Ethereum Whale Transactions Spike – High Volume Supports Surge To $3,200

10 Novembro 2024 - 5:00PM

NEWSBTC

Ethereum has reached a new local high at $3,219, marking an

impressive 35% surge since last Monday. This rapid rise has ignited

strong optimism among analysts and investors, who now see Ethereum

as primed for further gains as it begins to show strength against

Bitcoin. The rally reflects renewed confidence in ETH’s potential,

especially as major stakeholders increase their activity. Related

Reading: Cardano Skyrockets Over 40% – Funding Rate Suggests

Further Upside Key data from Santiment supports this bullish

outlook, highlighting a significant spike in whale transactions.

Increased activity among large ETH holders often signals

accumulation, suggesting that influential players see the potential

for Ethereum’s continued growth. This uptick in whale transactions

is typically seen as a precursor to further price appreciation, as

it indicates sustained interest from high-volume investors. As ETH

continues to rise, analysts are closely watching its performance

against Bitcoin, noting that Ethereum’s recent momentum could

indicate the beginning of a more sustained uptrend. Ethereum

Bull Phase Starting Ethereum has officially entered a bullish phase

after decisively breaking key resistance levels and establishing a

positive price structure. Recent data from Santiment confirms this

upward trend, as Ethereum is now showing strong growth metrics that

suggest further gains may lie ahead. Whale transaction data

points to a significant increase in activity from major

stakeholders—wallets holding substantial amounts of ETH—who have

actively contributed to Ethereum reaching its highest price in over

14 weeks. In addition to heightened whale activity, Ethereum’s

transaction volume has surged, reaching as much as $10.4 billion

over the past several days. This volume spike is an encouraging

sign of rising demand and sustained interest in ETH at its current

levels. Large transactions often signal confidence from

institutional players and high-net-worth investors, reinforcing the

bullish sentiment around Ethereum as they increase their holdings.

Related Reading: Chainlink Hits $13.5 For The First Time Since July

– Smart Money Accumulation? Santiment analysts suggest that

Bitcoin’s performance during this bull run could serve as a

catalyst for Ethereum, with profits likely redistributing from BTC

to ETH as market participants diversify into top altcoins. This

dynamic has historically benefited Ethereum during strong market

cycles, potentially setting the stage for ETH to revisit its

previous all-time high. Additionally, Ethereum’s network activity

appears robust, another key indicator of sustained growth

potential. With increased stakeholder participation, high

transaction volume, and a healthy network, Ethereum seems

well-positioned for continued upward momentum in the current

bullish environment. ETH Testing Fresh Supply Ethereum (ETH) is

currently trading at $3,170, showing strength after an aggressive

move above the 200-day moving average (MA) at $2,955. This breakout

above a long-term resistance level signals that bulls are now

firmly in control as ETH reaches new supply zones. Holding above

the 200-day MA is a positive indicator for sustaining the bullish

trend, as this level often supports price action when breached on

an upward move. If ETH experiences a pullback, a drop back to the

200-day MA around $2,955 would represent a healthy retracement,

potentially setting the stage for further gains. A consolidation at

or near this level would likely attract more demand, supporting a

continuation of the uptrend. Related Reading: Ethereum Analyst Sees

Altseason Potential As BTS Is Still Outpacing ETH – Time To Buy

Altcoins? However, the current strong price action combined with

fresh demand entering the market could propel Ethereum even higher

without a significant pullback. The momentum ETH is building now

may help it break through successive supply levels in the near

term, pushing toward higher targets. For now, Ethereum’s upward

trajectory is supported by solid technical levels and a market

environment increasingly favorable for continued gains. Featured

image from Dall-E, chart from TradingView

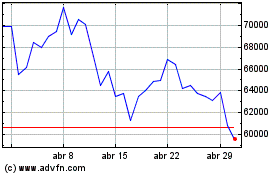

Bitcoin (COIN:BTCUSD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Bitcoin (COIN:BTCUSD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025