Dow Moves Sharply Higher But Nasdaq Closes Little Changed

21 Novembro 2024 - 6:44PM

IH Market News

Stocks saw considerable volatility early in the session on

Thursday but moved mostly higher over the course of the trading

day. The major averages all finished the day in positive territory,

with the Dow posting a standout gain.

The Dow jumped 461.88 points or 1.1 percent to 43,870.35 and the

S&P 500 (SPI:SP500) climbed 31.60 points or 0.5 percent to

5,948.71, while the tech-heavy Nasdaq posted a much more modest

gain, inching up 6.28 points or less than a tenth of a percent to

18,972.42.

The sharp increase by the Dow came amid strong gains by IBM

Corp. (NYSE:IBM), Sherwin-Williams (NYSE:SHW) and Salesforce

(CRM).

Meanwhile, the Nasdaq showed a lack of direction over the course

of the trading session as traders tracked the performance of AI

darling Nvidia (NASDAQ:NVDA). Shares of Nvidia fluctuated as the

day progressed before eventually ending the day up by 0.5

percent.

Nvidia reported better than expected third quarter earnings and

revenues, but some traders expressed concerns about slowing revenue

growth and a quarter-on-quarter decline by gross margins.

A steep drop by shares of Alphabet (NASDAQ:GOOGL) limited the

upside for the Nasdaq on news the Justice Department has urged a

federal judge to force a sale of the Google parent’s Chrome web

browser.

In U.S. economic news, the Labor Department released a report

showing initial jobless claims unexpectedly fell to their lowest

level in over six months last week.

The report said initial jobless claims slipped to 213,000 in the

week ended November 16th, a decrease of 6,000 from the previous

week’s revised level of 219,000.

Economists had expected jobless claims to inch up to 220,000

from the 217,000 originally reported for the previous week.

With the unexpected dip, jobless claims fell to their lowest

level since hitting 209,000 in the week ended April 27th.

Meanwhile, a reading on leading U.S. economic indicators fell by

slightly more than expected in the month of October, the Conference

Board revealed in a separate report.

The Conference Board said its leading economic index slid by 0.4

percent in October after dipping by a revised 0.3 percent in

September.

Economists had expected the leading economic index to fall by

0.3 percent compared to the 0.5 percent decrease originally

reported for the previous month.

“Apart from possible temporary impacts of hurricanes, the US LEI

continued to suggest challenges to economic activity ahead,” said

Justyna Zabinska-La Monica, Senior Manager, Business Cycle

Indicators, at The Conference Board.

Sector News

Computer hardware stocks showed a strong move back to the upside

following yesterday’s pullback, with the NYSE Arca Computer

Hardware Index soaring by 4.2 to its best closing level in a

month.

A sharp increase by the price of crude oil also contributed to

substantial strength among oil service stocks, as reflected by the

2.5 percent surge by the Philadelphia Oil Service Index.

Networking stocks also showed a significant move to the upside,

driving the NYSE Arca Networking Index up by 1.9 percent.

Utilities, banking, and natural gas stocks also saw considerable

strength, while some weakness was visible among airline stocks.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region moved mostly lower on Thursday. Japan’s Nikkei 225 Index

slid by 0.9 percent and Hong Kong’s Hang Seng Index fell by 0.5

percent, although China’s Shanghai Composite Index bucked the

downtrend and inched up by 0.1 percent.

Meanwhile, the major European markets moved to the upside on the

day. While the French CAC 40 Index edged up by 0.2 percent, the

German DAX Index and the U.K.’s FTSE 100 Index advanced by 0.7

percent and 0.8 percent, respectively.

In the bond market, treasuries moved lower over the course of

the session after showing a lack of direction in early trading,

Subsequently, the yield on the benchmark ten-year note, which moves

opposite of its price, rose by 2.6 basis points to 4.432

percent.

Looking Ahead

Trading activity on Friday may be somewhat subdued amid a

relatively quiet day in terms of U.S. economic news.

SOURCE: RTTNEWS

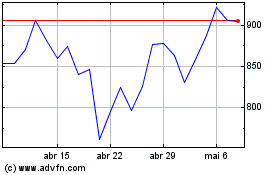

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024