Economic Worries May Lead To Weakness On Wall Street

04 Junho 2024 - 10:10AM

IH Market News

The major U.S. index futures are currently pointing to a lower

open on Tuesday, with stocks likely to move to the downside

following the mixed performance seen in the previous session.

Concerns about the outlook for the U.S. economy may weigh on the

markets following yesterday’s disappointing manufacturing data.

While economic weakness could prompt the Federal Reserve to

lower interest rates in the coming months, the central bank has

signaled it plans to keep rates at elevated levels until there is

greater confidence inflation is slowing.

A bigger than expected slowdown by the economy combined with

high interest rates could prove troubling for stocks, which have

recently reached record levels.

On Friday, the Labor Department is scheduled to release its

closely watched monthly jobs report, which could have a significant

impact on the outlook for the economy and interest rates.

Economists currently expect the report to show employment jumped

by 190,000 jobs in May after climbing by 175,000 jobs in April,

while the unemployment rate is expected to hold at 3.9 percent.

After a positive start and a subsequent retreat that resulted in

a fairly long spell in negative territory on Monday, U.S. stocks

recovered in afternoon trading and ended the day’s session on a

mixed note.

The Nasdaq outperformed, settling at 16,828.67 with a gain of

93.65 points or 0.6 percent. The S&P 500 edged up 5.89 points

or 0.1 percent to finish at 5,283.40, while the Dow ended down

115.29 points or 0.3 percent at 38,571.03.

Data showing a continued contraction in the nation’s

manufacturing activity in the month of May hurt sentiment.

A report from the Institute for Supply Management said

manufacturing activity in the U.S. unexpectedly contracted at a

slightly faster rate in the month of May.

The ISM said its manufacturing PMI edging down to 48.7 in the

month, from 49.2 in April. Economists had expected the index to

inch up to 49.6.

The report also said the prices index slid to 57.0 in May from

60.9 in April, suggesting a slowdown in the pace of price

growth.

On Wednesday, the ISM is scheduled to release a separate report

on service sector activity in the month of May. The services PMI is

expected to rise to 50.5 in May from 49.4 in April, with a reading

above 50 indicating growth.

Data from the Commerce Department showed U.S. construction

spending unexpectedly shrank in April amid declines in both private

and public construction.

The report said construction spending dipped 0.1 percent to

$2,099.0 billion from the revised estimate of $2,101.5 billion in

March. Spending was expected to grow 0.2 percent after a 0.2

percent decrease in March.

Several stocks from financial and energy sectors ended sharply

lower. Nvidia (NASDAQ:NVID)shares gained nearly 5 percent after the

company unveiled next-generation AI chips.

Autodesk (NASDAQ:ADSK) climbed about 4.6 percent. Moderna

(NASDAQ:MRNA), Vertex Pharmaceuticals (NASDAQ:VRTX), Dollar Tree

(NASDAQ:DLTR), Micron Technology (NASDAQ:MU), Starbucks

(NASDAQ:SBUX), Biogen (NASDAQ:BIIB) and Meta Platforms

(NASDAQ:META) gained 2 to 4 percent.

Salesforce.com (NYSE:CRM) climbed about 2.75 percent.

AstraZeneca (NASDAQ:AZN), Warner Bros. (NASDAQ:WBD), Amazon

(NASDAQ:AMZN), Merck (NYSE:MRK), Boeing (NYSE:BA) and American

Express (NYSE:AXP) posted moderate gains.

Sirius XM (NASDAQ:SIRI), Walgreens Boots Alliancec (NASDAQ:WBA),

AMD (NASDAQ:AMD), Old Dominion Freight Line (NASDAQ:ODFL) and Baker

Hughes (NASDAQ:BKR) ended sharply lower.

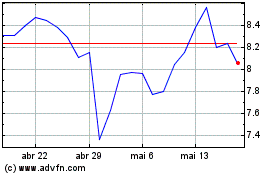

Warner Brothers Discovery (NASDAQ:WBD)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

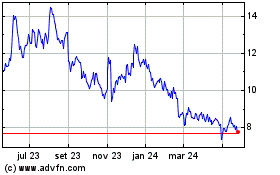

Warner Brothers Discovery (NASDAQ:WBD)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024