |

| 10.3 |

|

Amendment No. 2 to the Brainstorm Cell Therapeutics Inc. 2014 Stock Incentive Plan, incorporated by reference to Exhibit 10.1 of Current Report on Form 8-K (File No. 001-36641) filed November 30, 2018. |

| 10.4 |

|

Amendment No. 3 to the Brainstorm Cell Therapeutics Inc. 2014 Stock Incentive Plan, incorporated by reference to Appendix A of the Definitive Proxy Statement on Schedule 14A (File No. 001-36641) filed October 1, 2020. |

| 10.5* |

|

Amendment No. 4 to Brainstorm Cell Therapeutics Inc. 2014 Stock Incentive Plan. |

| 10.6 |

|

Brainstorm Cell Therapeutics Inc. 2014 Global Share Option Plan, incorporated by reference to Exhibit 10.2 of Current Report on Form 8-K (File No. 000-54365) filed August 15, 2014. |

| 10.7 |

|

Amendment No. 1 to Brainstorm Cell Therapeutics Inc. 2014 Global Share Option Plan, incorporated by reference to Appendix B of the Definitive Proxy Statement on Schedule 14A (File No. 000-36641) filed May 11, 2016. |

| 10.8 |

|

Amendment No. 2 to Brainstorm Cell Therapeutics Inc. 2014 Global Share Option Plan, incorporated by reference to Exhibit 10.2 of Current Report on Form 8-K (File No. 001-36641) filed November 30, 2018. |

| 10.9 |

|

Amendment

No. 3 to Brainstorm Cell Therapeutics Inc. 2014 Global Share Option Plan, incorporated by reference to Appendix B of the Definitive

Proxy Statement on Schedule 14A (File No. 001-36641) filed October 1, 2020. |

| 10.10* |

|

Amendment No. 4 to Brainstorm Cell Therapeutics Inc. 2014 Global Share Option Plan. |

| 104 |

|

Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101) |

* Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

BRAINSTORM CELL THERAPEUTICS INC. |

| |

|

|

| Date: September 16, 2024 |

By: |

/s/ Chaim Lebovits |

| |

|

Chaim Lebovits |

| |

Chief Executive Officer |

Exhibit 3.1

CERTIFICATE OF AMENDMENT

TO THE CERTIFICATE OF INCORPORATION

OF

BRAINSTORM CELL THERAPEUTICS INC.

a Delaware corporation

Brainstorm Cell Therapeutics Inc. (hereinafter called

the “Corporation”), organized and existing under and by virtue of the General Corporation Law of the State of Delaware, does

hereby certify as follows:

The Board of Directors of the Corporation, by unanimous

written consent, and the Stockholders of the Corporation, at a duly called and held meeting, duly approved and adopted a resolution, pursuant

to Sections 141 and 242 of the General Corporation Law of the State of Delaware, to amend the Certificate of Incorporation of the Corporation.

The resolution setting forth the amendment is as follows:

RESOLVED: That the Certificate of Incorporation

of the Corporation be amended by replacing the first sentence of Article FOURTH thereof with the following:

FOURTH: The Corporation shall have authority to issue

Two Hundred and Fifty Million (250,000,000) shares of Common Stock, par value $0.00005 per share (the “Common Stock”).

IN WITNESS WHEREOF, the Corporation has caused this

Certificate of Amendment to the Certificate of Incorporation to be signed by a duly authorized officer of the Corporation on this 16th

day of September, 2024.

| |

BRAINSTORM CELL THERAPEUTICS INC. |

| |

|

| |

By: |

/s/ Chaim Lebovits |

| |

Name: Chaim Lebovits |

| |

Title: Chief Executive Officer |

Exhibit 10.5

BRAINSTORM CELL THERAPEUTICS INC.

AMENDMENT NO. 4

TO

2014 STOCK INCENTIVE PLAN

The 2014 Stock Incentive Plan (the “Plan”)

of Brainstorm Cell Therapeutics Inc., a Delaware corporation (the “Company”), is hereby amended by this AMENDMENT

NO. 4 as follows:

Section 4(a)(1) of the Plan is hereby deleted in

its entirety and a new Section 4(a)(1) is inserted in lieu thereof which shall read as follows:

“(1). Authorized Number of

Shares. Subject to adjustment under Section 7. Awards may be made under the Plan for up to 13,600,000 shares (which number reflects

any stock split or reverse stock split prior to the date of its adoption, and which number shall be automatically adjusted after the date

of its adoption in accordance with Section 7(a) below) of common stock, $0.00005 par value per share, of the Company (the “Common

Stock”). Subject to such overall limitation, no more than 13,600,000 shares of Common Stock (subject to adjustment under

Section 7) may be issued under the Plan in the form of Incentive Stock Options (as defined in Section 5(b)). Shares issued under the Plan

may consist in whole or in part of authorized but unissued shares or treasury shares.”

Section 9(c) of the Plan is hereby deleted in its

entirety and a new Section 9(c) is inserted in lieu thereof which shall read as follows:

“(c). Effective Date and

Term of Plan. The Plan shall become effective on the date the Plan is approved by the Company’s stockholders (the “Effective

Date”). No Awards shall be granted under the Plan after August 14, 2034. but Awards previously granted may extend beyond

that date.”

Except as set forth above, the remainder of the Plan remains

in full force and effect.

**********

Adopted by the Board of Directors of the Company: August

5, 2024.

Adopted by the Stockholders of the Company: September 16,

2024.

Exhibit 10.10

BRAINSTORM CELL THERAPEUTICS INC.

AMENDMENT NO. 4

TO

2014 GLOBAL SHARE OPTION PLAN

The 2014 Global Share Option Plan (the “Plan”)

of Brainstorm Cell Therapeutics Inc., a Delaware corporation (the “Company”), is hereby amended by this AMENDMENT

NO. 4 as follows:

Section 5.1 of the Plan is hereby deleted in its

entirety and anew Section 5.1 is inserted in lieu thereof which shall read as follows:

“5.1 The Company has reserved 13,600,000

authorized but unissued Shares for the purposes of the Plan and for the purpose of the Company’s other share option plans when applicable,

subject to adjustment as set forth in Section 7 below. The pool of shares available for issuance under the Plan is the same pool of shares

reserved and available for issuance under the 2014 U.S. Stock Option and Incentive Plan (the “U.S. Plan”). Accordingly, shares

issued pursuant to awards under either the Plan or the U.S. Plan shall reduce the number of shares available for future issuance under

each plan. The shares available for issuance under the U.S. Plan and the Plan may be authorized but unissued shares of Stock or shares

of Stock reacquired by the Company. Any Shares which remain unissued and which are not subject to outstanding Awards at the termination

of the Plan shall cease to be reserved for the purpose of the Plan, but until termination of the Plan the Company shall at all times reserve

a sufficient number of Shares to meet the requirements of the Plan. Should any Award for any reason expire or be canceled prior to its

exercise or relinquishment in full, the Share or Shares subject to such Award may again be subjected to an Award under the Plan or under

future plans.”

Section 13 of the Plan is hereby deleted in its

entirety and a new Section 13 is inserted in lieu thereof which shall read as follows:

“The Plan shall be effective as

of the day it was adopted by the Board and shall terminate on July 9, 2034.

The Company shall obtain the approval

of the Company’s stockholders for the adoption of this Plan or for any amendment to this ISOP, if stockholders’ approval is

necessary or desirable to comply with any applicable law including without limitation the U.S. securities law or the securities laws of

other jurisdiction applicable to Awards granted to Participants under this Plan, or if stockholders’ approval is required by any

authority or by any governmental agencies or national securities exchanges including without limitation the LIS Securities and Exchange

Commission.”

Except as set forth above, the remainder of the Plan remains

in full force and effect.

**********

Adopted by the Board of Directors of the Company: August

5, 2024.

Adopted by the Stockholders of the Company: September 16,2024.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

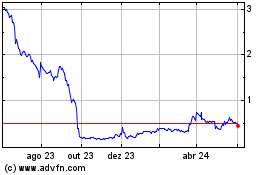

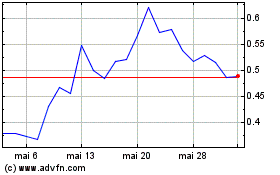

Brainstorm Cell Therapeu... (NASDAQ:BCLI)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Brainstorm Cell Therapeu... (NASDAQ:BCLI)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024