HSBC Holdings (NYSE:HSBC) – HSBC is undergoing

a major restructuring under new CEO Georges Elhedery, focusing on

cost-cutting and simplification. The merger of commercial and

institutional banking operations will be overseen by Michael

Roberts. Additionally, Pam Kaur has been appointed as the bank’s

first female CFO, while regional changes create new autonomous

units in the UK and Hong Kong. Shares rose 0.1% in pre-market after

closing down 1.2% on Monday.

Meta Platforms (NASDAQ:META) – Meta is

re-testing facial recognition three years after deactivating it to

combat “celebrity bait” scams. The test involves public figures,

comparing profile photos with images used in fraudulent ads. If a

match is found, Meta will block the ads. Celebrities will be

notified and can opt out of the program if they do not want to

participate. Shares fell 0.2% in pre-market after closing down 0.2%

on Monday.

Nebius Group NV (NASDAQ:NBIS) – Nebius Group

surged in its first trading session since February 2022 after a

long suspension due to the Ukraine invasion. Originally part of

Yandex, the company was spun off in July after a $5.4 billion deal.

Nebius now focuses on providing cloud services for AI and Nvidia

GPUs, targeting the AI infrastructure market. The company projects

its revenue to increase three to four times by 2025, reaching

between $500 million and $700 million, with significant investments

in data centers in Finland, France, and North America. Shares fell

3.0% in pre-market.

Microsoft (NASDAQ:MSFT) – Microsoft is

launching AI tools that automate business tasks like sending emails

and managing records, intensifying competition with rivals like

Salesforce. Ten “autonomous agents” will be available starting in

December. These tools, integrated into Dynamics 365, will enable

companies to automate repetitive tasks without human intervention.

Shares fell 0.1% in pre-market after closing up 0.2% on Monday.

Qualcomm (NASDAQ:QCOM) – Qualcomm is

integrating technology developed for its laptop chips into its

mobile chips, aiming to improve performance in generative AI tasks.

The new chip, Snapdragon 8 Elite, includes the “Oryon” suite and

special tools for developers. Samsung, Asus, and Xiaomi will adopt

this technology. Shares fell 0.3% in pre-market after closing down

1.1% on Monday.

Nvidia (NASDAQ:NVDA) – Nvidia shares surged on

Monday, reaching a market capitalization of $3.525 trillion,

joining the exclusive group of companies with a value above $3.5

trillion alongside Apple. The closing price of $143.71 marked a

4.1% gain, solidifying its position in the chip sector. Shares fell

0.6% in pre-market.

Texas Instruments (NASDAQ:TXN) – Weakness in

Texas Instruments’ key markets may lead to an underwhelming

forecast for investors. Analysts expect revenue of $4.12 billion

and adjusted earnings per share of $1.38 for the September quarter.

Demand in the automotive and industrial sectors remains weak, but a

recovery is expected next year. Shares fell 0.3% in pre-market

after closing down 1.4% on Monday.

Amazon (NASDAQ:AMZN) – Amazon’s ambitious

Project Kuiper, which aims to launch 3,236 broadband satellites, is

gaining attention ahead of its main mission in 2024. However, Bank

of America analysts warn that it may take years to impact the

company’s stock value due to high costs and competition. Shares

fell 0.3% in pre-market after closing flat on Monday.

Honeywell (NASDAQ:HON),

Alphabet (NASDAQ:GOOGL) – Honeywell has partnered

with Google to integrate advanced AI into its industrial data.

Using Google’s Gemini technology, the collaboration aims to

automate tasks and optimize operations, particularly in sectors

with labor shortages. The first AI solutions will be launched in

2025, aiming to boost efficiency and reduce costs. Alphabet shares

fell 0.1% in pre-market after closing up 0.4% on Monday.

Boeing (NYSE:BA) – Boeing has proposed a new

contract to end a strike that has lasted over a month. The offer

includes a 35% pay increase, a $7,000 bonus, and improved

retirement plans. However, workers have expressed dissatisfaction,

and approval remains uncertain. Shares rose 0.4% in pre-market

after closing up 3.1% on Monday.

Azul SA (NYSE:AZUL) – Azul’s efforts to raise

$400 million in new debt have faced challenges, with Jefferies

Financial Group struggling to attract investors to sell convertible

capital debt. Azul needs this financing to meet an agreement with

lessors and suppliers to reduce its debt by R$3 billion.

United Parcel Service (NYSE:UPS) – UPS received

a rare sell recommendation from Barclays on Monday, citing concerns

over declining profits due to lower demand for deliveries and a

potential reduction in business with Amazon. The analyst also

highlighted growing competition from FedEx, which could further

pressure UPS’s performance. Shares fell 3.4% on Monday.

Hasbro (NASDAQ:HAS), Mattel

(NASDAQ:MAT) – As the US presidential race heats up, companies and

economists are concerned about the impact of new tariffs if Donald

Trump returns to office. However, UBS analyst Arpine Kocharyan

stated that Hasbro and Mattel are less exposed to tariff risks due

to their lower reliance on China compared to other companies.

Mattel closed down 3.4% on Monday, while Hasbro fell 1.4%.

Nike (NYSE:NKE) – Nike renewed its partnership

with the NBA and WNBA for another 12 years, making it the exclusive

provider of uniforms and apparel until 2037. The previous $1

billion deal was significantly expanded, keeping Nike as the

primary merchandising and content partner. Shares rose 0.3% in

pre-market after closing down 1.7% on Monday.

Cheesecake Factory (NASDAQ:CAKE) – Activist

investor JCP Investment Management, with a 2% stake in Cheesecake

Factory, suggested that the company consider creating a new public

company by spinning off its smaller brands, such as North Italia,

Flower Child, and Culinary Dropout.

Unilever (NYSE:UL) – Former Unilever CEO Paul

Polman, along with the Rockefeller Foundation and other advocates,

is pushing major food companies to produce and market healthier

products. The campaign aims to combat junk food dependency and

promote more sustainable practices, with support from investors

focused on a healthier and more equitable future. Shares fell 0.3%

in pre-market after closing down 1.0% on Monday.

RH Inc. (NYSE:RH) – RH Inc. overpriced its

luxury goods but is recovering thanks to new products and stores.

Wedbush upgraded the company to outperform, with projected sales

growth despite a tough housing market. The target price was raised

to $430. Shares closed down 2.2% on Monday.

Walt Disney (NYSE:DIS) – Disney announced plans

to name a successor for CEO Bob Iger by early 2026, marking

progress in its leadership succession. Former Morgan Stanley CEO

James Gorman will become board chairman on January 2, 2025, while

Iger will remain until 2026. Shares fell 0.2% in pre-market after

closing down 0.7% on Monday.

Tesla (NASDAQ:TSLA), Warner Bros

Discovery (NASDAQ:WBD) – Alcon Entertainment sued Tesla

and Warner Bros, alleging misuse of images from “Blade Runner 2049”

to promote Tesla’s cyber cab. The studio claims copyright

infringement and “false endorsement,” arguing that Tesla used

AI-generated images even after Alcon denied Warner Bros’ request.

Tesla shares fell 0.7% in pre-market, while Warner shares rose

0.4%.

Lucid Group (NASDAQ:LCID) – Lucid CEO Peter

Rawlinson said the recent stock sale, which raised nearly $1.75

billion, will ensure liquidity until 2026. The company plans to

launch the Gravity SUV and expand factories in the US and Saudi

Arabia. It expects to increase deliveries by 50% in 2024 compared

to 2023. Shares rose 3.9% in pre-market after closing down 3.0% on

Monday.

Schlumberger (NYSE:SLB) – Dozens of US

lawmakers from both parties have called on the Biden administration

to toughen sanctions on Russian oil and questioned the exemption

given to SLB, the largest oilfield services company, which

continues to operate in Russia. They argue this helps fund Putin’s

war against Ukraine.

KKR and Company (NYSE:KKR), Bain

Capital (NYSE:BCSF) – Fuji Soft’s largest shareholder

confirmed support for KKR’s acquisition offer, preferring it over

Bain Capital’s higher bid. KKR has secured commitments from major

shareholders, controlling nearly a third of the company,

potentially blocking Bain’s offer. 3D Investment Partners expressed

confidence in KKR.

BlackRock (NYSE:BLK) – BlackRock CEO Larry Fink

said the growth of private markets could reduce the economic impact

of large deficits and high US government debt. He emphasized that

while rising public debt is a concern, private capital markets can

drive economic growth without increasing the deficit.

Blackstone (NYSE:BX), Apollo Global

Management (NYSE:APO) – Blackstone increased its

investment-grade private credit portfolio by 40%, while Apollo

manages $275 billion in high-quality credit. According to

Bloomberg, asset managers who previously financed struggling

companies are now seeking loans for highly rated firms. Both are

competing with banks by offering direct financing solutions to

large companies, backed by insurers seeking higher returns on safe

assets.

WisdomTree Inc. (NYSE:WT) – WisdomTree Asset

Management, a subsidiary of WisdomTree Inc., agreed to pay $4

million to settle SEC charges that it misleadingly marketed three

funds as ESG. The SEC found that the funds invested in fossil fuels

and tobacco, contrary to claims. Shares rose 3.7% in pre-market

after closing down 0.2% on Monday.

Moody’s (NYSE:MCO) – Moody’s adjusted its

outlook for the US banking system from negative to stable, citing

expectations that interest rate cuts and moderate economic growth

will stabilize banks’ asset quality and boost profitability,

promoting a more positive sector outlook.

CVS Health (NYSE:CVS) – David Joyner has taken

over as CEO of CVS Health following Karen Lynch’s departure, facing

questions about his experience in reviving Aetna, which is dealing

with high medical costs. The appointment comes amid investor

pressure as the company reviews its strategy, including asset sales

and pharmacy closures.

Catalent (NYSE:CTLT) – Catalent CEO Alessandro

Maselli stated that he will continue leading the company after its

$16.5 billion acquisition by Novo Holdings, despite concerns about

potential threats to competition in weight-loss drugs. He assured

that Catalent will continue to operate independently and protect

customer information.

Eli Lilly (NYSE:LLY) – Eli Lilly sued three

medical spas and online sellers for marketing products containing

tirzepatide, an ingredient in its Zepbound drug. The companies

Pivotal Peptides, MangoRx, and Genesis Lifestyle Medicine were

accused of selling unauthorized versions without proof of safety.

Lilly is seeking injunctions to stop the sales and monetary

damages.

Earnings

SAP (NYSE:SAP) – The enterprise software

company exceeded expectations in Q3, reporting adjusted earnings of

€1.23 per share, above the €1.06 expected, with revenue of €8.47

billion, slightly below the €8.63 billion estimate. Cloud revenue

grew 25% to €4.35 billion, and operating profit grew 28%, beating

expectations. AI played a key role, with 30% of contracts involving

AI. The company raised its 2024 profit forecast to between €7.8

billion and €8.0 billion. Shares rose 4.6% in pre-market after

closing down 0.4% on Monday.

Logitech (NASDAQ:LOGI) – The tech peripherals

maker raised its full-year forecast after a strong Q2, with

non-GAAP operating income of $193 million, beating the $176 million

estimate. Revenue grew 6% to $1.12 billion, surpassing the $1.10

billion forecast. The company now expects sales between $4.39

billion and $4.47 billion, driven by increasing demand. However,

shares fell 7.3% in pre-market after closing up 3.6% on Monday.

AGNC Investment Corp (NASDAQ:AGNC) – The real

estate investment firm reported earnings per share of $0.63 in Q3

2024, beating the $0.51 estimate but with revenue of $376 million,

well below the $707.77 million expectation. The company generated a

9.3% economic return and increased tangible net book value per

share to $8.82, a 5% growth from the previous quarter. Shares fell

0.2% in pre-market after closing down 2.1% on Monday.

RLI Corp (NYSE:RLI) – The niche-focused insurer

reported net income of $95.0 million, or $2.06 per share, in Q3

2024, a sharp increase from $13.5 million or $0.29 per share the

prior year. Revenue was $469.99 million, surpassing the $389.49

million estimate. Operating profit more than doubled to $60.4

million. Shares rose 2.5% in pre-market after closing down 0.6% on

Monday.

Nucor (NYSE:NUE) – The steel and products

company reported earnings per share of $1.49 in Q3, below the $1.52

estimate, while revenue reached $7.44 billion, exceeding the $7.29

billion forecast. For Q4 2024, the company expects lower earnings

due to declining selling prices and volumes in the steel mill

segment.

WR Berkley (NYSE:WRB) – The commercial

risk-focused insurer reported diluted earnings per share of $0.91

in Q3 2024, below the $0.97 estimate. Total revenue was $3.4

billion, with net written premiums of $3.06 billion, up from $2.85

billion the previous year. Investment income rose 19.5%, reaching

$323.8 million. The company posted record net income of $366

million, surpassing the $333.6 million from the prior year. Return

on equity was 19.6%, while operating cash flow reached $1.2

billion.

BOK Financial (NASDAQ:BOKF) – The regional bank

reported net income of $140 million in Q3 2024, with earnings per

share of $2.18, down from $163.7 million and $2.54 per share the

prior quarter. Net interest income increased to $308.1 million, and

total revenue was $510.6 million, in line with analyst

estimates.

Zions Bancorporation (NASDAQ:ZION) – The

regional financial services bank reported net income of $204

million in Q3 2024, with earnings per share of $1.37, beating the

$1.18 estimate. This represented a 21% increase compared to the

same quarter last year. Net interest margin rose to 3.03%, while

operating costs increased by 1%.

Washington Trust Bancorp (NASDAQ:WASH) – The

community bank reported net income of $11.0 million in Q3 2024,

with earnings per share of $0.64, slightly above the $0.63 from the

prior quarter. Net interest margin rose to 1.85%, and assets under

management grew 4% to $7.1 billion. Deposits increased by 3%, while

loans fell by 2%.

TFI International (NYSE:TFII) – The

transportation and logistics company reported adjusted earnings per

share of $1.60 in Q3 2024, below the $1.78 estimate. Revenue was

$2.19 billion, falling short of the $2.27 billion forecast but up

14.3% year-over-year. Operating income rose to $203.3 million,

while net income fell to $128 million.

Hexcel (NYSE:HXL) – The composite materials

manufacturer reported adjusted earnings of $0.47 per share on

revenue of $456.5 million in Q3, slightly below the $457.1 million

estimate from FactSet analysts. Furthermore, Hexcel’s revised

annual outlook for earnings and revenue fell below Wall Street

expectations.

Alexandria Real Estate (NYSE:ARE) – The real

estate investment trust reported Q3 revenue of $791.6 million and

adjusted operating funds of $2.37 per share, surpassing the $713.8

million in revenue and $2.26 per share from the same period last

year.

InterContinental Hotels Group (NYSE:IHG) – The

global hotel and resort chain reported a 1.5% increase in lodging

revenue in Q3 2024, driven by a 4.9% rise in revenue per available

room (RevPAR) in the EMEAA region. However, RevPAR declined by

10.3% in China. The company expects to meet market expectations for

the year, with a projected RevPAR growth of 2.6% for 2024.

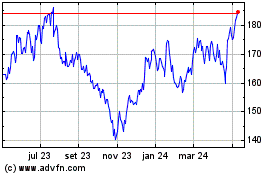

Texas Instruments (NASDAQ:TXN)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

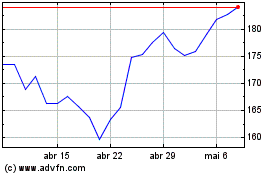

Texas Instruments (NASDAQ:TXN)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024