Bitcoin price drops 2% as falling inflation boosts US trade war fears

13 Março 2025 - 11:23AM

Cointelegraph

Bitcoin (BTC) shrugged off gains at the March

13 Wall Street open as US inflation markers continued to

fall.

BTC/USD 1-hour chart. Source:

Cointelegraph/TradingView

Good news is bad news? Bitcoin follows stocks lower

Data from Cointelegraph

Markets Pro and TradingView

showed BTC/USD circling $81,500, down 2.3% on the day.

The February print of the Producer Price Index (PPI) came in

below median expectations, copying the Consumer Price Index (CPI)

results from the day

prior.

“On an unadjusted basis, the index for final demand advanced 3.2

percent for the 12 months ended in February,” an

accompanying press release from

the US Bureau of Labor Statistics (BLS) stated.

“In February, a 0.3-percent increase in prices for

final demand goods offset a 0.2-percent decline in the index for

final demand services.”

US PPI 1-month % change. Source: BLS

Already a double tailwind for crypto and risk assets, cooling

inflation also stunted a rebound in US dollar strength, as viewed

through the US Dollar Index (DXY).

US Dollar Index (DXY) 1-hour chart. Source:

Cointelegraph/TradingView

Despite this, both stocks and crypto remained unmoved, leading

trading resource The Kobeissi Letter to tie in the ongoing US trade

war.

“As we have seen, the market has had a very MUTED reaction to

inflation data that would've previously sent the S&P 500

SHARPLY higher,” it wrote in part of its latest analysis

on X

“Why is this the case? This data provides President

Trump a reason to keep doing what he is currently

doing.”

S&P 500 1-hour chart. Source:

Cointelegraph/TradingView

Kobeissi explained that trader war efforts may now intensify

given slowing inflation.

“This is exactly why markets are not recovering losses following

some of the best inflation data in months,” it continued,

suggesting traders should “buckle up for more volatility.”

A week before the Federal Reserve’s next interest rate decision,

market expectations for financial easing remained similarly

lackluster, with the chance of a cut at just 1%, per data from CME

Group’s FedWatch

Tool. Odds for the Fed’s May meeting were at 28%.

Fed target rate probabilities. Source: CME Group

“The Fed has already decided: steady course, no cuts this FOMC.

Powell made that clear last week,” popular crypto trader Josh Rager

told X followers earlier in the

week, referencing a recent speech by Fed Chair Jerome

Powell.

“Rate cuts? More likely in May/June, not

March.”

BTC price inertia leaves key resistance intact

Bitcoin price action thus sat between bands of buy and sell

liquidity on exchange order books, with the 200-day simple moving

average (SMA) in place as resistance.

Related: Bitcoin whales hint at $80K ‘market rebound’ as

Binance inflows cool

For Keith Alan, co-founder of trading resource Material

Indicators, this trendline, which typically functions as support

during Bitcoin bull markets, was the nearest important level to

reclaim.

“Bitcoin faces strong resistance at the 200-Day MA for the 4th

consecutive day,” he summarized on X.

Referring to Material Indicators’ proprietary trading tools,

Alan concluded that such a reclaim was unlikely on the day,

notwithstanding surprise catalysts in the form of announcements

from the US government.

BTC/USD 1-day chart. Source: Keith Alan/X

Meanwhile, data from monitoring

resource CoinGlass showed key upside resistance clustered

immediately below $85,000.

BTC liquidation heatmap (screenshot). Source:

CoinGlass

This article does not

contain investment advice or recommendations. Every investment and

trading move involves risk, and readers should conduct their own

research when making a decision.

...

Continue reading Bitcoin price drops 2% as falling

inflation boosts US trade war fears

The post

Bitcoin price drops 2% as falling inflation boosts

US trade war fears appeared first on

CoinTelegraph.

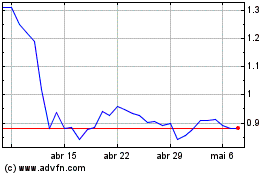

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025