Traders May Stick To The Sidelines Ahead Of Nvidia Earnings, Key Data

25 Fevereiro 2025 - 10:59AM

IH Market News

The major U.S. index futures are currently pointing to a roughly

flat open on Tuesday, with stocks likely to continue experiencing

choppy trading after seeing considerable volatility in the previous

session.

Uncertainty about the near-term outlook for the markets may keep

some traders on the sidelines following recent weakness, which saw

the Nasdaq and S&P 500 move sharply lower over the three

previous sessions.

Traders may also be reluctant to make significant moves of the

release of earnings news from Nvidia (NASDAQ:NVDA) after the close

of trading on Wednesday.

“Nvidia is due to report its fourth-quarter and full-year

results on Wednesday and investors will be looking forward to the

usual demolition of forecasts and also positive guidance for the

next quarter from chief executive Jensen Huang,” said AJ Bell

investment director Russ Mould.

“Failure to deliver the customary upside surprise might not sit

well,” he added. “Nvidia’s shares are no higher than they were last

summer, despite strong earnings and ongoing investor enthusiasm for

all things related to artificial intelligence, so any unexpected

disappointment could cause some share price turbulence.”

Traders are also looking ahead to the release of some key U.S.

economic data in the coming days, including the Federal Reserve’s

preferred readings on consumer price inflation.

Not long after the start of trading, the Conference Board is due

to release its report on consumer confidence in the month of

February. The consumer confidence index is expected to dip to 103.0

in February after falling to 104.1 in January.

Following the significant pullback seen during last Thursday and

Friday’s session, stocks saw considerable volatility over the

course of the trading day on Monday. The major averages showed wild

swings back and forth across the unchanged line as the day

progressed.

The Nasdaq and the S&P 500 eventually ended the day firmly

in negative territory, but the narrower Dow posted a modest

gain.

While the Dow inched up 33.19 points or 0.1 percent to

43,461.21, the S&P 500 fell 29.88 points or 0.5 percent to

5,983.25 and the Nasdaq tumbled 237.08 points or 1.2 percent to

19,286.92.

The Nasdaq and the S&P 500 ended the day firmly in the red

after President Donald Trump said previously delayed tariffs on

Canada and Mexico are “going forward on time.”

Claiming the U.S. has “been taken advantage of” on “just about

everything,” Trump said, “The tariffs will go forward… and we’re

going to make up a lot of territory.”

The volatility on Wall Street also came as traders looked ahead

to the release of the earnings news from Nvidia. The AI darling and

market leader is scheduled to release its fourth quarter results

after the close of trading on Wednesday.

A lack of major U.S. economic data may also have contributed to

the choppy trading ahead of the release of the Federal Reserve’s

preferred readings on consumer price inflation on Friday.

Semiconductor stocks moved sharply lower over the course of the

session, resulting in a 3.0 percent nosedive by the Philadelphia

Semiconductor Index.

Computer hardware, networking and software stocks also saw

considerable weakness, contributing to the steep drop by the

tech-heavy Nasdaq.

Retail stocks also showed a notable move to the downside, while

significant strength was visible among pharmaceutical stocks.

U.S Index Futures Trading – Taking the first steps with Plus500

Beginning your futures trading journey requires careful

preparation. Start by opening a Plus500

account with their minimum $100 deposit — qualifying

for their initial bonus program.

Spend time in the demo environment, understanding how futures

contracts behave and how the platform’s tools can support your

strategy.

As you develop confidence, consider starting with micro

contracts, which offer smaller position sizes ideal for learning

position management.

Plus500’s educational resources can guide you through

this process, helping you understand both basic concepts

and advanced trading strategies.

Start your futures trading journey with Plus500

today

Trading futures carries substantial risk of loss and is not

suitable for all investors. Plus500US Financial Services LLC is

registered with the CFTC and member of the NFA. Past performance

does not guarantee future results. Bonus terms and conditions

apply.

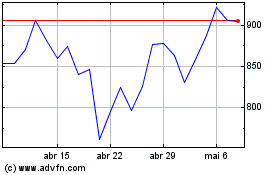

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025