CryptoQuant CEO Warns Not To Short XRP Due To Insider Whale Activity

03 Dezembro 2024 - 9:30AM

NEWSBTC

XRP has experienced an extraordinary surge in recent weeks, with

its price skyrocketing by 380% over the past 23 days. In just the

last four days, the price jumped 75%, reaching a peak of $2.87 on

December 2. This rapid ascent appears to be fueled by significant

buying activity from large investors, commonly known as “whales.”

Ki Young Ju, CEO of on-chain analysis firm CryptoQuant, highlighted

that these whales are primarily operating through the US based

exchange Coinbase. On December 2, he pointed out that “Coinbase

whales are driving this XRP rally,” noting that Coinbase’s

minute-level price premium ranged from 3% to 13% during the surge.

In contrast, Upbit—a Korean exchange with more XRP investors than

Binance—showed no significant premium, suggesting the buying

pressure is predominantly originating from the United States. On

his alternative X account (@kate_young_ju), Ki Young Ju hinted at

possible insider activity influencing the market dynamics, stating,

“Someone knew something.” Related Reading: XRP Price Prediction:

Analyst Says History Is Repeating Itself, Here’s How Today, he

cautioned traders against shorting XRP. “Shorting XRP right now

seems risky, imo. $25B XRP deposit before the pump might look like

market manipulation but could simply be front-running. This insider

whale might know something extremely bullish about XRP, such as

spot ETF approval,” he speculated. He further shared a chart “XRP:

Retail Activity Through Trading Frequency Surge (Spot &

Futures), which indicates that retail trading activity for XRP has

surpassed the highs of 2021 and is nearing levels last seen in

January 2018, when XRP reached its all-time high of $3.92. Related

Reading: Crypto Analyst Says Litecoin Is About To Pull An XRP,

Here’s What He Means Observing the one-year cumulative volume delta

(CVD) of taker buy/sell volume, he remarked: “1-year CVD of Taker

Buy/Sell Volume for XRP shows a historic rebound. Whales are

aggressively using market orders, driving overwhelming demand.” A

700% Rallye Incoming For XRP Against BTC? From a technical analysis

perspective, crypto analyst Jacob Canfield emphasizes the

importance of examining the XRP/BTC pairing. He notes that XRP is

currently at a critical resistance zone on the BTC pair chart

(XRPBTC), having just reached the $2.75 level on the USDT pair—a

resistance point since December 2019. Canfield suggests that a

breakout here could signal a potential 240% move back to key

resistance zones from 2017, 2018, and 2019. “If we get real FOMO,

then we could be setting up for another 700% move to all-time high

against Bitcoin,” he commented, acknowledging the “two of the

strongest monthly candles for XRP that we’ve seen in over 5 years.”

Looking at shorter time-frames of the XRP/USD pair, Canfield

highlights the utility of support and resistance levels to identify

new entry points in these time frames. “In bull markets, you need

to use low time frame support/resistance to find new entries. 5

min/15 min are the best. XRP as an example – $2.20 was the clear

S/R invalidation. Base of the biggest green candle = base of

impulse. Usually the best place to re-enter a trade.” At press

time, XRP traded at $2.63. Featured image created with DALL.E,

chart from TradingView.com

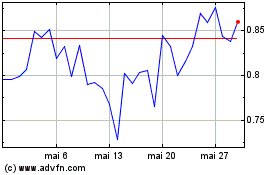

Mina (COIN:MINAUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Mina (COIN:MINAUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024