Dow Jumps To New Record Closing High

22 Novembro 2024 - 6:31PM

IH Market News

Extending the upward move seen over the course of Thursday’s

session, stocks saw continued strength during trading on Friday.

The Dow led the way higher once again, reaching a new record

closing high.

The major averages all ended the day in positive territory, with

the Dow jumping 426.16 points or 1.0 percent to 44,296.51. The

S&P 500 (SPI:SP500) also climbed 20.63 points or 0.4 percent to

5,969.34, while the Nasdaq rose 31.23 points or 0.2 percent to

19,003.65.

With the continued upward move, the major averages posted strong

gains for the week, partly offsetting the sharp pullback seen last

week.

For the week, the Dow surged by 2.0 percent, while the Nasdaq

and the S&P 500 both shot up by 1.7 percent.

Stocks rallied in reaction to President-elect Donald Trump’s

decisive victory early this month but gave back ground the

following week before rebounding in recent sessions.

The advance by the markets came despite a pullback by shares of

Nvidia (NASDAQ:NVDA), as the AI darling tumbled by 3.2 percent.

Nvidia fluctuated before ending Thursday’s session up by 0.5

percent after reporting better than expected third quarter earnings

and revenues.

Overall trading appeared somewhat subdued, however, as traders

looked ahead to the release of key U.S. economic data next week,

including readings on consumer price inflation preferred by the

Federal Reserve.

Among individual stocks, shares of Gap (NYSE:GAP) surged after

the apparel retailer reported better than expected third quarter

earnings and raised its full-year guidance.

Meanwhile, shares of Intuit (NASDAQ:INTU) came under pressure

after the financial software company reported better than expected

fiscal first quarter results but provided disappointing guidance

for the current quarter.

In U.S. economic news, revised data released by the University

of Michigan showed consumer sentiment in the U.S. improved less

than previously estimated in the month of November.

The University of Michigan said its consumer sentiment index for

November was downwardly revised to 71.8 from the preliminary

reading of 73.0.

While the downward revision surprised economists, who had

expected the reading to be upwardly revised to 73.7, the index is

still above the final October reading of 70.5.

Despite the unexpected downward revision, the consumer sentiment

index is also still at its highest level since hitting 77.2 in

April.

Sector News

Networking stocks turned in some of the market’s best

performances on the day, resulting in a 2.1 percent jump by the

NYSE Arca Networking Index.

Considerable strength was also visible among computer hardware

stocks, as reflected by the 1.8 percent gain posted by the NYSE

Arca Computer Hardware Index. The index reached its best closing

level in well over three months.

Housing stocks also showed a significant move to the upside,

driving the Philadelphia Housing Sector Index up by 1.6

percent.

Banking, biotechnology and oil service stocks also saw notable

strength, while utilities stocks gave back some ground.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region turned in a mixed performance on Friday. Japan’s Nikkei 225

Index climbed by 0.7 percent, while Hong Kong’s Hang Seng Index

slumped by 1.9 percent and China’s Shanghai Composite Index plunged

by 3.1 percent.

Meanwhile, the major European markets all moved to the upside on

the day. While the U.K.’s FTSE 100 Index jumped by 1.4 percent, the

German DAX Index advanced by 0.9 percent and the French CAC 40

Index rose by 0.6 percent.

In the bond market, treasuries saw modest strength after moving

lower over the two previous sessions. Subsequently, the yield on

the benchmark ten-year note, which moves opposite of its price,

dipped 2.2 basis points to 4.410 percent.

Looking Ahead

Trading activity may be somewhat subdued next week due to the

Thanksgiving Day holiday on Thursday, although traders are still

likely to keep a close eye on the latest U.S. economic news.

The Fed’s preferred inflation readings are likely to be in

focus, while reports on durable goods orders, new home sales and

weekly jobless claims are also likely to attract attention along

with the minutes of the latest Fed meeting.

SOURCE: RTTNEWS

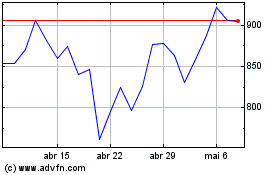

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024