XRP To $1? Summary Judgment Is Very Close, Lawyers Predict

07 Março 2023 - 8:06AM

NEWSBTC

The legal battle between Ripple Labs and the U.S. Securities and

Exchange Commission (SEC) is picking up steam again, and now things

could move really fast. Several attorneys at once predict that

summary judgment could appear at any time, within the next few

days. As Bitcoinist reported, the judge in charge ruled on the

“Daubert” motions yesterday. One of the attorneys is John E.

Deaton, who is representing the XRP community as amicus in the

case. When asked if the publication of the judge’s decision on the

Daubert motions gives any indication of the timing of the summary

judgment decision, Deaton said that he believes the decision is

imminent. The attorney stated that the judge could release her

decision as early as tonight or in a couple of weeks: I seriously

doubt that we see a significant delay from here. Could be tonight

or in a couple of weeks. The theory that Judge Analisa Torres will

decide all the motions together, or within a very short time, stems

from defense attorney and former federal prosecutor James K.

Filan’s examination of Torres’ ruling history a few months ago.

Filan noted that Torres likes to make her decisions in one go. In

that vein, Fred Rispoli, senior managing partner at Hodl Law, also

wrote that he expects summary judgment soon: “This is not the SJ

ruling, but this means the SJ ruling is very, very close.” Related

Reading: XRP Bullish Cross Is Looming, An Easy Path Toward The $2

Mark? However, Rispoli also wrote that after partially reviewing

the Daubert motions ruling, he believes neither the SEC nor Ripple

will get a full summary judgment victory and parts of the case will

go to trial. “At the same time, I think I’ll be correct in my

prediction on secondary sales of XRP,” Rispoli commented. What

Could A Summary Judgement Mean For The XRP Price? If Ripple

succeeds in winning the lawsuit against SEC, a massive price rally

is very likely in store, as also shown by the recent partial

success of LBRY. Unlike in December 2020, when the lawsuit was

filed by the SEC, there could be a reverse effect. Within a week,

the XRP price crashed by a staggering -72%. The price plummeted

from $0.60 to $0.17. Compared to Bitcoin and Ethereum, XRP still

exhibits a huge undervaluation since this event. XRP bulls may want

to make up for this deficit, driven by several factors, including

the re-listing of XRP on US exchanges. How high the price could

rise is difficult to predict, but an analysis using Fibonacci

retracement levels can provide some clues. Related Reading: XRP

Price Prediction: Bears Reject $0.40, Ripple Turns Vulnerable To

More Losses The Fibonacci retracement is a method of finding

potential resistance and support zones. Traditionally, the most

common retracement levels are 38.2%, 50% and 61.8%. These levels

are noted by most analysts because they represent potential

reversal points for the markets. First, however, XRP is likely to

find a first hurdle at the price of $0.68 (23.6%). If this mark is

crushed, the retracement level at $0.93 (38.2%) could become the

key hurdle to break through the $1 mark. A rise to $0.93 would

already mean a price rally of 150% from the current price. The LBC

token has risen 154% after LBRY’s partial victory in late January –

when the SEC admitted that LBC token sales on the secondary market

are not securities. Hence, a similar scenario could be on the

table, even if the XRP market is much more liquid. If, contrary to

expectations, XRP is also able to break the 38.2% Fibonacci level,

resistance at $1.13 (50%) would be the main target to climb above

$1. However, as Rispoli pointed out, the judge could hand out

partial victories, so it will be a matter of paying attention to

the nuances of a soon to come ruling. Featured image from iStock,

Chart from TradingView.com

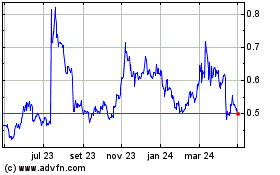

Ripple (COIN:XRPUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Ripple (COIN:XRPUSD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024