Positive Reaction To Earnings News May Lead To Strength On Wall Street

30 Janeiro 2025 - 11:03AM

IH Market News

The major U.S. index futures are currently

pointing to a higher open on Thursday, with stocks likely to move

back to the upside after ending yesterday’s trading mostly

lower.

Stocks may benefit from a positive reaction to earnings news

from big-name companies such as IBM Corp. (NYSE:IBM), Meta

Platforms (NASDAQ:META) and Tesla (NASDAQ:TSLA).

Shares of IBM are surging by 9.5 percent in pre-market trading

after the tech giant reported fourth quarter earnings that exceeded

analyst estimates.

Facebook parent Meta is also seeing notable pre-market strength

after reporting fourth quarter results that beat estimates on both

the top and bottom lines.

Shares of Tesla may also move to the upside even though the

electric vehicle maker reported fourth quarter earnings that missed

expectations.

On the other hand, shares of Microsoft (NASDAQ:MSFT) are

plunging by 4.5 percent in pre-market trading after the software

giant reported better than expected fiscal second quarter results

but provided disappointing revenue guidance for the current

quarter.

Stocks moved mostly lower over the course of the trading day on

Wednesday, partly offsetting the notable rebound seen during

Tuesday’s session. The major averages climbed off their worst

levels in late-day trading but still closed in negative

territory.

The Nasdaq slid 101.26 points or 0.5 percent to 19,632.32, the

S&P 500 fell 28.39 points or 0.5 percent to 6,039.31 and the

Dow dipped 136.83 points or 0.3 percent to 44,713.52.

The lower close on Wall Street came after the

Federal Reserve announced its widely expected decision to leave

interest rates unchanged following its first monetary policy

meeting of 2025.

The Fed said it decided to maintain the target range for the

federal funds rate at 4.25 to 4.50 percent in support of its dual

goals of maximum employment and inflation at the rate of 2 percent

over the longer run.

The decision to leave rates unchanged came as the Fed noted

inflation remains “somewhat elevated” and reiterated its strong

commitment to returning inflation to its 2 percent objective.

Notably, the Fed removed a phrase included in previous

statements indicating that inflation has “made progress” towards it

target.

The Fed’s latest decision comes after it lowered rates by a

total of 100 basis points or 1.0 percentage point over the three

previous meetings, beginning with a 50 basis point cut in

September.

The central bank’s next monetary policy meeting is scheduled for

March 18-19, when Fed officials will also provide their latest

projections for rates, inflation and the economy.

CME Group’s FedWatch Tool is currently indicating a 77.6 percent

chance the Fed will once again leave rates unchanged but a 22.3

percent chance of a quarter point rate cut.

A slump by shares of Nvidia (NASDAQ:NVDA) also weighed on the

markets, with the AI darling and market leader tumbling by 4.0

percent after surging by 8.8 percent on Tuesday.

Nvidia came under pressure after a report from Bloomberg said

Trump administration officials are exploring additional curbs on

the sale of the company’s chips to China.

Interest rate-sensitive housing stocks showed a significant move

to the downside, dragging the Philadelphia Housing Sector Index

down by 2.2 percent.

Considerable weakness was also visible among telecom stocks, as

reflected by the 1.5 percent loss posted by the NYSE Arca North

American Telecom Index.

Software and commercial real estate stocks also saw notable

weakness on the day, while airline and computer hardware stocks

moved to the upside.

U.S Index Futures Trading – Taking the first steps with Plus500

Beginning your futures trading journey requires careful

preparation. Start by opening a Plus500

account with their minimum $100 deposit — qualifying

for their initial bonus program.

Spend time in the demo environment, understanding how futures

contracts behave and how the platform’s tools can support your

strategy.

As you develop confidence, consider starting with micro

contracts, which offer smaller position sizes ideal for learning

position management.

Plus500’s educational resources can guide you through

this process, helping you understand both basic concepts

and advanced trading strategies.

Start your futures trading journey with Plus500

today

Trading futures carries substantial risk of loss and is not

suitable for all investors. Plus500US Financial Services LLC is

registered with the CFTC and member of the NFA. Past performance

does not guarantee future results. Bonus terms and conditions

apply.

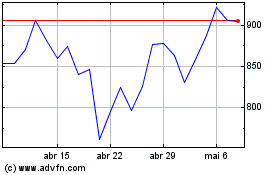

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025