U.S. Futures Decline Ahead of Key Economic Events, Oil Prices Rise

27 Junho 2024 - 8:06AM

IH Market News

U.S. index futures point to a lower opening on Thursday,

influenced by a disappointing revenue forecast from chipmaker

Micron Technology (NASDAQ:MU), with focus on the

release of Q1 GDP this morning and anticipation for May PCE

inflation data on Friday.

At 6:25 AM, Dow Jones futures (DOWI:DJI) fell 65 points, or

0.16%. S&P 500 futures declined 0.14%, and Nasdaq-100 futures

lost 0.15%. The 10-year Treasury yield was at 4.329%.

In the commodities market, oil prices are rising due to fears

that a potential expansion of the war in Gaza could disrupt supply

in the Middle East. West Texas Intermediate crude for August rose

0.36% to $81.19 per barrel. Brent crude for August increased 0.38%

to near $85.57 per barrel. Iron ore traded on the Dalian exchange

rose 1.24% to $112.68 per metric ton.

The U.S. economic indicators schedule for Thursday begins at

8:30 AM with the release of the Q1 GDP, projected by LSEG to rise

by 1.3%. Simultaneously, the Department of Labor will release the

weekly jobless claims data for the week ending last Saturday. Also

at 8:30 AM Department of Commerce will report on durable goods

orders for May. Later, at 10:00 AM, the same department will reveal

pending home sales for May. Additionally, political debate heats up

with the confrontation between Joe Biden and Donald Trump on CNN,

marking the first electoral clash.

Asia-Pacific markets ended the day with sharp declines. The

standout was the Japanese yen, which depreciated to its lowest

level in almost 38 years, reaching 160.82 against the dollar,

according to FactSet data. Among the indices, Hong Kong’s Hang Seng

led the losses with a 2.06% drop, followed by significant declines

in Shanghai and Nikkei, which fell by 0.90% and 0.82%,

respectively. South Korea’s Kospi and Australia’s ASX 200 also

recorded losses, ending the day with decreases of 0.29% and 0.30%,

respectively.

European markets are predominantly negative today, reflecting

continued investor concerns over global inflation. While media

stocks are outperforming, retail stocks are retreating. Retailer

H&M suffered a sharp decline after reporting

Q2 profit growth below expectations and questioning the feasibility

of reaching its full-year profit margin target.

Data releases in Europe include the latest consumer and business

confidence indices in Italy and retail sales in Spain. Meanwhile,

an EU leaders’ summit began in Brussels, and the Bank of England

released its latest Financial Stability Report.

On Wednesday, U.S. stocks closed slightly higher after a

cautious session, with the main indices posting gains. The Dow

Jones rose 0.04%, closing at 39,127.80 points, while the S&P

500 gained 0.16%, ending the day at 5,477.60 points. The Nasdaq

Composite outperformed, increasing by 0.49% to 17,805.16

points.

In the economic scenario, a report from the Department of

Commerce revealed that new home sales in the U.S. significantly

decreased in May, with an 11.3% drop to an annual rate of 619,000

units, after an upward revision in April to 698,000 units.

Additionally, building permit applications fell 2.8% in May,

seasonally adjusted to an annual rate of 1.399 million, revised up

from the preliminary estimate of 1.386 million.

In quarterly reports, before the market opens, Walgreens

Boots Alliance (NASDAQ:WBA), McCormick

(NYSE:MKC), Acuity Brands (NYSE:AYI),

Simply Good (NASDAQ), Lindsay

Corporation (NYSE:LNN), and Apogee

Enterprises (NASDAQ:APOG) will report earnings.

After the closing, numbers from Nike

(NYSE:NKE), Accolade (NASDAQ:ACCD),

American Outdoor Brands (NASDAQ:AOUT), and

Pinstripes (NYSE:PNST) are awaited.

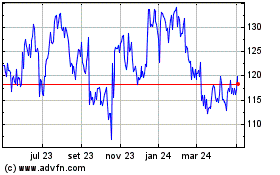

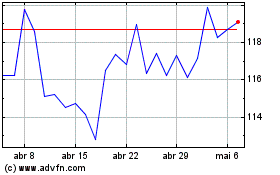

Lindsay (NYSE:LNN)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Lindsay (NYSE:LNN)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024