Nvidia Earnings and Futures Point to Higher Open Amid Market Recovery

21 Novembro 2024 - 11:09AM

IH Market News

The major U.S. index futures are currently pointing to a higher

open on Thursday, with stocks likely to extend the upward move seen

late in the previous session.

Nvidia (NASDAQ:NVDA) may help lead the markets higher, as the AI

darling has turned higher over the course of pre-market trading is

currently jumping by 1.5 percent.

Traders initially reacted negatively to Nvidia’s fiscal third

quarter results, which were released after the close of trading on

Wednesday.

Nvidia reported better than expected third quarter earnings and

revenues, but some traders expressed concerns about slowing revenue

growth and a quarter-on-quarter decline by gross margins.

After seeing weakness throughout much of the session, stocks

recovered in the latter part of the trading day on Wednesday. The

major averages climbed well off their worst levels before

eventually ending the session narrowly mixed.

The Dow ended the day up 139.53 points or 0.3 percent at

43,408.47, while the S&P 500 closed little changed, up just

0.13 points at 5,917.11.

The tech-heavy Nasdaq closed down 21.32 points or 0.1 percent at

18,966.14 but staged a notable recovery attempt after tumbling by

as much as 1.4 percent.

The roughly flat close by the major averages came as traders

looked ahead to the release of quarterly results from Nvidia after

the close of trading. Nvidia fluctuated over the course of the

session before closing down 0.8 percent.

The volatility seen late in the session also came as trading

activity was somewhat subdued amid a lack of major U.S. economic

data.

Traders may also have been reluctant to make more significant

moves as they kept an eye on developments overseas amid escalating

tensions between Ukraine and Russia.

Biotechnology stocks showed a strong move to the upside on the

day, driving the NYSE Arca Biotechnology Index up by 1.8 percent.

The index continued to regain ground after hitting a three-month

closing low on Monday.

An increase by the price of crude oil also contributed to

strength among oil service stocks, while healthcare and

pharmaceutical stocks also turned in strong performances.

Meanwhile, notable weakness remained visible among computer

hardware stocks, with the NYSE Arca Computer Hardware Index falling

by 1.3 percent after surging over the two previous sessions. A

sharp pullback by shares of Super Micro Computer (NASDAQ:SMCI)

weighed on the sector.

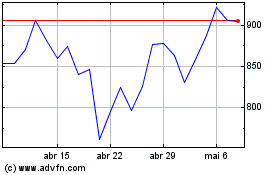

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025