false

0001500375

0001500375

2025-01-30

2025-01-30

|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

| |

|

Washington, D.C. 20549

|

| |

|

FORM 8-K

|

| |

|

CURRENT REPORT

|

|

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

| |

| |

|

Date of Report (Date of earliest event reported)

|

January 30, 2025

|

| |

| |

|

HOME FEDERAL BANCORP, INC. OF LOUISIANA

|

|

(Exact name of registrant as specified in its charter)

|

| |

| |

|

Louisiana

|

001-35019

|

02-0815311

|

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

| |

| |

| |

| |

|

624 Market Street, Shreveport, Louisiana

|

71101

|

|

(Address of principal executive offices)

|

(Zip Code)

|

| |

| |

|

Registrant's telephone number, including area code

|

(318) 222-1145

|

| |

| |

|

Not Applicable

|

|

(Former name or former address, if changed since last report)

|

| |

| |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

|

| |

|

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading

Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock (par value $.01 per share)

|

HFBL

|

Nasdaq Stock Market, LLC

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

Emerging growth company ☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02 Results of Operations and Financial Condition

On January 30, 2025, Home Federal Bancorp, Inc. of Louisiana (the “Company”) reported its results of operations for the three and six months ended December 31, 2024.

For additional information, reference is made to the Company’s press release dated January 30, 2025, which is included as Exhibit 99.1 hereto and is incorporated herein by reference thereto. The press release attached hereto is being furnished to the Securities and Exchange Commission and shall not be deemed to be “filed” for any purpose except as otherwise provided herein.

Item 9.01 Financial Statements and Exhibits

|

(a)

|

Not applicable.

|

|

(b)

|

Not applicable.

|

|

(c)

|

Not applicable.

|

|

(d)

|

Exhibits

|

The following exhibits are included herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

HOME FEDERAL BANCORP, INC. OF LOUISIANA

|

| |

|

|

| |

|

|

| |

|

|

|

Date:

|

January 30, 2025

|

By:

|

/s/ Brad Ezernack |

| |

|

|

Brad Ezernack

|

| |

|

|

Executive Vice President and Chief Financial Officer

|

EXHIBIT 99.1

FOR RELEASE: Thursday, January 30, 2025 at 4:30 PM (Eastern)

HOME FEDERAL BANCORP, INC. OF LOUISIANA REPORTS RESULTS OF OPERATIONS

FOR THE THREE AND SIX MONTHS ENDED DECEMBER 31, 2024

Shreveport, Louisiana – January 30, 2025 – Home Federal Bancorp, Inc. of Louisiana (the “Company”) (Nasdaq: HFBL), the holding company of Home Federal Bank, reported net income for the three months ended December 31, 2024, of $1.02 million compared to net income of $1.00 million reported for the three months ended December 31, 2023. The Company’s basic and diluted earnings per share were $0.33 for the three months ended December 31, 2024 and December 31, 2023. The Company reported net income of $2.0 million for the six months ended December 31, 2024, compared to $2.2 million for the six months ended December 31, 2023. The Company’s basic and diluted earnings per share were $0.64 for the six months ended December 31, 2024 compared to $0.73 and $0.72, respectively, for the six months ended December 31, 2023.

The Company reported the following highlights during the six months ended December 31, 2024:

| |

● |

Nonperforming assets totaled $1.8 million, or 0.30% of total assets at December 31, 2024 compared to $1.9 million, or 0.30% of total assets, at June 30, 2024.

|

| |

● |

There were no advances from the FHLB at December 31, 2024 or June 30, 2024.

|

| |

● |

Other borrowings totaled $4.0 million at December 31, 2024 compared to $7.0 million at June 30, 2024.

|

The increase in net income for the three months ended December 31, 2024, as compared to the same period in 2023 resulted primarily from a decrease of $413,000, or 9.7%, in non-interest expense and an increase of $351,000, or 256.2%, in non-interest income, partially offset by an increase of $383,000, or 195.4%, in provision for income taxes, a decrease of $303,000, or 6.2%, in net interest income, and an increase of $61,000, or 381.3%, in the provision for credit losses. The decrease in net interest income for the three months ended December 31, 2024, as compared to the same period in 2023, was primarily due to a decrease of $422,000, or 5.2%, in total interest income, partially offset by a decrease of $119,000, or 3.7%, in total interest expense. The Company’s average interest rate spread was 2.40% for the three months ended December 31, 2024, compared to 2.45% for the three months ended December 31, 2023. The Company’s net interest margin was 3.12% for the three months ended December 31, 2024, compared to 3.14% for the three months ended December 31, 2023.

The decrease in net income for the six months ended December 31, 2024, as compared to the same period in 2023 resulted primarily from a decrease of $1.2 million, or 11.4%, in net interest income and an increase of $71,000, or 62.3%, in provision for income taxes, partially offset by a decrease of $591,000, or 7.0%, in non-interest expense, an increase of $216,000, or 37.8%, in non-interest income, and an increase of $162,000 in the recovery of credit losses. The decrease in net interest income for the six months ended December 31, 2024, as compared to the same period in 2023, was primarily due to a decrease of $755,000, or 4.7%, in total interest income and an increase of $405,000, or 6.8%, in total interest expense. The Company’s average interest rate spread was 2.32% for the six months ended December 31, 2024 compared to 2.60% for the six months ended December 31, 2023. The Company’s net interest margin was 3.06% for the six months ended December 31, 2024 compared to 3.26% for the six months ended December 31, 2023.

The following tables set forth the Company’s average balances and average yields earned and rates paid on its interest-earning assets and interest-bearing liabilities for the periods indicated.

| |

|

For the Three Months Ended December 31,

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

Average

Balance

|

|

|

Average

Yield/Rate

|

|

|

Average

Balance

|

|

|

Average

Yield/Rate

|

|

| |

|

(Dollars in thousands)

|

|

|

Interest-earning assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans receivable

|

|

$ |

457,553 |

|

|

|

5.89 |

% |

|

$ |

507,844 |

|

|

|

5.78 |

% |

|

Investment securities

|

|

|

96,715 |

|

|

|

2.19 |

|

|

|

109,485 |

|

|

|

2.43 |

|

|

Interest-earning deposits

|

|

|

29,653 |

|

|

|

4.47 |

|

|

|

1,751 |

|

|

|

2.95 |

|

|

Total interest-earning assets

|

|

$ |

583,921 |

|

|

|

5.20 |

% |

|

$ |

619,080 |

|

|

|

5.18 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Savings accounts

|

|

$ |

90,696 |

|

|

|

1.71 |

% |

|

$ |

73,228 |

|

|

|

0.40 |

% |

|

NOW accounts

|

|

|

70,685 |

|

|

|

1.26 |

|

|

|

65,252 |

|

|

|

0.43 |

|

|

Money market accounts

|

|

|

79,365 |

|

|

|

2.21 |

|

|

|

95,763 |

|

|

|

2.49 |

|

|

Certificates of deposit

|

|

|

188,929 |

|

|

|

4.03 |

|

|

|

212,792 |

|

|

|

4.01 |

|

|

Total interest-bearing deposits

|

|

|

429,675 |

|

|

|

2.75 |

|

|

|

447,035 |

|

|

|

2.57 |

|

|

Other bank borrowings

|

|

|

4,489 |

|

|

|

7.16 |

|

|

|

9,202 |

|

|

|

8.58 |

|

|

FHLB advances

|

|

|

- |

|

|

|

- |

|

|

|

5,379 |

|

|

|

5.75 |

|

|

Total interest-bearing liabilities

|

|

$ |

434,164 |

|

|

|

2.80 |

% |

|

$ |

461,616 |

|

|

|

2.73 |

% |

| |

|

For the Six Months Ended December 31,

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

Average

Balance

|

|

|

Average

Yield/Rate

|

|

|

Average

Balance

|

|

|

Average

Yield/Rate

|

|

| |

|

(Dollars in thousands)

|

|

|

Interest-earning assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans receivable

|

|

$ |

461,531 |

|

|

|

5.88 |

% |

|

$ |

503,043 |

|

|

|

5.79 |

% |

|

Investment securities

|

|

|

96,732 |

|

|

|

2.14 |

|

|

|

111,535 |

|

|

|

2.46 |

|

|

Interest-earning deposits

|

|

|

27,635 |

|

|

|

4.81 |

|

|

|

5,843 |

|

|

|

3.43 |

|

|

Total interest-earning assets

|

|

$ |

585,898 |

|

|

|

5.21 |

% |

|

$ |

620,421 |

|

|

|

5.16 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Savings accounts

|

|

$ |

86,626 |

|

|

|

1.66 |

% |

|

$ |

75,900 |

|

|

|

0.39 |

% |

|

NOW accounts

|

|

|

71,736 |

|

|

|

1.18 |

|

|

|

66,639 |

|

|

|

0.41 |

|

|

Money market accounts

|

|

|

77,290 |

|

|

|

2.29 |

|

|

|

102,327 |

|

|

|

2.37 |

|

|

Certificates of deposit

|

|

|

196,443 |

|

|

|

4.17 |

|

|

|

203,779 |

|

|

|

3.88 |

|

|

Total interest-bearing deposits

|

|

|

432,095 |

|

|

|

2.83 |

|

|

|

448,645 |

|

|

|

2.43 |

|

|

Other bank borrowings

|

|

|

5,239 |

|

|

|

7.50 |

|

|

|

8,928 |

|

|

|

8.47 |

|

|

FHLB advances

|

|

|

- |

|

|

|

- |

|

|

|

3,259 |

|

|

|

5.66 |

|

|

Total interest-bearing liabilities

|

|

$ |

437,334 |

|

|

|

2.89 |

% |

|

$ |

460,832 |

|

|

|

2.57 |

% |

The $351,000 increase in non-interest income for the three months ended December 31, 2024, compared to the prior year quarterly period, was primarily due to a decrease of $369,000 in loss on sale of real estate, an increase of $62,000 in other non-interest income, and an increase of $2,000 in income on bank owned life insurance, partially offset by a decrease of $71,000 in gain on sale of loans, an increase of $6,000 in loss on sale of securities, and a decrease of $5,000 in service charges on deposit accounts. The $216,000 increase in non-interest income for the six months ended December 31, 2024 compared to the prior year six-month period was primarily due to a decrease of $149,000 in loss on sale of real estate, an increase of $88,000 in other non-interest income, and an increase of $4,000 in income from bank owned life insurance, partially offset by a decrease of $14,000 in gain on sale of loans, an increase of $6,000 in loss on sale of securities, and a decrease of $5,000 in service charges on deposit accounts.

The $413,000 decrease in non-interest expense for the three months ended December 31, 2024, compared to the same period in 2023, is primarily attributable to decreases of $163,000 in franchise and bank shares tax expense, $132,000 in other non-interest expense, $99,000 in compensation and benefits expense, $80,000 in audit and examination fees, $53,000 in professional fees, $38,000 in advertising expense, $33,000 in deposit insurance premium expense, $13,000 in amortization of core deposit intangible expense, $7,000 in occupancy and equipment expense, and $2,000 in loan and collection expense. The decreases were partially offset by an increase of $207,000 in data processing expense. The $591,000 decrease in non-interest expense for the six months ended December 31, 2024, compared to the same six-month period in 2023, is primarily attributable to decreases of $153,000 in compensation and benefits expense, $151,000 in franchise and bank shares tax expense, $124,000 in advertising expense, $105,000 in other non-interest expense, $96,000 in professional fees, $50,000 in audit and examination fees, $34,000 in loan and collection expense, $34,000 in deposit insurance premium expense, and $33,000 in amortization of core deposit intangible expense. The decreases were partially offset by increases of $180,000 in data processing expense and $9,000 in occupancy and equipment expense.

Total assets decreased $29.7 million, or 4.7%, from $637.5 million at June 30, 2024 to $607.8 million at December 31, 2024. The decrease in assets was comprised of decreases in cash and cash equivalents of $15.4 million, or 44.1%, from $34.9 million at June 30, 2024 to $19.5 million at December 31, 2024, net loans receivable of $12.2 million, or 2.6%, from $470.9 million at June 30, 2024 to $458.7 million at December 31, 2024, loans-held-for-sale of $1.5 million, or 87.5%, from $1.7 million at June 30, 2024 to $216,000 at December 31, 2024, premises and equipment of $459,000, or 2.5%, from $18.3 million at June 30, 2024 to $17.8 million at December 31, 2024, real estate owned of $418,000, or 100.0% from $418,000 at June 30, 2024 to none at December 31, 2024, investment securities of $264,000, or 0.3%, from $96.0 million at June 30, 2024 to $95.7 million at December 31, 2024, and core deposit intangible of $146,000, or 12.2%, from $1.2 million at June 30, 2024 to $1.1 million at December 31, 2024, partially offset by increases in deferred tax asset of $357,000, or 30.2%, from $1.2 million at June 30, 2024 to $1.5 million at December 31, 2024, other assets of $195,000, or 14.4%, from $1.3 million at June 30, 2024 to $1.5 million at December 31, 2024, bank owned life insurance of $58,000, or 0.9%, from $6.81 million at June 30, 2024 to $6.87 million at December 31, 2024, and accrued interest receivable of $12,000, or 0.7%, from $1.78 million at June 30, 2024 to $1.79 million at December 31, 2024.

Total liabilities decreased $30.9 million, or 5.3%, from $584.7 million at June 30, 2024 to $553.8 million at December 31, 2024. The decrease in liabilities was comprised of decreases in total deposits of $27.5 million, or 4.8%, from $574.0 million at June 30, 2024 to $546.5 million at December 31, 2024, other borrowings of $3.0 million, or 42.9%, from $7.0 million at June 30, 2024 to $4.0 million at December 31, 2024, advances from borrowers for taxes and insurance of $252,000, or 48.4%, from $521,000 at June 30, 2024 to $269,000 at December 31, 2024, and other accrued expenses and liabilities of $164,000, or 5.2%, from $3.2 million at June 30, 2024 to $3.0 million at December 31, 2024. The decrease in deposits resulted from decreases in certificates of deposit of $30.8 million, or 14.3%, from $214.9 million at June 30, 2024 to $184.1 million at December 31, 2024, money market deposits of $12.2 million, or 14.3%, from $85.5 million at June 30, 2024 to $73.3 million at December 31, 2024, and non-interest deposits of $1.9 million, or 1.5%, from $130.3 million at June 30, 2024 to $128.4 million at December 31, 2024, partially offset by increases in savings deposits of $16.7 million, or 21.7%, from $76.6 million at June 30, 2024 to $93.3 million at December 31, 2024, and NOW accounts of $796,000, or 1.2%, from $66.6 million at June 30, 2024 to $67.4 million at December 31, 2024. The Company had no balances in brokered deposits at December 31, 2024 or June 30, 2024.

At December 31, 2024, the Company had $1.8 million of non-performing assets (defined as non-accruing loans, accruing loans 90 days or more past due, and other real estate owned) compared to $1.9 million on non-performing assets at June 30, 2024, consisting of five one-to-four family residential loans, five home equity loans, two commercial non-real estate loans, and one commercial real-estate loan at December 31, 2024, compared to five one-to-four family residential loans, four home equity loans, three commercial non-real estate loans, and three single-family residences in other real estate owned at June 30, 2024. At December 31, 2024 the Company had eight one-to-four family residential loans, five home equity loans, five commercial non-real-estate loans, two commercial real-estate loans, and one consumer loan classified as substandard, compared to six one-to-four family residential loans, five commercial non-real-estate loans, four home equity loans and one consumer loan classified as substandard at June 30, 2024. There were no loans classified as doubtful at December 31, 2024 or June 30, 2024.

Shareholders’ equity increased $1.1 million, or 2.1%, from $52.8 million at June 30, 2024 to $53.9 million at December 31, 2024. The increase in shareholders’ equity was comprised of net income for the six-month period of $2.0 million, the vesting of restricted stock awards, stock options, and the release of employee stock ownership plan shares totaling $311,000, and proceeds from the issuance of common stock from the exercise of stock options of $19,000, partially offset by an increase in the Company’s accumulated other comprehensive loss of $10,000, dividends paid totaling $816,000, and stock repurchases of $335,000.

Home Federal Bancorp, Inc. of Louisiana is the holding company for Home Federal Bank which conducts business from its ten full-service banking offices and home office in northwest Louisiana.

Statements contained in this news release which are not historical facts may be forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words like “believe”, “expect”, “anticipate”, “estimate”, and “intend”, or future or conditional verbs such as “will”, “would”, “should”, “could”, or “may”. We undertake no obligation to update any forward-looking statements.

In addition to factors previously disclosed in the reports filed by the Company with the Securities and Exchange Commission and those identified elsewhere in this press release, the following factors, among others, could cause actual results to differ materially from forward-looking statements or historical performance: the strength of the United States economy in general and the strength of the local economies in which the Company conducts its operations; general economic conditions; legislative and regulatory changes; monetary and fiscal policies of the federal government; changes in tax policies, rates and regulations of federal, state and local tax authorities including the effects of the Tax Reform Act; changes in interest rates, deposit flows, the cost of funds, demand for loan products and the demand for financial services, competition, changes in the quality or composition of the Company’s loans, investment and mortgage-backed securities portfolios; geographic concentration of the Company’s business; fluctuations in real estate values; the adequacy of loan loss reserves; the risk that goodwill and intangibles recorded in the Company’s financial statements will become impaired; changes in accounting principles, policies or guidelines and other economic, competitive, governmental and technological factors affecting the Company’s operations, markets, products, services and fees.

|

HOME FEDERAL BANCORP, INC. OF LOUISIANA

|

|

CONSOLIDATED BALANCE SHEETS

(In thousands except share and per share data)

|

| |

|

December 31, 2024

|

|

|

June 30, 2024

|

|

| |

|

(Unaudited)

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Cash and Cash Equivalents (Includes Interest-Bearing Deposits with Other Banks of $16,389 and $25,505 at

December 31, 2024 and June 30, 2024, Respectively)

|

|

$ |

19,540 |

|

|

$ |

34,948 |

|

|

Securities Available-for-Sale (amortized cost December 31, 2024: $32,930; June 30, 2024: $30,348, Respectively)

|

|

|

29,607 |

|

|

|

27,037 |

|

|

Securities Held-to-Maturity (fair value December 31, 2024: $52,451; June 30, 2024: $54,450, Respectively)

|

|

|

64,431 |

|

|

|

67,302 |

|

|

Other Securities

|

|

|

1,651 |

|

|

|

1,614 |

|

|

Loans Held-for-Sale

|

|

|

216 |

|

|

|

1,733 |

|

|

Loans Receivable, Net of Allowance for Credit Losses (December 31, 2024: $4,749; June 30, 2024: $4,574, Respectively)

|

|

|

458,693 |

|

|

|

470,852 |

|

|

Accrued Interest Receivable

|

|

|

1,787 |

|

|

|

1,775 |

|

|

Premises and Equipment, Net

|

|

|

17,844 |

|

|

|

18,303 |

|

|

Bank Owned Life Insurance

|

|

|

6,868 |

|

|

|

6,810 |

|

|

Goodwill

|

|

|

2,990 |

|

|

|

2,990 |

|

|

Core Deposit Intangible

|

|

|

1,053 |

|

|

|

1,199 |

|

|

Deferred Tax Asset

|

|

|

1,538 |

|

|

|

1,181 |

|

|

Real Estate Owned

|

|

|

- |

|

|

|

418 |

|

|

Other Assets

|

|

|

1,545 |

|

|

|

1,350 |

|

| |

|

|

|

|

|

|

|

|

|

Total Assets

|

|

$ |

607,763 |

|

|

$ |

637,512 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Deposits:

|

|

|

|

|

|

|

|

|

|

Non-interest bearing

|

|

$ |

128,439 |

|

|

$ |

130,334 |

|

|

Interest-bearing

|

|

|

418,105 |

|

|

|

443,673 |

|

|

Total Deposits

|

|

|

546,544 |

|

|

|

574,007 |

|

|

Advances from Borrowers for Taxes and Insurance

|

|

|

269 |

|

|

|

521 |

|

|

Other Borrowings

|

|

|

4,000 |

|

|

|

7,000 |

|

|

Other Accrued Expenses and Liabilities

|

|

|

3,017 |

|

|

|

3,181 |

|

| |

|

|

|

|

|

|

|

|

|

Total Liabilities

|

|

|

553,830 |

|

|

|

584,709 |

|

| |

|

|

|

|

|

|

|

|

|

SHAREHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Preferred Stock - $0.01 Par Value; 10,000,000 Shares

|

|

|

|

|

|

|

|

|

|

Authorized: None Issued and Outstanding

|

|

|

- |

|

|

|

- |

|

|

Common Stock - $0.01 Par Value; 40,000,000 Shares Authorized: 3,132,764 and 3,142,168 Shares Issued and

|

|

|

|

|

|

|

|

|

|

Outstanding at December 31, 2024 and June 30, 2024, Respectively

|

|

|

32 |

|

|

|

32 |

|

|

Additional Paid-in Capital

|

|

|

42,010 |

|

|

|

41,739 |

|

|

Unearned ESOP Stock

|

|

|

(350 |

) |

|

|

(408 |

) |

|

Retained Earnings

|

|

|

14,866 |

|

|

|

14,055 |

|

|

Accumulated Other Comprehensive Loss

|

|

|

(2,625 |

) |

|

|

(2,615 |

) |

| |

|

|

|

|

|

|

|

|

|

Total Shareholders’ Equity

|

|

|

53,933 |

|

|

|

52,803 |

|

| |

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

$ |

607,763 |

|

|

$ |

637,512 |

|

|

HOME FEDERAL BANCORP, INC. OF LOUISIANA

CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except per share data)

|

|

(Unaudited)

|

| |

|

Three Months Ended

|

|

|

Six Months Ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Interest income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans, including fees

|

|

$ |

6,791 |

|

|

$ |

7,397 |

|

|

$ |

13,686 |

|

|

$ |

14,671 |

|

|

Investment securities

|

|

|

63 |

|

|

|

210 |

|

|

|

130 |

|

|

|

449 |

|

|

Mortgage-backed securities

|

|

|

470 |

|

|

|

460 |

|

|

|

913 |

|

|

|

933 |

|

|

Other interest-earning assets

|

|

|

334 |

|

|

|

13 |

|

|

|

670 |

|

|

|

101 |

|

|

Total interest income

|

|

|

7,658 |

|

|

|

8,080 |

|

|

|

15,399 |

|

|

|

16,154 |

|

|

Interest expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits

|

|

|

2,977 |

|

|

|

2,901 |

|

|

|

6,175 |

|

|

|

5,494 |

|

|

Federal Home Loan Bank borrowings

|

|

|

- |

|

|

|

78 |

|

|

|

- |

|

|

|

93 |

|

|

Other bank borrowings

|

|

|

81 |

|

|

|

198 |

|

|

|

198 |

|

|

|

381 |

|

|

Total interest expense

|

|

|

3,058 |

|

|

|

3,177 |

|

|

|

6,373 |

|

|

|

5,968 |

|

|

Net interest income

|

|

|

4,600 |

|

|

|

4,903 |

|

|

|

9,026 |

|

|

|

10,186 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for (recovery of) credit losses

|

|

|

45 |

|

|

|

(16 |

) |

|

|

(178 |

) |

|

|

(16 |

) |

|

Net interest income after provision for credit losses

|

|

|

4,555 |

|

|

|

4,919 |

|

|

|

9,204 |

|

|

|

10,202 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-interest income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss on sale of real estate

|

|

|

(12 |

) |

|

|

(381 |

) |

|

|

(266 |

) |

|

|

(415 |

) |

|

Gain on sale of loans

|

|

|

5 |

|

|

|

76 |

|

|

|

101 |

|

|

|

115 |

|

|

Loss on sale of securities

|

|

|

(6 |

) |

|

|

- |

|

|

|

(6 |

) |

|

|

- |

|

|

Income on Bank-Owned Life Insurance

|

|

|

30 |

|

|

|

28 |

|

|

|

58 |

|

|

|

54 |

|

|

Service charges on deposit accounts

|

|

|

392 |

|

|

|

397 |

|

|

|

783 |

|

|

|

788 |

|

|

Other income

|

|

|

79 |

|

|

|

17 |

|

|

|

118 |

|

|

|

30 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-interest income

|

|

|

488 |

|

|

|

137 |

|

|

|

788 |

|

|

|

572 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-interest expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits

|

|

|

2,229 |

|

|

|

2,328 |

|

|

|

4,531 |

|

|

|

4,684 |

|

|

Occupancy and equipment

|

|

|

537 |

|

|

|

544 |

|

|

|

1,101 |

|

|

|

1,092 |

|

|

Data processing

|

|

|

336 |

|

|

|

129 |

|

|

|

554 |

|

|

|

374 |

|

|

Audit and examination fees

|

|

|

191 |

|

|

|

271 |

|

|

|

323 |

|

|

|

373 |

|

|

Franchise and bank shares tax

|

|

|

1 |

|

|

|

164 |

|

|

|

169 |

|

|

|

320 |

|

|

Advertising

|

|

|

44 |

|

|

|

82 |

|

|

|

101 |

|

|

|

225 |

|

|

Legal fees

|

|

|

134 |

|

|

|

187 |

|

|

|

251 |

|

|

|

347 |

|

|

Loan and collection

|

|

|

30 |

|

|

|

32 |

|

|

|

58 |

|

|

|

92 |

|

|

Amortization Core Deposit Intangible

|

|

|

72 |

|

|

|

85 |

|

|

|

146 |

|

|

|

179 |

|

|

Deposit insurance premium

|

|

|

75 |

|

|

|

108 |

|

|

|

165 |

|

|

|

199 |

|

|

Other expenses

|

|

187

|

|

|

|

319 |

|

|

|

447 |

|

|

|

552 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-interest expense

|

|

|

3,836 |

|

|

|

4,249 |

|

|

|

7,846 |

|

|

|

8,437 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

1,207 |

|

|

|

807 |

|

|

|

2,146 |

|

|

|

2,337 |

|

|

Provision for income tax expense (benefit)

|

|

|

187 |

|

|

|

(196 |

) |

|

|

185 |

|

|

|

114 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME

|

|

$ |

1,020 |

|

|

$ |

1,003 |

|

|

$ |

1,961 |

|

|

$ |

2,223 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EARNINGS PER SHARE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.33 |

|

|

$ |

0.33 |

|

|

$ |

0.64 |

|

|

$ |

0.73 |

|

|

Diluted

|

|

$ |

0.33 |

|

|

$ |

0.33 |

|

|

$ |

0.64 |

|

|

$ |

0.72 |

|

| |

|

Three Months Ended

|

|

|

Six Months Ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selected Operating Ratios(1):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average interest rate spread

|

|

|

2.40 |

% |

|

|

2.45 |

% |

|

|

2.32 |

% |

|

|

2.60 |

% |

|

Net interest margin

|

|

|

3.12 |

% |

|

|

3.14 |

% |

|

|

3.06 |

% |

|

|

3.26 |

% |

|

Return on average assets

|

|

|

0.65 |

% |

|

|

0.60 |

% |

|

|

0.62 |

% |

|

|

0.67 |

% |

|

Return on average equity

|

|

|

7.76 |

% |

|

|

7.81 |

% |

|

|

7.50 |

% |

|

|

8.64 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset Quality Ratios(2):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-performing assets as a percent of total assets

|

|

|

0.30 |

% |

|

|

0.34 |

% |

|

|

0.30 |

% |

|

|

0.34 |

% |

|

Allowance for credit losses as a percent of non-performing loans

|

|

|

260.70 |

% |

|

|

226.50 |

% |

|

|

260.70 |

% |

|

|

226.50 |

% |

|

Allowance for credit losses as a percent of total loans receivable

|

|

|

1.02 |

% |

|

|

1.00 |

% |

|

|

1.02 |

% |

|

|

1.00 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares outstanding at period end

|

|

|

3,132,764 |

|

|

|

3,143,532 |

|

|

|

3,132,764 |

|

|

|

3,143,532 |

|

|

Weighted average shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

3,059,305 |

|

|

|

3,040,006 |

|

|

|

3,062,666 |

|

|

|

3,033,341 |

|

|

Diluted

|

|

|

3,075,221 |

|

|

|

3,085,271 |

|

|

|

3,077,371 |

|

|

|

3,096,546 |

|

|

Book value per share at period end

|

|

$ |

17.22 |

|

|

$ |

16.73 |

|

|

$ |

17.22 |

|

|

$ |

16.73 |

|

| _____________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Ratios for the three and six month periods are annualized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) Asset quality ratios are end of period ratios.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

CONTACT:

|

James R. Barlow

Chairman of the Board, President and Chief Executive Officer

(318) 222-1145

|

v3.24.4

Document And Entity Information

|

Jan. 30, 2025 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

HOME FEDERAL BANCORP, INC. OF LOUISIANA

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jan. 30, 2025

|

| Entity, Incorporation, State or Country Code |

LA

|

| Entity, File Number |

001-35019

|

| Entity, Tax Identification Number |

02-0815311

|

| Entity, Address, Address Line One |

624 Market Street

|

| Entity, Address, City or Town |

Shreveport

|

| Entity, Address, State or Province |

LA

|

| Entity, Address, Postal Zip Code |

71101

|

| City Area Code |

318

|

| Local Phone Number |

222-1145

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock (par value $.01 per share)

|

| Trading Symbol |

HFBL

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001500375

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

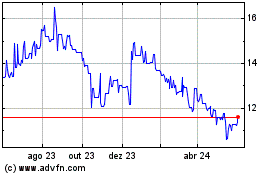

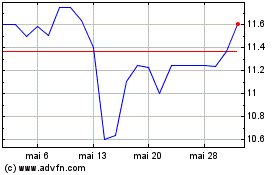

Home Federal Bancorp Inc... (NASDAQ:HFBL)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Home Federal Bancorp Inc... (NASDAQ:HFBL)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025