Bitcoin To $10,000? Top Analyst Issues A Stark Warning

16 Março 2025 - 10:00AM

NEWSBTC

An analyst revealed on Friday that Bitcoin might suffer a 91%

decline from the coin’s all-time high of $109,000 per coin in

January 2025, suggesting that the most popular cryptocurrency could

potentially crash. Related Reading: 200 Million XRP On The

Move—Is Ripple Preparing For A Big Play? Mike McGlone believes that

the firstborn crypto might plummet to a low of $10,000 per coin,

reigniting concerns that Bitcoin might experience another deep

correction similar to 2011 when Bitcoin dipped by as much as 92%.

BTC To Crash To $10K? McGlone, a Senior Commodity Strategist at

Bloomberg Intelligence, predicted that Bitcoin might be heading to

what he described as a devastating collapse, resulting in the

crypto sliding to $10,000. “Bitcoin Back to $10,000? Peak Leveraged

Beta Risks, Rising Gold – #Gold is up about the same amount in 2025

to March 13 — about 15% — that #Bitcoin is down,” McGlone said. If

Bitcoin will plunge to $10,000, it will represent a 90% decrease

from BTC’s all-time high of $109,000 in January 2025. On the other

hand, it will fall by 88% if based on its current price of about

$83,000. Bitcoin Back to $10,000? Peak Leveraged Beta Risks, Rising

Gold – #Gold is up about the same amount in 2025 to March 13 —

about 15% — that #Bitcoin is down. But with Bitcoin at about

$80,000, what stops those trajectories? About a 6% decline in the

S&P 500 could suggest what… pic.twitter.com/aMgL0LANFt — Mike

McGlone (@mikemcglone11) March 14, 2025 The analyst explained that

Bitcoin is more likely to face a significant correction that might

push it downward to $10,000. Historically, the firstborn crypto

experienced a deep correction in 2011 when the BTC declined to 92%

from its high at that time. Has The Crash Begun? In an X

post, McGlone suggested Bitcoin’s crash to $10,000 may have already

started, citing that risk markets are showing signs of overheating

while gold rises. The analyst explained that gold has increased by

1% while Bitcoin went down, saying, “But with Bitcoin at about

$80,000, what stops those trajectories?” “About a 6% decline

in the S&P 500 could suggest what matters. The biggest #ETF

launch in history, President Donald Trump’s shift to highly

volatile and speculative #cryptos, and reelection could prove [a]

peak-bubble akin to about 25 years ago,” he added in a post,

suggesting that BTC might have reached the peak of a dot-com-style

bubble. Rebuttal Of The Analysis Many Bitcoin proponents and

analysts disagree with McGlone’s analysis, with one crypto analyst,

David Weisberger countering the evaluation of the Bloomberg

analyst, saying his assessment was flawed. Related Reading: TRUMP

Token Takedown—Did Insiders Plan The Crash? “When one considers an

option as an asset, THIS is what happens to one’s analysis. If

there was ZERO increase in Bitcoin adoption and IF those who

invested thinking Bitcoin will demonetize gold change their minds

and IF the stock market correction turns into a rout, and IF “BETA”

was stable, Then this scenario could play out,” Weisberger

explained. He argued that the scenario in McGlone’s analysis

is unlikely to happen. “I think none of the above will happen with

a chance the stock market crashes, which, of course, would trigger

a flood of liquidity.” Featured image from Gemini Imagen, chart

from TradingView

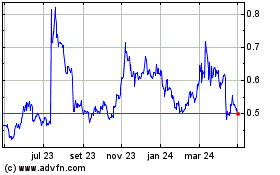

Ripple (COIN:XRPUSD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Ripple (COIN:XRPUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025