‘Crypto Winter’ Arrives Early For The Altcoin Market As Venture Capital, Founder Selloffs Mount

25 Junho 2024 - 1:00AM

NEWSBTC

The altcoin market is experiencing an early “crypto winter” as

initial investors and founders of various projects sell off their

tokens. According to a recent Bloomberg report, this decline

can be attributed to a combination of factors, including the

unlocking of tokens held by venture capitalists (VCs) and founders,

as well as the selling pressure caused by the correlation between

altcoins and major network tokens. Altcoin Market Hit By Token

Unlock Wave As the crypto market recovered from the prolonged

decline of two years ago, many projects’ tokens have reached their

unlock dates this year. Per the report, venture capitalists and

founders who received these tokens in exchange for investments or

work contributions now have the opportunity to sell them. Out

of the 138 tokens tracked by researcher TokenUnlocks, 120 have

scheduled for this year, with a combined market value of

approximately $58 billion. This anticipated selling from

unlocking VCs has led to downside price reflexivity as non-VC

holders attempt to front-run the selling pressure, often resulting

in steep discounts to spot prices. Related Reading: Bitcoin Price

Crashes Below $61,000: The Main Reasons The price performance of

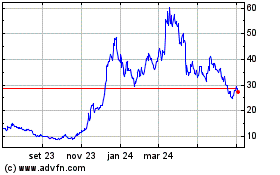

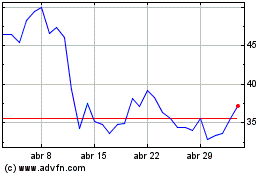

altcoins such as DYDX, Avalanche (AVAX), and Pyth (PYTH) has been

significantly impacted by token unlocks. DYDX’s token price has

more than cut in half since mid-March, while AVAX and PYTH have

also seen significant declines. These three tokens had unlocks

scheduled for May, adding to the selling pressure. Token

unlocks, which had previously helped drive 2023 prices, are now

receiving more attention from both VCs and public participants,

prioritizing short-term profits over long-term holdings for

altcoins with unlocks. Liquidity Crisis? Notably, since March

14, when Bitcoin (BTC) reached an all-time high of $73,700, only 12

out of the top 90 non-stablecoin assets tracked on centralized

exchanges (CEXs) have posted positive returns, while 81 have

recorded negative returns, according to the report. Bitcoin

has dropped around 12% since its peak, and most of the top 100

tokens have declined by more than 25%. The smaller altcoins,

including those correlated with major network tokens like Ethereum

(ETH) and Solana (SOL), tend to be sold off first when there is a

decline. The unlocking of tokens exacerbates this selling pressure,

further impacting the altcoin market. Related Reading: Toncoin On

Fire: Crypto Explodes To All-Time High – Can It Hit $10? According

to Bloomberg, the current market presents challenges for

infrastructure projects funded during the bear market phase.

While these projects launch their tokens, there is limited demand

from “regular buyers” at high prices. The altcoin market is

currently characterized by a lack of liquidity and a surplus of

tokens being unlocked, leading to downward pressure on prices.

Featured image from DALL-E, chart from TradingView.com

Avalanche (COIN:AVAXUSD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Avalanche (COIN:AVAXUSD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025