Tesla Rises 5% Pre-Market After Surpassing $1T Market Value; U.S. Bans TSMC From Selling Advanced Chips to China

11 Novembro 2024 - 8:04AM

IH Market News

Tesla (NASDAQ:TSLA) – On Friday, Tesla’s market

capitalization surpassed $1 trillion following Donald Trump’s

election, anticipated to support CEO Elon Musk’s business ventures,

as he was a campaign supporter. Tesla closed last week with a 29%

cumulative gain, with shares rising 5.2% pre-market after an 8.2%

gain on Friday.

Taiwan Semiconductor Manufacturing Co

(NYSE:TSM) – Reuters reported Saturday that the U.S. ordered TSMC

to halt shipments of advanced chips to Chinese clients, impacting

those used in artificial intelligence. The ban aims to prevent

Huawei and other Chinese companies from accessing critical

technology without authorization, as seen recently. Shares fell

1.9% pre-market.

Sony Group (NYSE:SONY) – In Q2, Sony’s net

income surged 69% to $2.22 billion (¥338.50 billion), exceeding

analysts’ ¥254.0 billion forecast. Despite a decline in PS5 sales,

which reached 3.8 million units, gaming operating profit more than

doubled thanks to software and services sales. Sony revised its

annual revenue forecast, now projecting a 2.4% decline, better than

the previously forecasted 3.2%. Shares fell 2.3% pre-market after a

9.0% rise on Friday.

Salesforce (NYSE:CRM) – Salesforce is

optimistic about its new generative AI product, Agentforce,

launched recently, and plans to add 1,000 new sales

representatives. Shares rose 0.1% pre-market following a 3.6% rise

on Friday.

ASML (NASDAQ:ASML) – ASML faced a global IT

outage on Friday, affecting communication with suppliers and

requiring some staff to work remotely. The issue was resolved the

same day, though the company has yet to disclose the cause. Shares

rose 0.6% pre-market after a 1.1% drop on Friday.

Toyota Motor (NYSE:TM) – Toyota plans to

produce at least 2.5 million vehicles annually in China by 2030,

focusing on increased autonomy for local executives in product

development. This strategy contrasts with other global automakers

distancing their operations from China.

Stellantis (NYSE:STLA) – Stellantis signed a

binding agreement with Australia’s Novonix to acquire

high-performance synthetic graphite for its North American cell

manufacturing partners. Between 2026 and 2031, Stellantis expects

to receive up to 115,000 metric tons of the material. Shares fell

0.7% pre-market after a 4.2% drop on Friday.

Chevron (NYSE:CVX) – After Hurricane Rafael

weakened, Chevron resumed the relocation of teams and production at

its Gulf of Mexico platforms, where it operates six facilities.

Shares rose 0.4% pre-market after a 0.1% increase on Friday.

Embraer (NYSE:ERJ) – Brazilian company Embraer

is gaining ground internationally. Sweden selected Embraer’s C-390

Millennium as its new military cargo aircraft, marking the model’s

first sale to a Northern European country. Shares closed up 6.4% on

Friday.

Booking.com (NASDAQ:BKNG), Enphase

Energy (NASDAQ:ENPH) – After a 13.6% increase in operating

costs last quarter, Booking.com announced layoffs as part of a

restructuring, including modernization and acquisition

optimizations. Enphase Energy announced a 17% global workforce

reduction, incurring $17-$20 million in charges. Enphase shares

rose 0.3% pre-market after a 6.6% drop on Friday.

Quarterly reports expected before market open include

Monday.com (NASDAQ:MNDY), ICL

Group (NYSE:ICL), Aramark (NYSE:ARMK), Global

Ship

Lease (NYSE:GSL), Nuwellis (NASDAQ:NUWE), Rockwell

Medical (NASDAQ:RMTI), RadNet (NASDAQ:RDNT), Sapiens (NASDAQ:SPNS)

and Bridgestone (USOTC:BRDCY).

After-market reports expected from Zeta

Global (NYSE:ZETA), Grab (NASDAQ:GRAB), Luminar (NASDAQ:LAZR), Live

Nation (NYSE:LYV), Assertio (NASDAQ:ASRT), Angi

Inc. (NASDAQ:ANGI), Assured

Guaranty (NYSE:AGO), Double Down

Interactive (NASDAQ:DDI) and Vaalco

Energy (NYSE:EGY).

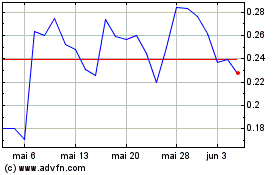

Newellis (NASDAQ:NUWE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Newellis (NASDAQ:NUWE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024