Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

12 Março 2025 - 7:54AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration No. 333-265958

Free Writing Prospectus dated March 11, 2025

(to Prospectus dated July 1, 2022 and

Preliminary Prospectus Supplement dated March 11, 2025)

Pricing Term Sheet

B.A.T CAPITAL CORPORATION

$1,000,000,000 5.350% Notes due 2032

$1,000,000,000 5.625% Notes due 2035

$500,000,000 6.250% Notes due 2055

March 11, 2025

| | | | | | | | | | | | | | |

Issuer: | | B.A.T Capital Corporation (the “Issuer”) |

| | |

Guarantors: | | British American Tobacco p.l.c., B.A.T. International Finance p.l.c., B.A.T. Netherlands Finance B.V. and, unless its guarantee is released in accordance with the indenture governing the Notes (as defined below), Reynolds American Inc. |

| | |

Security Title: | | $1,000,000,000 5.350% Notes due 2032 (the “2032 Notes”) $1,000,000,000 5.625% Notes due 2035 (the “2035 Notes”) $500,000,000 6.250% Notes due 2055 (the “2055 Notes” and, together with the 2032 Notes and the 2035 Notes, the “Notes”) |

| | |

Ranking: | | Senior and Unsubordinated |

| | |

Form: | | SEC-Registered Global Notes |

| | |

Principal Amount: | | $1,000,000,000 for the 2032 Notes $1,000,000,000 for the 2035 Notes $500,000,000 for the 2055 Notes |

| | |

Maturity Date: | | August 15, 2032 for the 2032 Notes August 15, 2035 for the 2035 Notes August 15, 2055 for the 2055 Notes |

| | |

| | | | | | | | | | | | | | |

Interest Rate: | | 5.350% per annum for the 2032 Notes 5.625% per annum for the 2035 Notes 6.250% per annum for the 2055 Notes |

| | |

Benchmark Treasury: | | 4.125% due February 29, 2032 for the 2032 Notes 4.625% due February 15, 2035 for the 2035 Notes 4.500% due November 15, 2054 for the 2055 Notes |

| | |

Benchmark Treasury Price and Yield: | | 99-24+ / 4.164% for the 2032 Notes 102-24 / 4.282% for the 2035 Notes 98-08+ / 4.607% for the 2055 Notes |

| | |

Spread to Benchmark Treasury: | | #VALUE! |

| | |

Yield to Maturity: | | 5.364% for the 2032 Notes 5.632% for the 2035 Notes 6.287% for the 2055 Notes |

| | |

Day Count Convention: | | 30/360 (or, in the case of an incomplete month, the number of days elapsed) |

| | |

Business Day Convention: | | Following, Unadjusted |

| | |

Price to Public: | | 99.920% for the 2032 Notes 99.950% for the 2035 Notes 99.507% for the 2055 Notes |

| | |

Net Proceeds to Issuer (before Expenses): | | $995,700,000 for the 2032 Notes $995,500,000 for the 2035 Notes $493,785,000 for the 2055 Notes |

| | |

Interest Payment Dates: | | Semi-annually in arrear on February 15 and August 15 of each year, commencing on August 15, 2025 |

| | |

Interest Payment Record Dates: | | The close of business on the fifteenth calendar day preceding each Interest Payment Date, whether or not such day is a Business Day |

| | | | | | | | | | | | | | |

Optional Redemption: | | The Issuer may redeem a series of Notes, in whole or in part, at its option, at any time and from time to time before the applicable “Par Call Date” (as set out in the table below) at a redemption price equal to the greater of (x) 100% of the principal amount of the series of Notes to be redeemed and (y) the sum of the present values of the applicable Remaining Scheduled Payments (as defined in the Prospectus) discounted to the date of redemption on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months or, in the case of an incomplete month, the number of days elapsed) at the Treasury Rate (as defined in the Prospectus), plus the applicable Make-Whole Spread (as set out in the table below) together with accrued and unpaid interest on the principal amount of the series of Notes to be redeemed to, but excluding, the date of redemption. The Issuer may redeem a series of Notes on or after the applicable Par Call Date at a redemption price equal to 100% of the principal amount of the series of Notes to be redeemed, plus accrued and unpaid interest, if any, to, but excluding, the date of redemption. |

| | |

| | Series | Par Call Date | Make-Whole Spread |

| | 2032 Notes | June 15, 2032 | 20 basis points |

| | 2035 Notes | May 15, 2035 | 25 basis points |

| | 2055 Notes | February 15, 2055 | 30 basis points |

| | | | |

Trade Date: | | March 11, 2025 |

| | |

Expected Settlement Date: | | March 13, 2025 (T+2) |

| | |

Expected Ratings: | | Baa1 (Moody’s) / BBB+ (S&P) / BBB+ (Fitch) |

| | |

CUSIP: | | 05526D CB9 for the 2032 Notes 05526D CC7 for the 2035 Notes 05526D CD5 for the 2055 Notes |

| | |

| | | | | | | | | | | | | | |

ISIN: | | US05526DCB91 for the 2032 Notes US05526DCC74 for the 2035 Notes US05526DCD57 for the 2055 Notes |

| | |

Governing Law: | | State of New York |

| | |

Listing and Trading: | | Application will be made to list each series of the Notes on the New York Stock Exchange. No assurance can be given that such application will be approved or that any of the Notes will be listed and, if listed, that such Notes will remain listed for the entire term of such Notes. Currently there is no active trading market for the Notes. |

| | |

Joint Book-Running Managers: | | BofA Securities, Inc. Citigroup Global Markets Inc. Deutsche Bank Securities Inc. Goldman Sachs & Co. LLC HSBC Securities (USA) Inc. Standard Chartered Bank |

| | |

Bookrunners: | | BBVA Securities Inc. Commerz Markets LLC Lloyds Securities Inc. Mizuho Securities USA LLC |

| | | | |

Co-Managers: | | Bank of China Limited, London Branch SMBC Nikko Securities America, Inc. |

Note: A security rating is not a recommendation to buy, sell or hold securities and should be evaluated independently of any other rating. The rating is subject to revision or withdrawal at any time by the assigning rating organization.

It is expected that delivery of the Notes will be made against payment therefor on or about March 13, 2025, which will be two business days (as such term is used for purposes of Rule 15c6-1 of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”)) following the date hereof (such settlement cycle being referred to as “T+2”). Under Rule 15c6-1 of the Exchange Act, trades in the secondary market generally are required to settle in one business day (as such term is used for purposes of Rule 15c6-1 of the Exchange Act) unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade Notes prior to one business day before the delivery of the Notes will be required, by virtue of the fact that the Notes initially will settle in T+2, to specify an alternative settlement cycle at the time of any such trade to prevent a failed settlement. Purchasers of the Notes who wish to make such trades should consult their own advisors.

Bank of China Limited, London Branch and Standard Chartered Bank will not effect any offers or sales of any Notes in the United States unless it is through one or more U.S. registered broker-dealers as permitted by the Financial Industry Regulatory Authority.

The Issuer and the Guarantors have filed a registration statement (including a Prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the Prospectus in that registration statement and other documents the Issuer and the Guarantors have filed with the Securities and Exchange Commission (the “SEC”) for more complete information about the Issuer, the Guarantors and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, any underwriter or any dealer participating in the offering of the Notes will arrange to send you the Prospectus if you request it by calling BofA Securities, Inc. toll-free at 1-800-294-1322, Citigroup Global Markets Inc. toll-free at 1-800-831-9146, Deutsche Bank Securities Inc. toll-free at 1-800-503-4611, Goldman Sachs & Co. LLC toll-free at 1-866-471-2526, HSBC Securities (USA) Inc. toll-free at

1-866-811-8049 and Standard Chartered Bank toll-free at +44 2078 855739.

This Pricing Term Sheet is only being distributed to and is only directed at (a) persons who are located outside the United Kingdom (the “UK”) or (b) persons who are in the UK that are qualified investors within the meaning of Article 2 of Regulation (EU) 2017/1129 as it forms part of UK domestic law by virtue of the EUWA (as defined below) that are also (i) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended) (the “Order”), (ii) persons falling within Article 49(2)(a) to (d) of the Order or (iii) persons to whom an invitation or inducement to engage in investment activity (within the meaning of Section 21 of the Financial Services and Markets Act 2000 (the “FSMA”)) in connection with the issue or sale of any Notes may lawfully be communicated or caused to be communicated (all such persons together being referred to as “relevant persons”). Accordingly, by accepting delivery of this Pricing Term Sheet, the recipient warrants and acknowledges that it is such a relevant person. The Notes are available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such Notes will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents. No part of this Pricing Term Sheet should be published, reproduced, distributed or otherwise made available in whole or in part to any other person without the prior written consent of the Issuer. The Notes are not being offered or sold to any person in the United Kingdom, except in circumstances which will not result in an offer of securities to the public in the United Kingdom within the meaning of Part VI of the FSMA.

Prohibition of sales to European Economic Area (“EEA”) retail investors: The Notes are not intended to be offered, sold or otherwise made available to, and should not be offered, sold or otherwise made available to, any retail investor in the EEA. For these purposes, a “retail investor” means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU (as amended, “MiFID II”), or (ii) a customer within the meaning of Directive (EU) 2016/97, where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II or (iii)

not a qualified investor as defined in Regulation (EU) 2017/1129 and the expression “offer” includes the communication in any form and by any means of sufficient information on the terms of the offer and the Notes to be offered so as to enable an investor to decide to purchase or subscribe for the Notes. Consequently, no key information document required by Regulation (EU) No 1286/2014 (as amended, the “PRIIPs Regulation”) for offering or selling the Notes or otherwise making them available to retail investors in the EEA has been prepared and therefore offering or selling the Notes or otherwise making them available to any retail investor in the EEA may be unlawful under the PRIIPs Regulation.

Prohibition of sales to UK retail investors: The Notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to, any retail investor in the UK. For these purposes, a “retail investor” means a person who is one (or more) of: (i) a retail client, as defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 (as amended, the “EUWA”); (ii) a customer within the meaning of the provisions of the FSMA and any rules or regulations made under the FSMA to implement Directive (EU) 2016/97, where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of UK domestic law by virtue of the EUWA; or (iii) not a qualified investor as defined in Article 2 of Regulation (EU) 2017/1129 as it forms part of UK domestic law by virtue of the EUWA and the expression “offer” includes the communication in any form and by any means of sufficient information on the terms of the offer and the Notes to be offered so as to enable an investor to decide to purchase or subscribe for the Notes. Consequently, no key information document required by Regulation (EU) No 1286/2014 as it forms part of UK domestic law by virtue of the EUWA (the “UK PRIIPs Regulation”) for offering or selling the Notes or otherwise making them available to retail investors in the UK has been prepared and therefore offering or selling the Notes or otherwise making them available to any retail investor in the UK may be unlawful under the UK PRIIPs Regulation.

UK MiFIR Product Governance / Professional Investors and Eligible Counterparties only target market: Solely for the purposes of each manufacturer’s product approval process, the target market assessment in respect of the Notes has led to the conclusion that: (i) the target market for the Notes is only eligible counterparties, as defined in the FCA Handbook Conduct of Business Sourcebook, and professional clients, as defined in Regulation (EU) No. 600/2014 as it forms part of UK domestic law by virtue of the EUWA (as amended, “UK MiFIR”); and (ii) all channels for distribution of the Notes to eligible counterparties and professional clients are appropriate. Any person subsequently offering, selling or recommending the Notes (a “distributor”) should take into consideration the manufacturers’ target market assessment; however, a distributor subject to the FCA Handbook Product Intervention and Product Governance Sourcebook is responsible for undertaking its own target market assessment in respect of the Notes (by either adopting or refining the manufacturers’ target market assessment) and determining appropriate distribution channels.

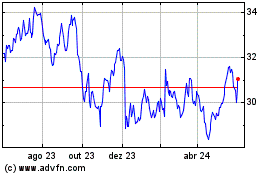

British American Tobacco (NYSE:BTI)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

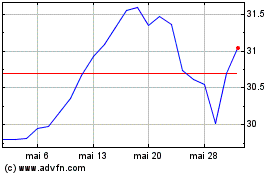

British American Tobacco (NYSE:BTI)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025