Tech Stocks May Lead Early Sell-Off On Wall Street

27 Janeiro 2025 - 11:05AM

IH Market News

The major U.S. index futures are currently

pointing to a sharply lower open on Monday, with stocks likely to

extend the pullback seen during last Friday’s session.

A sell-off by technology stocks is likely to weigh on Wall

Street, as AI darling and sector leader Nvidia (NASDAQ:NVDA) is

plummeting by 11.5 percent in pre-market trading.

The plunge by Nvidia comes after Chinese startup DeepSeek’s AI

Assistant overtook rival ChatGPT to become the top-rated free

application available on Apple’s App Store in the United

States.

DeepSeek’s ascendance has doubt on Silicon Valley’s hefty AI

capex spending and the sustainability of the U.S. technical edge in

artificial intelligence.

After turning in a relatively lackluster performance early in

the session, stocks moved mostly lower over the course of the

trading day on Friday. The major averages all moved to the

downside, with the S&P 500 giving back ground after reaching a

new record intraday high.

The major averages climbed off their worst levels going into the

close but remained in negative territory. The Dow fell 148.82

points or 0.3 percent to 44,424.25, the Nasdaq slid 99.38 points or

0.5 percent to 19,954.30 and the S&P 500 dipped 17.37 points or

0.3 percent to 6,101.24.

Despite the pullback on the day, the major averages still posted

strong gains for the holiday-shortened week. While the Dow surged

by 2.2 percent, the Nasdaq and the S&P 500 both jumped by 1.7

percent.

The weakness that emerged on Wall Street may have reflected

concerns about the outlook for interest rates ahead of the Federal

Reserve’s monetary policy meeting next week.

While the Fed is almost universally expected to leave interest

rates unchanged, traders are likely to pay close attention to the

accompanying statement for clues about the outlook for rates.

Recent economic data has led to concerns about the Fed leaving

rates on hold for a prolonged period, but many economists still

expect the central bank to resume cutting rates sometime in the

first half of the year.

CME Group’s FedWatch Tool is currently indicating a 71.1 percent

chance rates will be lower by at least a quarter point following

the Fed’s June meeting.

On U.S. economic front, revised data released by the University

of Michigan showed consumer sentiment unexpectedly deteriorated by

more than previously estimated in the month of January.

The University of Michigan said its consumer sentiment index for

January was downwardly revised to 71.1 from the preliminary reading

of 73.2. Economists had expected the index to be unrevised.

The consumer sentiment index is down from the final December

reading of 74.0, marking the first decrease in six months.

Meanwhile, a report released by the National Association of

Realtors showed existing home sales jumped by much more than

expected in the month of December, reaching their highest level

since last February.

Semiconductor stocks showed a significant move to the downside

on the day, dragging the Philadelphia Semiconductor Index down by

1.9 percent.

Texas Instruments (NASDAQ:TXN) led the semiconductor sector

lower, plunging by 7.5 percent after reporting better than expected

fourth quarter results but providing disappointing earnings

guidance for the current quarter.

Oil and networking stocks also saw notable

weakness, while pharmaceutical stocks showed a strong move to the

upside, driving the NYSE Arca Pharmaceutical Index up by 1.4

percent.

U.S.-listed shares of Danish drug maker Novo Nordisk (NYSE:NVO)

surged by 8.5 percent after the company announced positive trial

results for its obesity drug.

U.S Index Futures Trading – Taking the first steps with Plus500

Beginning your futures trading journey requires careful

preparation. Start by opening a Plus500

account with their minimum $100 deposit — qualifying

for their initial bonus program.

Spend time in the demo environment, understanding how futures

contracts behave and how the platform’s tools can support your

strategy.

As you develop confidence, consider starting with micro

contracts, which offer smaller position sizes ideal for learning

position management.

Plus500’s educational resources can guide you through

this process, helping you understand both basic concepts

and advanced trading strategies.

Start your futures trading journey with Plus500

today

Trading futures carries substantial risk of loss and is not

suitable for all investors. Plus500US Financial Services LLC is

registered with the CFTC and member of the NFA. Past performance

does not guarantee future results. Bonus terms and conditions

apply.

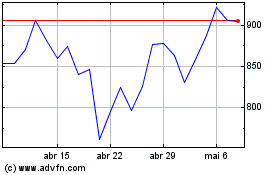

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025