Bitcoin Price Prediction: Charting The Roadmap Of BTC To $150,000 By 2025

03 Dezembro 2024 - 8:00AM

NEWSBTC

Crypto analyst TradingShot had predicted before that the Bitcoin

price could rally to as high as $150,000 in this bull run. With the

flagship crypto now close to the $100,000 milestone, the analyst

has charted Bitcoin’s current price action and provided insights

into how the crypto could reach this $150,000 target by 2025.

The Current Bitcoin Price Action And Road To $150,000 In a

TradingView post, TradingShot stated that the Bitcoin price is now

off the 0.786 to 1.0 Fibonacci range, where it consolidated from

March 2024 until October 2024. The analyst noted how the breakout

in October was largely thanks to the US presidential elections and

the euphoria after Donald Trump won. Related Reading: Fantom

Price Breakout: Analyst Shares Anatomy Of FTM’s 18,000% Move To

$150 By 2025 TradingShot said that the Bitcoin price is only one

month outside this range and is already much higher. He noted that

last month’s candle was similar to November 2020 and May 2017.

Coincidentally, those periods were when the “most aggressive

rallies of those bull cycles started.” The crypto stated that the

Bitcoin price was at a 71.5° angle between May and December 2017.

In the 2021 cycle, Bitcoin was at a 68.5° angle (3° lower) between

November 2020 and April 2021. If this happens to be a trend,

TradingShot remarked that it is safe to assume that the 2024/2025

parabolic rally could be at a 65.5° angle (-3° from the previous

cycle). In line with this, TradingShot said that this gives

the Bitcoin price a potential target of $300,000 as early as May

2025 if the crypto records a double top cycle as in 2021.

Meanwhile, the crypto analyst asserted that the $150,000 target is

“very plausible” from a technical analysis perspective since it is

just below the top of a multi-year channel he highlighted on the

chart. BTC’s Next Move Still Unclear Amid this bullish

prediction for the Bitcoin price, crypto analyst Kevin Capital has

suggested that BTC’s move is still unclear. He stated that while

Bitcoin has a lot of liquidity to the downside of about $88,000,

the real bulk of liquidity is still around the $100,000 to $103,000

range. Based on this, the analyst stated that it is best to sit

back and watch what comes next. Meanwhile, crypto analyst

Mikybull Crypto has suggested that the Bitcoin price may experience

a cooling-off period in the meantime. This came as he revealed that

the sell signal has flashed on Bitcoin’s dominance for the first

time since 2020. In line with this development, he stated that it

is officially altcoin season. Related Reading: Crypto Analyst

Says Litecoin Is About To Pull An XRP, Here’s What He Means

Blockchain center data shows that it is indeed altcoin season. In

the last 90 days, 75% of the top 50 coins by market cap have

outperformed the Bitcoin price. With this being altcoin season,

Bitcoin could cool off while altcoins record parabolic

rallies. At the time of writing, the Bitcoin price is trading

at around $95,600, down in the last 24 hours, according to data

from CoinMarketCap. Featured image created with Dall.E, chart

from Tradingview.com

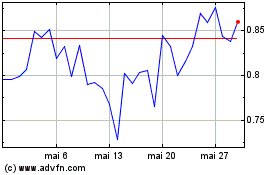

Mina (COIN:MINAUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Mina (COIN:MINAUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024