McDonald’s (NYSE:MCD) – A U.S. investigation

into an E. coli outbreak focuses on McDonald’s Quarter Pounder

hamburgers. The company has suspended the use of fresh onions and

beef patties in certain states. Health authorities are working to

identify the contaminated ingredient.

Arm Holdings (NASDAQ:ARM),

Qualcomm (NASDAQ:QCOM) – Arm canceled its

licensing agreement with Qualcomm, which allowed the use of its

intellectual property to design chips. The decision comes amid a

legal battle, with a 60-day notice. Qualcomm disputes the

cancellation and expects it to impact future laptop shipments.

Arm’s shares fell 1.1%, while Qualcomm’s dropped 5.3% in pre-market

trading.

Apple (NASDAQ:AAPL) – Apple’s CEO, Tim Cook,

met with China’s Minister of Industry, Jin Zhuanglong, during his

visit to Beijing. Jin encouraged Apple to expand its presence in

China, increase investments in innovation, and collaborate with

Chinese companies. Apple recently launched its new iPhones in

China, facing tough competition from Huawei. Investors should also

watch Verizon’s earnings report, which revealed a 3.0% postpaid

plan renewal rate, down from 3.4% last year, hinting at a softer

start for the iPhone’s new cycle. Shares fell 0.3% in pre-market

trading.

Meta Platforms (NASDAQ:META) – Meta’s CEO, Mark

Zuckerberg, successfully had a lawsuit dismissed that accused the

company of misleading shareholders about child safety on Facebook

and Instagram. Judge Charles Breyer ruled that the plaintiff, Matt

Eisner, failed to prove economic losses and that Meta wasn’t

obligated to disclose specific child safety issues. Shares fell

0.1% in pre-market trading.

Netflix (NASDAQ:NFLX) – Netflix shares have

surged over 50% this year, and co-founder Reed Hastings has sold

nearly $200 million worth of stock through an automated trading

plan. Hastings still holds over 2.2 million shares to sell through

2033, valued at about $1.74 billion.

Qualcomm (NASDAQ:QCOM) – Qualcomm’s CEO,

Cristiano Amon, projected that within five years, all smartphones

would feature integrated artificial intelligence capabilities. He

emphasized that Qualcomm is leading innovation with its faster and

more efficient Snapdragon processors, preparing mobile devices to

run advanced AI features and laptop-level applications.

Alphabet (NASDAQ:GOOGL),

Qualcomm (NASDAQ:QCOM) – Qualcomm announced a

partnership with Alphabet to combine chips and software to help

automakers develop custom AI voice assistants. This collaboration

involves the Android Automotive OS running on Qualcomm chips,

offering built-in voice assistants for vehicles without relying on

drivers’ phones. Alphabet’s shares fell 0.2% in pre-market

trading.

Taiwan Semiconductor Manufacturing Co

(NYSE:TSM) – TSMC notified the U.S. after TechInsights found a chip

made by TSMC in a Huawei product, suggesting potential violations

of U.S. sanctions against the Chinese company. While TSMC claims it

hasn’t supplied chips to Huawei since 2020, the discovery raises

questions about export restrictions. Shares fell 0.8% in pre-market

trading.

Walmart (NYSE:WMT) – Walmart agreed to pay $7.5

million to settle claims of illegally disposing of hazardous and

medical waste in California’s municipal landfills from 2015 to

2021. Without admitting fault, the company will pay a fine and hire

an independent auditor to monitor and improve waste management in

its facilities. Shares fell 0.2% in pre-market trading.

Abercrombie & Fitch (NYSE:AFN) – Former

Abercrombie & Fitch CEO Mike Jeffries has been accused of

running a sex trafficking ring, coercing young men into sexual acts

with promises of modeling careers. Jeffries, his partner, and

another man face charges of sex trafficking and interstate

prostitution. According to Bloomberg, they could face a maximum

sentence of life imprisonment or a minimum of 15 years if

convicted. Shares closed down 3.2% on Tuesday.

Spirit Airlines (NYSE:SAVE), Frontier

Airlines (NASDAQ:ULCC) – Frontier Airlines is considering

a new bid to acquire Spirit Airlines, with discussions at an early

stage, according to The Wall Street Journal. A deal could occur if

Spirit faces bankruptcy as part of a debt restructuring. In 2022,

Spirit nearly merged with Frontier, but JetBlue won the bidding

war. Spirit’s shares rose 15.6% in pre-market trading, while

Frontier’s fell 0.1%.

Latam Airlines Group SA (NYSE:LTM) – Latam sees

growth opportunities in South America, leveraging its strengthened

financial position. The company plans to increase capacity by up to

16% in 2024 and expects moderate growth in the following years.

Latam also refinanced part of its debt and recently returned to the

New York Stock Exchange.

Bank of America (NYSE:BAC) – Bank of America’s

CEO, Brian Moynihan, advised the Federal Reserve to be cautious

with the pace of interest rate cuts, stating that they “were late”

in raising rates in 2022. He predicts more gradual reductions until

2025, with inflation falling to 2.3%. Moynihan highlighted that a

terminal rate of 3% would be a positive change for the U.S.

economic environment. Shares fell 0.1% in pre-market trading.

HSBC Holdings (NYSE:HSBC) – HSBC’s new CEO,

Georges Elhedery, implemented a major restructuring at the company

but left many important details vague, such as potential job cuts

and the value of the cost savings. Employees and investors remain

uncertain about their roles in the new structure and the financial

impact of the changes. Shares fell 0.7% in pre-market trading.

Blackstone (NYSE:BX) – Blackstone’s CEO, Steve

Schwarzman, stated that the U.S. is likely to avoid a recession

regardless of who wins the presidential election, due to economic

growth-focused policy proposals. He noted that both Democrats and

Republicans are proposing stimulus policies, with the real impact

depending on what is implemented. Additionally, Blackstone said the

private credit sector is in the early stages of expansion, driven

by investment-grade assets. The $30 trillion investment-grade loan

market has significant potential. Blackstone’s credit arm has

grown, attracting investors seeking higher returns.

Earnings

Texas Instruments (NASDAQ:TXN) – Texas

Instruments exceeded third-quarter earnings expectations due to

recovering demand for analog chips, especially in the Chinese

automotive market and smartphone and PC orders. The company

reported earnings per share of $1.47 in Q3 2024, surpassing the

estimate of $1.38. Revenue was $4.15 billion, above the expected

$4.12 billion. However, revenue guidance for the next quarter,

between $3.7 billion and $4 billion, fell short of the expected

$4.06 billion, projecting weakness in the industrial segment.

Shares rose 4.1% in pre-market trading.

Starbucks (NASDAQ:SBUX) – Starbucks suspended

its annual forecast after reporting preliminary results showing a

7% drop in same-store sales in the U.S. and a 14% drop in China.

Net sales fell 3%, reaching $9.1 billion. Earnings per share were

$0.80, below the $1.03 expected by analysts. Shares fell 6% in

pre-market trading.

Tesla (NASDAQ:TSLA) – Tesla is set to release

its earnings report after the market closes. Wall Street expects

adjusted earnings of 60 cents per share in the third quarter, with

revenue of $25.47 billion. Operating margin is expected to rise to

around 8%. Shares fell 0.7% in pre-market trading.

Enphase Energy (NASDAQ:ENPH) – Enphase Energy

reported revenue of $380.9 million for the third quarter of 2024,

below the estimate of $391.98 million. GAAP net income was $45.8

million, and diluted earnings per share were $0.33, falling short

of the expected $0.38. Gross margin was 46.8%, and free cash flow

reached $161.6 million, with $1.77 billion in cash. Revenue

guidance for the next quarter fell below analyst expectations,

ranging from $360 million to $400 million. Shares fell 12.8% in

pre-market trading.

Seagate Technology (NASDAQ:STX) – Seagate

reported revenue of $2.17 billion in the first quarter of fiscal

2025, surpassing the estimate of $2.12 billion. GAAP earnings per

share were $1.41, reversing last year’s loss, with net income of

$305 million. Gross margin increased to 32.9%. Free cash flow was

$27 million, and the dividend increased by 3% to $0.72 per share.

Shares fell 4.6% in pre-market trading.

Baker Hughes (NASDAQ:BKR) – Baker Hughes

reported revenue of $6.9 billion, below the estimate of $7.2

billion. However, diluted GAAP earnings per share were $0.77, a 51%

increase from last year, while net income reached $766 million, up

48%. Free cash flow was $754 million, and adjusted EBITDA reached

$1.208 billion, a 23% YoY increase. Growth was driven by

international demand for drilling equipment and LNG projects,

offsetting declines in North America.

Canadian National Railway (NYSE:CNI) – Canadian

National Railway reported sales of CAD 4.11 billion in the third

quarter of 2024, compared to CAD 3.99 billion last year. Net income

was CAD 1.085 billion, slightly below CAD 1.108 billion from the

prior year. Diluted earnings per share were CAD 1.72, compared to

CAD 1.69 in the same period last year.

Volaris (NYSE:VLRS) – Volaris reported net

income of $37 million in Q3 2024, reversing last year’s $39 million

loss. Total operating revenue was $813 million, a 4% decline.

EBITDAR rose 52% to $315 million, with a 38.7% margin, while TRASM

increased by 12% to $9.38 cents, despite capacity reductions due to

engine inspections.

Nabors Industries (NYSE:NBR) – Nabors

Industries reported revenue of $743.31 million in Q3, slightly

below last year’s $744.14 million. Net loss was $55.83 million,

higher than last year’s $48.92 million. Diluted loss per share

increased to $6.86, compared to $6.26 in the same quarter last

year.

Lloyds Banking Group (NYSE:LYG) – Lloyds

Banking Group beat third-quarter earnings expectations, posting

$2.34 billion (£1.8 billion), exceeding the £1.6 billion forecast.

Although lower than last year’s £1.9 billion profit, the bank

maintained its guidance for 2024. Performance was driven by

increased lending and growth in credit cards and mortgages. Shares

rose 0.9% in pre-market trading.

Deutsche Bank (NYSE:DB) – Deutsche Bank posted

a Q3 net profit of €1.46 billion, up 42% from the previous year and

in line with analyst expectations. Investment bank revenue grew by

11%, surpassing the 6.5% forecast. Provisions of $475 million for

litigation helped recover after losses in Q2. Shares fell 2.7% in

pre-market trading.

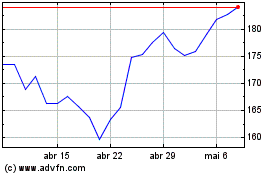

Texas Instruments (NASDAQ:TXN)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

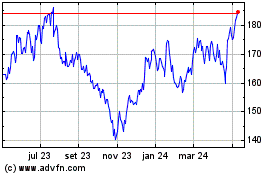

Texas Instruments (NASDAQ:TXN)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024