AI surpasses Bitcoin mining in energy consumption

Recent research reveals that the energy consumed by artificial

intelligence (AI) systems may be surpassing that used in Bitcoin

mining. With the growing adoption of generative AI, it’s estimated

that AI will consume 169 TWh in 2024 and 240 TWh by 2027, compared

to 160 TWh for Bitcoin mining. Additionally, AI data centers

require significant water for cooling, with five to 50 ChatGPT

queries using about 500 ml of water. In comparison, Bitcoin mining

in the U.S. consumes between 93 and 120 gigaliters annually. AI

also offers much higher profit margins, ranging from $3 to $5 per

kWh, compared to Bitcoin mining’s $0.17 to $0.20. With AI

generating up to 25 times more revenue per kWh than Bitcoin, miners

are considering transitioning to AI or adding AI processing to

their data centers. The revenue gap and financial capabilities of

AI companies are intensifying this competition for electricity and

equipment.

Goldman Sachs invests $418 million in Bitcoin ETFs

Goldman Sachs (NYSE:GS) has revealed $418 million investments in

Bitcoin ETFs, signaling increasing institutional interest. Among

its top holdings are BlackRock’s iShares Bitcoin Trust

(NASDAQ:IBIT) with nearly $240 million and Fidelity Bitcoin ETF

(AMEX:FBTC) with $79.5 million. The bank, previously skeptical

about Bitcoin, now sees ETFs as a way to gain exposure to the asset

without directly owning it.

Bitcoin and Ethereum ETF inflows and outflows on August 13

On August 13, Bitcoin ETFs recorded a net inflow of $39 million,

led by BlackRock’s ETF (NASDAQ:IBIT) with $34.6 million, followed

by Fidelity’s ETF (AMEX:FBTC) with $22.6 million and Bitwise’s ETF

(AMEX:BITB) with $16.5 million. However, Grayscale’s ETFs

(AMEX:GBTC) and Ark’s ETFs (AMEX:ARKB) saw outflows of $28.6

million and $6.1 million, respectively.

Ethereum ETFs had an inflow of $24.3 million, with BlackRock’s

ETF (NASDAQ:ETHA) seeing $49.1 million in inflows. Fidelity

(AMEX:FETH) and Invesco saw inflows of $5.4 million and $0.8

million, respectively. Grayscale’s ETF (AMEX:ETHE) saw outflows of

$31 million.

Bitcoin faces correction after lower-than-expected CPI data

On August 14, Bitcoin (COIN:BTCUSD) hit a high of $61,827.20

following the release of U.S. CPI data but quickly dropped, trading

down over 2% in the last 24 hours to around $59,250. Despite

below-expectation data that usually favors risk assets, BTC

couldn’t sustain the gains. U.S. CPI showed an annualized inflation

rate of 2.9%, the lowest since 2021. Zach Pandl of Grayscale stated

that this could lead the Federal Reserve to cut interest rates,

benefiting Bitcoin and potentially enabling new all-time highs.

However, some traders warn of a possible further drop to $55,000

before considering new buys. Withdrawals of over $1 billion in USDT

from exchanges indicate potential risk aversion among investors.

Historically, large stablecoin withdrawals have preceded BTC

declines. Additionally, data shows that August and September are

typically weak months for Bitcoin.

Norwegian Sovereign Fund increases indirect exposure to Bitcoin

According to K33 Research Vetle Lunde, the Norwegian Government

Pension Fund, the world’s largest sovereign wealth fund, increased

its indirect exposure to Bitcoin by 62% in the first half of 2024,

reaching 2,446 BTC.

Hut 8 stock rises after HC Wainwright upgrades rating

Shares of Hut 8 (NASDAQ:HUT) are up 2.7% on Wednesday after

broker HC Wainwright upgraded its rating from “sell” to “buy” and

raised the price target from $7.50 to $13.50. The revision is

attributed to reduced electricity costs in Texas, investments in

equipment, and potential growth with AI and HPC clients.

Exodus and Blockchain.com join forces to enhance cryptocurrency

access

Exodus Movement, Inc. has partnered with Blockchain.com to

integrate the Passkeys Wallet into Blockchain.com’s fiat onramp

services. This will allow users to buy cryptocurrencies directly

within the Exodus interface, facilitating transactions in over 50

countries. The collaboration includes advanced security features

like biometric login and Multi-Party Computation (MPC), promising a

more accessible and secure cryptocurrency experience.

Fantom faces potential challenges after 17% surge

Fantom (COIN:FTMUSD) rose 17.3% last week, reaching $0.3755.

However, momentum indicators like RSI and MFI are low, suggesting

potential difficulty in maintaining the gains. The Chaikin Money

Flow also indicates market weakness. Low demand and negative

divergence with the number of daily active addresses suggest an

imminent correction, with the price potentially dropping to

$0.17.

Open Network Ventures launches $40 million fund for TON platform

projects and partners with Pyth Network

Open Network Ventures, a new venture capital firm formed by

former members of the TON Foundation, has launched a $40 million

fund to support early-stage cryptocurrency projects on the TON

platform. The fund will focus on applications utilizing Telegram

and will offer financial and strategic support to selected

projects, leveraging Telegram’s infrastructure and global network

to foster innovation. Additionally, Open Network has partnered with

Pyth Network to integrate real-time, high-fidelity price data into

its decentralized applications. This collaboration aims to

strengthen DeFi projects on TON with accurate and rapid

information, improving the performance and security of

applications. The partnership promises greater engagement with the

TON community. TON Coin (COIN:TONCOINUSD) is up 8.8% in the last 24

hours.

Swell launches swBTC for liquid Bitcoin restaking

Ethereum staking project Swell has launched “swBTC,” a liquid

restaking token that generates yield for Bitcoin holders. Utilizing

wBTC (COIN:WBTCUSD), a 1:1 Bitcoin-backed token on the Ethereum

network, swBTC will allow users to earn yield starting in

mid-September. The initiative aims to leverage Bitcoin’s value

while maximizing yields across different blockchain ecosystems.

Crypto.com returns as UEFA Champions League sponsor

Crypto.com is resuming its push into sports sponsorship after a

hiatus. The company has resumed sponsorship of the UEFA Champions

League nearly two years after abandoning a similar deal. The new

sponsorship will be announced during the UEFA Super Cup between

Real Madrid and Atalanta. Financial details and the duration of the

contract have not been disclosed. Previously, Crypto.com backed out

of a $495 million deal due to regulatory issues.

WazirX ends agreement with Liminal after $235 million hack

Indian exchange WazirX (COIN:WRXUSD) has terminated its custody

contract with Liminal and is moving assets to new multi-signature

wallets following a $235 million hack in July. WazirX stated that

this move is crucial to ensure the security of remaining funds,

despite mutual allegations over the source of the attack. The

company is also restoring balances and collaborating with experts

to resolve the incident.

dYdX introduces permissionless listing and new MegaVault

dYdX (COIN:DYDXUSD) has launched updates to its chain, including

a new feature that allows permissionless token listings, making it

easier to add new markets. Additionally, it introduced MegaVault, a

liquidity pool that will ensure market liquidity and allow users to

earn yields on deposits. These innovations promise to increase

platform efficiency and liquidity.

Coinbase plans to launch tokenized bitcoin product cbBTC

Coinbase (NASDAQ:COIN) announced on X a possible launch of

cbBTC, a tokenized bitcoin product similar to the company’s cbETH.

This new product will allow bitcoin to be used on Ethereum and

Layer 2 networks, serving as a liquidity source. cbBTC will compete

with BitGo’s WBTC, currently the largest tokenized bitcoin.

Additional details have yet to be disclosed, but the launch seems

imminent.

Bitget appoints Hon Ng as chief legal officer

Cryptocurrency exchange Bitget has hired Hon Ng as its new Chief

Legal Officer. With 20 years of experience, Ng will oversee the

company’s global regulatory compliance. Previously at Binance, he

is known for his work in compliance and licensing. Ng will help

Bitget navigate the rapidly evolving regulatory landscape and

expand the company’s presence in the cryptocurrency and Web3

sectors.

MetaMask launches blockchain-based debit card in EU and UK

MetaMask is launching a blockchain-based debit card in

collaboration with Mastercard and Baanx. Initially available as a

digital pilot for select users in the European Union and the United

Kingdom, the card will enable purchases directly with

cryptocurrencies stored in the MetaMask wallet. MetaMask plans to

expand distribution and explore launches in other regions in the

future.

Brazil may launch first Solana ETF before other countries

Brazil is poised to become the first country to list a spot

Solana ETF (COIN:SOLUSD), with approval from the Comissão de

Valores Mobiliários (CVM) on August 7. The ETF awaits final

approval from B3. This innovation could spark global interest,

especially in the U.S., where approval of a Solana ETF remains

uncertain. The success of this fund in Brazil could encourage other

nations to explore similar ETFs, highlighting Brazil’s leadership

in cryptocurrencies.

Hong Kong launches AI sandbox for finance

The Hong Kong Monetary Authority (HKMA) has launched a

generative artificial intelligence (GenA.I.) sandbox in

collaboration with Cyberport. The new environment will allow AI

applications in finance, such as risk management and customer

service, to be tested, aiming to facilitate the adoption of

generative AI and provide regulatory feedback, promoting innovation

in the financial sector.

Circle reveals interest from Harris campaign in cryptocurrency

policies

Circle CEO Jeremy Allaire stated that representatives from

Kamala Harris’s campaign are exploring cryptocurrency policies for

the 2024 elections. In an interview, Allaire highlighted that

crypto is a “purple” issue, with bipartisan interest. He mentioned

a meeting with White House and Harris campaign officials to discuss

the sector. Harris has yet to present a detailed economic platform,

while Donald Trump has already included cryptocurrency in his

agenda.

Bitcoin donations to RFK Jr. are low, but he continues to support

cryptocurrency

Robert F. Kennedy Jr. has raised only $61,000 in Bitcoin

donations since 2023, according to Breadcrumbs data. This amount is

small compared to the campaign’s total $100 million. Kennedy’s

campaign uses complex tracking methods, such as multiple addresses

and the Lightning Network, making transparency difficult. Despite

this, Kennedy is a strong Bitcoin advocate (COIN:BTCUSD) and

promises favorable cryptocurrency policies.

Sahara AI raises $43 million to revolutionize collaborative AI

economy

Sahara AI secured $43 million in funding to create a

decentralized platform that combines artificial intelligence and

blockchain. With support from investors like Pantera Capital and

Binance Labs, the startup aims to ensure a fair collaborative

economy, offering rewards and transparency in AI models and

infrastructure contributions. The promised platform is expected to

launch its testnet and mainnet soon.

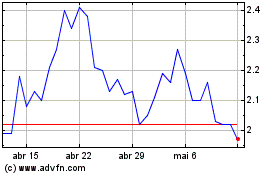

dYdX (COIN:DYDXUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

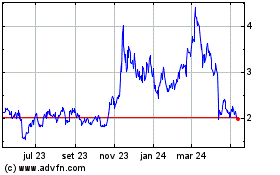

dYdX (COIN:DYDXUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024