Bitcoin ETFs reach $2.1 billion in weekly inflows, with IBIT

leading

Last Friday, Bitcoin ETFs saw their fifth consecutive day of

inflows, with net entries reaching $273.71 million, totaling

approximately $2.1 billion for the week. ARK 21Shares (AMEX:ARKB)

led with $109.86 million, followed by BlackRock’s iShares

(NASDAQ:IBIT) with $70.41 million.

Of the $2.1 billion total, IBIT alone attracted over $1.1

billion in inflows last week, marking its best performance since

March 2024. This allowed IBIT to surpass the Vanguard Total Stock

Market ETF (AMEX:VTI), securing the third spot in cumulative

year-to-date flows. With $22.8 billion under management, IBIT is

considered one of the largest ETFs, reflecting investors’ growing

interest in Bitcoin through traditional investment vehicles.

According to Bloomberg analyst Eric Balchunas, European

investors have allocated more than $105 billion into Bitcoin ETFs

in the U.S. by October, a historic record. He highlighted that this

significant flow was driven by the superior performance of U.S.

ETFs compared to their European counterparts. Capital inflows

accounted for 75% of the momentum that helped Bitcoin surpass

$50,000 in February 2024, though the price remains below

$70,000.

Ethereum ETFs closed with a modest $1.91 million in net inflows

from the Bitwise Ethereum ETF (AMEX:ETHW). Ethereum ETFs marked

their third consecutive positive week, accumulating $78.89 million

in weekly inflows.

Hunter Horsley, CEO of Bitwise, stated that Ethereum ETFs saw

lower volumes due to their launch timing, which occurred during a

period of low investment activity. While Bitcoin ETFs attracted

more attention, Horsley emphasized that BlackRock (NASDAQ:ETHA) and

Fidelity (AMEX:FETH) funds remain among the 25 fastest-growing

ETFs. He also mentioned that the absence of staking in Ethereum

ETFs does not significantly impact results, but he sees future

growth potential.

Bitcoin dips after hitting $69K high, traders see support at $66K

Bitcoin (COIN:BTCUSD) reached an intraday high of $69,431 near

the Asian market open before dipping 1.6% to $67,410 at the time of

publication. This followed the asset’s largest weekly close in five

months. Traders like Jelle and Emperor suggest BTC may test support

between $66,000 and $63,300, with possible deeper pullbacks.

According to Keith Alan, BTC needs to close above $69,000 to

challenge all-time highs.

QCP Capital indicates that macroeconomic factors from Japan and

China are expected to benefit risk assets like Bitcoin. Traders are

also focused on the U.S. election in two weeks, with Donald Trump,

a crypto advocate, leading on the Polymarket prediction

platform.

Sui launches blockchain hub in Dubai to incubate developers and

quick solutions

Sui Network (COIN:SUIUSD), developed by Mysten Labs, opened a

center in Dubai aimed at incubating blockchain developers and

entrepreneurs. Sui co-founder Kostas Chalkias compared the

initiative to leading an army of engineers, aiming to create quick

solutions for governmental issues through smart contracts. The hub,

in collaboration with Ghaf Group, is the first in a global series

and seeks to make Dubai a center for hackathons and blockchain

innovation. Dubai has attracted the Web3 community with clear and

accessible regulations.

DYDX rises 32%, but profit-taking could lead to correction

DYDX (COIN:DYDXUSD) surged 32% on Sunday, driven by the hype of

dYdX Day in Dubai. However, investors began taking profits, marking

the first peak in seven months. Given the Relative Strength Index

(RSI) indicating overbought conditions, the token may face further

pressure. If support at $1.16 is breached, the altcoin could face a

larger correction, undoing recent gains.

ApeCoin surges over 100% with the launch of ApeChain

ApeCoin (COIN:APEUSD) is gaining investor attention with a

weekly rise of 103.1%, driven by the launch of the ApeChain

blockchain network on October 20. The token rose from $0.861 to a

high of $1.74 before correcting to $1.54 at the time of

publication. Integration with the LayerZero protocol and increased

demand for tokens within the Yuga Labs ecosystem bolstered trading

volume, though the Relative Strength Index suggests a potential

correction.

SOL could skyrocket based on bullish technical pattern

Analyst Peter Brandt identified a “cup and handle” pattern on

the weekly chart of Solana (COIN:SOLUSD), suggesting that the price

could surge by over 2,000%. This technical pattern indicates a

potential breakout above the $205 resistance, with a price

projection around $4,500 by 2025-2026. However, despite the

optimistic setup, studies show that only 61% of cup-and-handle

patterns reach their expected targets.

AI scam targets XRP holders with fake Chris Larsen video

A new AI scam is circulating on YouTube, featuring a fake video

of Ripple co-founder Chris Larsen. In the video, Larsen claims that

Ripple will return 150 million XRP (COIN:XRPUSD), encouraging

holders to visit a website to double their assets. The unlisted

YouTube video is shared via email, directing users to send funds to

a scam address. This fraud is similar to past scams involving Elon

Musk.

18 people arrested in Japan over Monero scam

Japanese police arrested 18 individuals, including Yuta

Kobayashi, the leader of a fraudulent scheme involving Monero

(COIN:XMRUSD). The arrests, made on October 21, followed an

investigation into 900 fraudulent transactions that caused

approximately $667,216 in losses. This is the first case in Japan

where Monero was tracked to identify and dismantle a criminal

network, despite its strong privacy features.

Coinbase CEO supports pro-crypto candidates in U.S. elections

Brian Armstrong, co-founder and CEO of Coinbase Global

(NASDAQ:COIN), expressed support for pro-crypto Republican

candidates in the upcoming November elections. On October 20,

Armstrong highlighted John Deaton and David McCormick, both running

for Senate. Armstrong criticized Senator Elizabeth Warren’s

anti-crypto stance and praised McCormick as the “best crypto

candidate” in Pennsylvania. While endorsing these candidates,

Armstrong did not endorse a presidential candidate but reaffirmed

Coinbase’s focus on crypto-friendly policies.

Stripe acquires Bridge for $1.1 billion in its largest purchase

Stripe, the payments processing giant, acquired the stablecoin

platform Bridge for $1.1 billion, according to TechCrunch. The

deal, Stripe’s largest acquisition to date, has not yet been

officially commented on by the companies. Founded by former

Coinbase executives, Bridge facilitates stablecoin payments and

raised $58 million in funding this year. The acquisition follows

Stripe’s integration of the USD Coin (COIN:USDCUSD) stablecoin into

its platform, expanding its support for digital payments.

Bitcoin mining deal failure in Kentucky results in legal dispute

In eastern Kentucky, Mohawk Energy, co-founded by Senator

Brandon Smith, reached an agreement with HBTPower to operate a

Bitcoin mining facility. According to Wired.com, after promising

hopes of revitalizing the region, the relationship soured when the

warehouse was never activated. HBT filed a lawsuit alleging

contract breach by Mohawk, while the company countersued for unpaid

rent and fees. The project now faces uncertainties, with the

potential failure of an initiative that promised jobs and local

development.

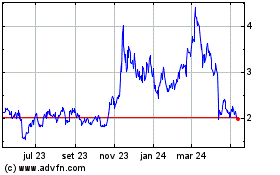

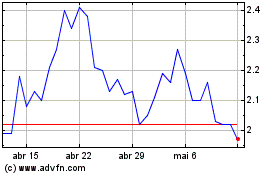

dYdX (COIN:DYDXUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

dYdX (COIN:DYDXUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024