Interest Rate Concerns May Weigh On Wall Street Ahead Of Fed Announcement

29 Janeiro 2025 - 10:58AM

IH Market News

The major U.S. index futures are currently

pointing to a lower open on Wednesday, with stocks likely to move

back to the downside following the rebound seen in the previous

session.

Concerns about the outlook for interest rates may weigh on the

markets ahead of the Federal Reserve’s monetary policy announcement

this afternoon.

With the Fed widely expected to leave interest rates unchanged,

traders will pay close attention to the accompanying statement as

well as Fed Chair Jerome Powell’s post-meeting press

conference.

Recent economic data has led to worries about the Fed leaving

rates on hold for a prolonged period, but many economists still

expect the central bank to resume cutting rates sometime in the

first half of the year.

CME Group’s FedWatch Tool is currently indicating a 75.3 percent

chance rates will be lower by at least a quarter point following

the Fed’s June meeting.

The downward momentum on Wall Street also comes as traders look

ahead to the release of earnings news from big-name companies like

Microsoft (NASDAQ:MSFT), IBM (NYSE:IBM), Meta Platforms

(NASDAQ:META) and Tesla (NASDAQ:TSLA) after the close of today’s

trading.

After seeing considerable weakness in the previous session,

stocks showed a strong move back to the upside during trading on

Tuesday. The tech-heavy Nasdaq led the way higher after posting a

particularly steep loss on Monday.

The Nasdaq surged 391.75 points or 2.0 percent to 19,733.59,

partly offsetting the 3.1 percent plunge seen during Monday’s

session. The S&P 500 also jumped 55.42 points or 0.9 percent to

6,067.70, while the narrower Dow rose 136.77 points or 0.3 percent

to 44,850.35.

The strength on Wall Street came as some traders looked to pick

up technology stocks at somewhat reduced levels following the

sell-off seen in the sector during Monday’s trading.

Shares of Nvidia (NASDAQ:NVDA) soared by 8.8 percent after the

AI darling and market leader plunged by 17.0 percent in yesterday’s

session.

Buying interest was somewhat subdued, however, as traders looked

ahead to the Federal Reserve’s monetary policy announcement on

Wednesday.

In U.S. economic news, a report released by the Commerce

Department unexpectedly showed a steep drop by new orders for U.S.

manufactured durable goods in the month of December amid a nosedive

by orders for transportation equipment.

The Commerce Department said durable goods orders plunged by 2.2

percent in December after tumbling by a revised 2.0 percent in

November.

Economists had expected durable goods orders to climb by 0.8

percent compared to the 1.2 percent slump that had been reported

for the previous month.

However, excluding the steep drop by orders for transportation

equipment, durable goods orders rose by 0.3 percent in December

after edging down by 0.2 percent in November. Ex-transportation

orders were expected to increase by 0.4 percent.

The Conference Board also released a report showing its U.S.

consumer confidence index decreased from a notably upwardly revised

level in January.

The report said the consumer confidence index slid to 104.1 in

January from an upwardly revised 109.5 in December.

Economists had expected the consumer confidence index to climb

to 106.3 from the 104.7 originally reported for the previous

month.

Software stocks turned in some of the market’s best performances

on the day, resulting in a 3.0 percent surge by the Dow Jones U.S.

Software Index.

Considerable strength was also visible among brokerage stocks,

as reflected by the 1.3 percent gain posted by the NYSE Arca

Broker/Dealer Index.

Semiconductor and networking stocks also regained ground

following yesterday’s sell-off, while airline stocks showed a

significant move to the downside, dragging the NYSE Arca Airline

Index down by 2.4 percent.

Oil producer, commercial real estate and

pharmaceutical stocks also saw notable weakness, partly offsetting

the strength in the aforementioned sectors.

U.S Index Futures Trading – Taking the first steps with Plus500

Beginning your futures trading journey requires careful

preparation. Start by opening a Plus500

account with their minimum $100 deposit — qualifying

for their initial bonus program.

Spend time in the demo environment, understanding how futures

contracts behave and how the platform’s tools can support your

strategy.

As you develop confidence, consider starting with micro

contracts, which offer smaller position sizes ideal for learning

position management.

Plus500’s educational resources can guide you through

this process, helping you understand both basic concepts

and advanced trading strategies.

Start your futures trading journey with Plus500

today

Trading futures carries substantial risk of loss and is not

suitable for all investors. Plus500US Financial Services LLC is

registered with the CFTC and member of the NFA. Past performance

does not guarantee future results. Bonus terms and conditions

apply.

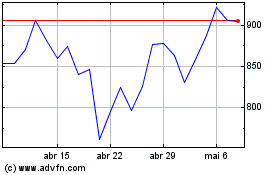

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025