Bitcoin ETFs in the US register largest inflow in four months

On October 14, US Bitcoin ETFs received $555.9 million, the

largest daily inflow since June. The Fidelity Wise Bitcoin Origin

Fund (AMEX:FBTC) led with $239.3 million, followed by Bitwise

(AMEX:BITB) with just over $100 million, and BlackRock’s iShares

Bitcoin Trust (NASDAQ:IBIT) with $79.6 million. Bitcoin ETFs have

seen nearly $20 billion in inflows over the past 10 months, while

gold ETFs recorded only $1.4 billion during the same period.

Canary Capital moves forward with Litecoin ETF, its second crypto

fund

Canary Capital Group, recently founded by Steven McClurg, is

aiming to lead the crypto ETF sector. After filing for an XRP

(COIN:XRP) ETF, the firm submitted a new request for the Canary

Litecoin ETF, the first fund linked to Litecoin (COIN:LTCUSD). The

registration process doesn’t yet include details about the

management fee or ticker. Litecoin rose after the announcement,

reaching a daily high of $71.94, currently trading at $68.71.

PancakeSwapX facilitates adoption by eliminating gas fees

PancakeSwap (COIN:CAKEUSD) launched PancakeSwapX, a new product

enabling fee-free transfers and gasless swaps on Ethereum and

Arbitrum networks. This innovation simplifies DeFi trading by

removing the need for gas tokens like Ether (COIN:ETHUSD).

According to Chef Kids, the leader of PancakeSwap, PancakeSwapX

reduces complexity for new users and improves execution prices,

driving broader DeFi adoption without relying on centralized

platforms. This could boost decentralized finance growth.

Bitcoin nearly reaches 68K before a new drop amid volatility

Bitcoin (COIN:BTCUSD) reached $67,944.76 for the first time in

two months but quickly pulled back, currently trading at $66,904.

Volatility returned due to market and political factors in the US,

with resistance at $68,000. The rally brought Bitcoin closer to the

psychological level of $70,000.

According to Chris Newhouse from Cumberland Labs, a combination

of short squeezes and speculation pushed the price higher, while

the Fear and Greed Index indicated 2024 as the most greedy year.

Increased interest in futures also reflected greater institutional

exposure, resembling price movements from last October. Although

retail demand remained low, a 3% increase in new investor purchases

and growing open interest suggests optimism despite upcoming

volatility.

Traders limit expectations for Ether while Bitcoin gains spotlight

While Bitcoin is attracting optimistic predictions, traders are

more cautious about Ether. According to Derive, the volume of sold

calls on Ether is 2.5 times higher than bought calls, signaling

skepticism about ETH’s (COIN:ETHUSD) upside potential. This

divergence between the two cryptos will be crucial as the US

election approaches, with significant bets on Bitcoin at levels of

$75,000 and $100,000.

Standard Chartered predicts Bitcoin above $73K before US election

Standard Chartered projects Bitcoin (COIN:BTCUSD) could surpass

$73,000 by November, driven by strong ETF inflows and rising call

options. Geoffrey Kendrick, head of digital assets at StanChart,

highlights that traders are positioning for a possible rally, with

significant interest in $80,000 call options. The US presidential

election may also benefit Bitcoin, particularly with a potential

Trump victory, which could result in more favorable regulations for

digital assets.

dYdX launches perpetual market for Trump election prediction

dYdX (COIN:DYDXUSD) launched the Trump Prediction Market

Perpetuals, allowing traders to leverage positions on Donald

Trump’s chances of winning the 2024 election. After community

approval, the decentralized market enables non-custodial trading

with perpetual contracts that can be held indefinitely. Traders can

adjust positions using leverage and advanced orders like stop-loss

and take-profit to mitigate risks in a volatile political

environment.

Cryptocurrencies mature in 2024 with billions in ETFs

According to a report by Coinbase and Glassnode, the

cryptocurrency market matured significantly in 2024, with billions

of dollars flowing into spot cryptocurrency ETFs and an increase in

transaction volumes across blockchain networks. Stablecoins and

Layer 2 solutions fueled this growth, while Bitcoin volatility

dropped to under 60%. The adoption of stablecoins and Ethereum’s

expansion reflected the growing crypto economy.

Sui Foundation denies insider token sale allegations

The Sui Foundation denied insider trading allegations following

the sale of $400 million in SUI tokens (COIN:SUIUSD). Community

members, including Kyle Samani, raised concerns. On October 14, the

foundation stated that no insider violated lock-up agreements, and

the token release schedule remains intact.

Ripple announces exchange partners for RLUSD stablecoin

Ripple revealed partnerships with exchanges like Uphold,

Bitstamp, and Bitso to distribute its new stablecoin, Ripple USD

(RLUSD). Brad Garlinghouse, Ripple’s CEO, highlighted that RLUSD

will be used in financial cases like payments and asset

tokenization, in addition to facilitating international

transactions. Issued under strict regulatory oversight, the

stablecoin will be backed by dollar reserves and undergo

third-party audits to ensure transparency and compliance. Ripple

aims to establish RLUSD as the standard for enterprise

stablecoins.

Paxos and Stripe team up to integrate stablecoin payments

Paxos launched a new stablecoin payment platform, targeting

payment service providers and fintechs to accelerate global

transactions. Stripe, a payments processing giant, was the first to

adopt this infrastructure, allowing users to accept stablecoin

payments converted into fiat currencies. The platform, supporting

USDP (COIN:USDPUSD), PYUSD (COIN:PYUSDUSD), and USDC

(COIN:USDCUSD), promises to reduce costs and improve global payment

efficiency, initially operating in the US with plans for

expansion.

Scammers exploit Unichain launch with fake website

Scammers created a fake Unichain website, Uniswap’s Layer 2

network, promoted through Google ads. The site tricked users into

connecting their Web3 wallets and attempted to steal

cryptocurrencies. Although quickly taken down, the scam highlighted

the risks of clicking on sponsored ads and the importance of

inspecting transactions. Uniswap Labs announced the Unichain

testnet, with the mainnet expected by the end of the year.

Blockstream raises $210 million to expand Bitcoin infrastructure

Blockstream secured $210 million in funding through a

convertible note round led by Fulgur Ventures. The capital will be

used to expand Bitcoin infrastructure projects such as the Liquid

Network, mining operations, and financial products. The Liquid

Network has already issued over $1.8 billion in assets, including

stablecoins and tokenized bonds, strengthening the company’s

presence in Layer 2 solutions and faster transactions.

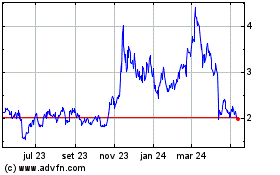

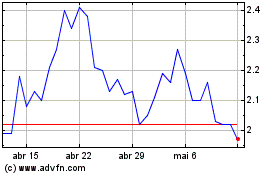

dYdX (COIN:DYDXUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

dYdX (COIN:DYDXUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024